Duke Energy 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

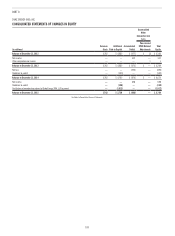

Years Ended December 31,

2015 2014 2013

Duke Energy 2.9% 2.8% 2.8%

Duke Energy Carolinas 2.8% 2.7% 2.8%

Progress Energy 2.6% 2.5% 2.5%

Duke Energy Progress 2.6% 2.5% 2.5%

Duke Energy Florida 2.7% 2.7% 2.4%

Duke Energy Ohio 2.7% 2.3% 3.3%

Duke Energy Indiana 3.0% 3.0% 2.8%

In general, when the Duke Energy Registrants retire regulated property,

plant and equipment, original cost plus the cost of retirement, less salvage

value, is charged to accumulated depreciation. However, when it becomes

probable a regulated asset will be retired substantially in advance of its original

expected useful life or is abandoned, the cost of the asset and the corresponding

accumulated depreciation is recognized as a separate asset. If the asset is still

in operation, the net amount is classified as Generation facilities to be retired,

net on the Consolidated Balance Sheets. If the asset is no longer operating,

the net amount is classified in Regulatory Assets on the Consolidated Balance

Sheets. The carrying value of the asset is based on historical cost if the Duke

Energy Registrants are allowed to recover the remaining net book value and a

return equal to at least the incremental borrowing rate. If not, an impairment

is recognized to the extent the net book value of the asset exceeds the present

value of future revenues discounted at the incremental borrowing rate.

When the Duke Energy Registrants sell entire regulated operating units,

or retire or sell nonregulated properties, the original cost and accumulated

depreciation and amortization balances are removed from Property, Plant and

Equipment on the Consolidated Balance Sheets. Any gain or loss is recorded in

earnings, unless otherwise required by the applicable regulatory body.

See Note 10 for further information.

Nuclear Fuel

Nuclear fuel is classified as Property, Plant and Equipment on the

Consolidated Balance Sheets, except for Duke Energy Florida. Refer to

Note 4, “Regulatory Matters,” for additional information on Crystal River Unit 3

investments, including nuclear fuel.

Nuclear fuel in the front-end fuel processing phase is considered work

in progress and not amortized until placed in service. Amortization of nuclear

fuel is included within Fuel used in electric generation and purchased power

– regulated in the Consolidated Statements of Operations. Amortization is

recorded using the units-of-production method.

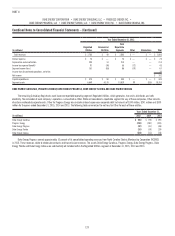

Allowance for Funds Used During Construction and Interest Capitalized

For regulated operations, the debt and equity costs of financing the

construction of property, plant and equipment are reflected as AFUDC and

capitalized as a component of the cost of property, plant and equipment. AFUDC

equity is reported on the Consolidated Statements of Operations as non-cash

income in Other income and expenses, net. AFUDC debt is reported as a non-

cash offset to Interest Expense. After construction is completed, the Duke Energy

Registrants are permitted to recover these costs through their inclusion in rate

base and the corresponding subsequent depreciation or amortization of those

regulated assets.

AFUDC equity, a permanent difference for income taxes, reduces the

effective tax rate when capitalized and increases the effective tax rate when

depreciated or amortized. See Note 22 for additional information.

For nonregulated operations, interest is capitalized during the

construction phase with an offsetting non-cash credit to Interest Expense on the

Consolidated Statements of Operations.

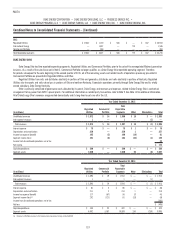

Asset Retirement Obligations

Asset retirement obligations are recognized for legal obligations

associated with the retirement of property, plant and equipment. Substantially

all asset retirement obligations are related to regulated operations. When

recording an asset retirement obligation, the present value of the projected

liability is recognized in the period in which it is incurred, if a reasonable

estimate of fair value can be made. The liability is accreted over time. For

operating plants, the present value of the liability is added to the cost of the

associated asset and depreciated over the remaining life of the asset. For retired

plants, the present value of the liability is recorded as a regulatory asset.

The present value of the initial obligation and subsequent updates are

based on discounted cash flows, which include estimates regarding timing of

future cash flows, selection of discount rates and cost escalation rates, among

other factors. These estimates are subject to change. Depreciation expense is

adjusted prospectively for any changes to the carrying amount of the associated

asset. The Duke Energy Registrants receive amounts to fund the cost of the

asset retirement obligation for regulated operations through a combination of

regulated revenues and earnings on the NDTF. As a result, amounts recovered in

regulated revenues, earnings on the NDTF, accretion expense and depreciation of

the associated asset are all deferred as a regulatory asset or liability.

Obligations for nuclear decommissioning are based on-site-specific

cost studies. Duke Energy Carolinas and Duke Energy Progress assume prompt

dismantlement of the nuclear facilities after operations are ceased. Duke

Energy Florida assumes Crystal River Unit 3 will be placed into a safe storage

configuration until eventual dismantlement is completed by 2074. Duke Energy

Carolinas, Duke Energy Progress and Duke Energy Florida also assume that

spent fuel will be stored on-site until such time that it can be transferred to a

U.S. Department of Energy (DOE) facility.

Obligations for closure of ash basins are based upon discounted cash

flows of estimated costs for site specific plans, if known, or probability

weightings of the potential closure methods if the closure plans are under

development and multiple closure options are being considered and evaluated

on a site-by-site basis. See Note 9 for additional information.

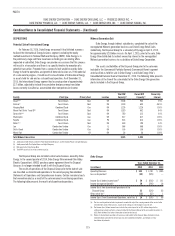

Revenue Recognition and Unbilled Revenue

Revenues on sales of electricity and gas are recognized when service

is provided or the product is delivered. Unbilled revenues are recognized by

applying customer billing rates to the estimated volumes of energy delivered but

not yet billed. Unbilled revenues can vary significantly from period to period as a

result of seasonality, weather, customer usage patterns, customer mix, average

price in effect for customer classes, timing of rendering customer bills and

meter reading schedules.

Unbilled revenues are included within Receivables and Restricted

receivables of variable interest entities on the Consolidated Balance Sheets as

shown in the following table. This table excludes amounts included in assets

held for sale (AHFS) at December 31, 2014.