Duke Energy 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

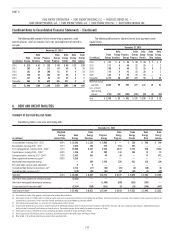

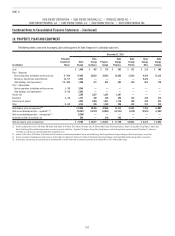

AVAILABLE CREDIT FACILITIES

Duke Energy has a Master Credit Facility with a capacity of $7.5 billion through January 2020. The Duke Energy Registrants, excluding Progress Energy (Parent), have

borrowing capacity under the Master Credit Facility up to specified sublimits for each borrower. Duke Energy has the unilateral ability at any time to increase or decrease

the borrowing sublimits of each borrower, subject to a maximum sublimit for each borrower. The amount available under the Master Credit Facility has been reduced to

backstop the issuances of commercial paper, certain letters of credit and variable-rate demand tax-exempt bonds that may be put to the Duke Energy Registrants at the

option of the holder and as security to meet obligations under the Plea Agreements. The table below includes the current borrowing sublimits and available capacity under

the Master Credit Facility.

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

(Parent)

Duke

Energy

Carolinas

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Facility size(a) $ 7,500 $ 3,475 $ 800 $ 1,000 $ 1,200 $ 425 $ 600

Reduction to backstop issuances

Commercial paper(b) (3,138) (1,531) (300) (333) (709) (115) (150)

Outstanding letters of credit (72) (65) (4) (2) (1) — —

Tax-exempt bonds (116) — (35) — — — (81)

Coal ash set-aside(c) (500) — (250) (250) — — —

Available capacity $ 3,674 $ 1,879 $ 211 $ 415 $ 490 $ 310 $ 369

(a) Represents the sublimit of each borrower.

(b) Duke Energy issued $625 million of commercial paper and loaned the proceeds through the money pool to Duke Energy Carolinas, Duke Energy Progress, Duke Energy Ohio and Duke Energy Indiana. The balances are classified

as Long-Term Debt Payable to Affiliated Companies in the Consolidated Balance Sheets.

(c) On May 14, 2015, the United States District Court for the Eastern District of North Carolina approved the separate Plea Agreements entered into by Duke Energy Carolinas, Duke Energy Progress and DEBS, a wholly owned

subsidiary of Duke Energy, in connection with the investigation initiated by the USDOJ. Duke Energy Carolinas and Duke Energy Progress are required to each maintain $250 million of available capacity under the Master Credit

Facility as security to meet their obligations under the Plea Agreements, in addition to certain other conditions. See Note 5 for further details.

In connection with the Merger Agreement with Piedmont, Duke Energy

entered into a $4.9 billion senior unsecured bridge financing facility (Bridge

Facility) with Barclays Capital, Inc. (Barclays). The Bridge Facility, if drawn

upon, may be used (i) to fund the cash consideration for the transaction and

(ii) to pay certain fees and expenses in connection with the transaction. In

November 2015, Barclays syndicated its commitment under the Bridge Facility

to a broader group of lenders. Duke Energy intends to finance the transaction

with proceeds raised through the issuance of debt, equity, and other sources

and, therefore, does not expect to draw upon the Bridge Facility. See Note 2 for

further details.

On February 22, 2016, Duke Energy entered into a six-month term loan

facility (Term Loan) with commitments totaling $1 billion to provide additional

flexibility in managing short-term liquidity. The Term Loan can be drawn upon

in a single borrowing of up to $1 billion, which must occur no later than 45

calendar days following February 22, 2016. As of February 24, 2016, no

amounts have been drawn under the Term Loan. Amounts drawn under this

facility, if any, will be due on August 19, 2016. The terms and conditions of

this Term Loan are generally consistent with those governing the Master Credit

Facility discussed above.

OTHER DEBT MATTERS

Duke Energy Florida expects to issue $1.3 billion of securitization bonds

related to Crystal River Unit 3 in the first half of 2016. See Note 4 for additional

details.

In September 2013, Duke Energy filed a registration statement (Form S-3)

with the Securities and Exchange Commission (SEC). Under this Form S-3, which

is uncapped, the Duke Energy Registrants, excluding Progress Energy, may issue

debt and other securities in the future at amounts, prices and with terms to be

determined at the time of future offerings. The registration statement also allows

for the issuance of common stock by Duke Energy.

Duke Energy has an effective Form S-3 with the SEC to sell up to $3 billion

of variable denomination floating-rate demand notes, called PremierNotes. The

Form S-3 states that no more than $1.5 billion of the notes will be outstanding at

any particular time. The notes are offered on a continuous basis and bear interest

at a floating rate per annum determined by the Duke Energy PremierNotes

Committee, or its designee, on a weekly basis. The interest rate payable on notes

held by an investor may vary based on the principal amount of the investment.

The notes have no stated maturity date, are non-transferable and may be

redeemed in whole or in part by Duke Energy or at the investor’s option at any

time. The balance as of December 31, 2015 and 2014 was $1,121 million and

$968 million, respectively. The notes are short-term debt obligations of Duke

Energy and are reflected as Notes payable and commercial paper on Duke

Energy’s Consolidated Balance Sheets.

At December 31, 2015 and 2014, $767 million of debt issued by Duke

Energy Carolinas was guaranteed by Duke Energy.

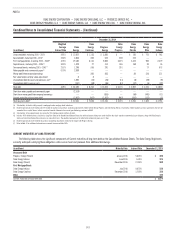

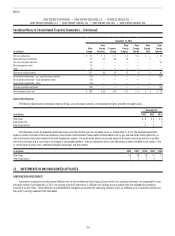

Money Pool

The Subsidiary Registrants, excluding Progress Energy, receive support for

their short-term borrowing needs through participation with Duke Energy and

certain of its subsidiaries in a money pool arrangement. Under this arrangement,

those companies with short-term funds may provide short-term loans to

affiliates participating in this arrangement. The money pool is structured such

that the Subsidiary Registrants, excluding Progress Energy, separately manage

their cash needs and working capital requirements. Accordingly, there is no net

settlement of receivables and payables between money pool participants. Duke

Energy (Parent), may loan funds to its participating subsidiaries, but may not

borrow funds through the money pool. Accordingly, as the money pool activity

is between Duke Energy and its wholly owned subsidiaries, all money pool

balances are eliminated within Duke Energy’s Consolidated Balance Sheets.