Duke Energy 2015 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

204

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

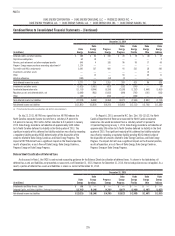

Valuation allowances have been established for certain foreign and state NOL carryforwards and state income tax credits that reduce deferred tax assets to an

amount that will be realized on a more-likely-than-not basis. The net change in the total valuation allowance is included in Tax differential on foreign earnings and

State income tax, net of federal income tax effect in the above tables.

Undistributed Foreign Earnings

As of December 31, 2015, Duke Energy’s intention was to indefinitely reinvest undistributed earnings generated by Duke Energy’s foreign subsidiaries. As a

result, no U.S. tax is recorded on such earnings of approximately $250 million. The amount of unrecognized deferred tax liability related to undistributed earnings was

approximately $12 million.

On February 18, 2016, Duke Energy announced it had initiated a process to divest the International Energy business segment, excluding the investment in NMC.

See Note 2 for further information. Accordingly, Duke Energy no longer intends to indefinitely reinvest the undistributed foreign earnings of International Energy and will

therefore record U.S. taxes related to International Energy’s undistributed foreign earnings during the first quarter of 2016.

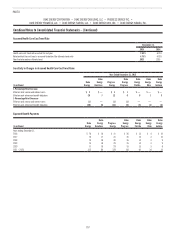

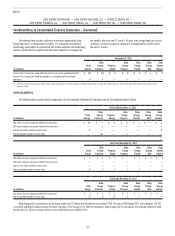

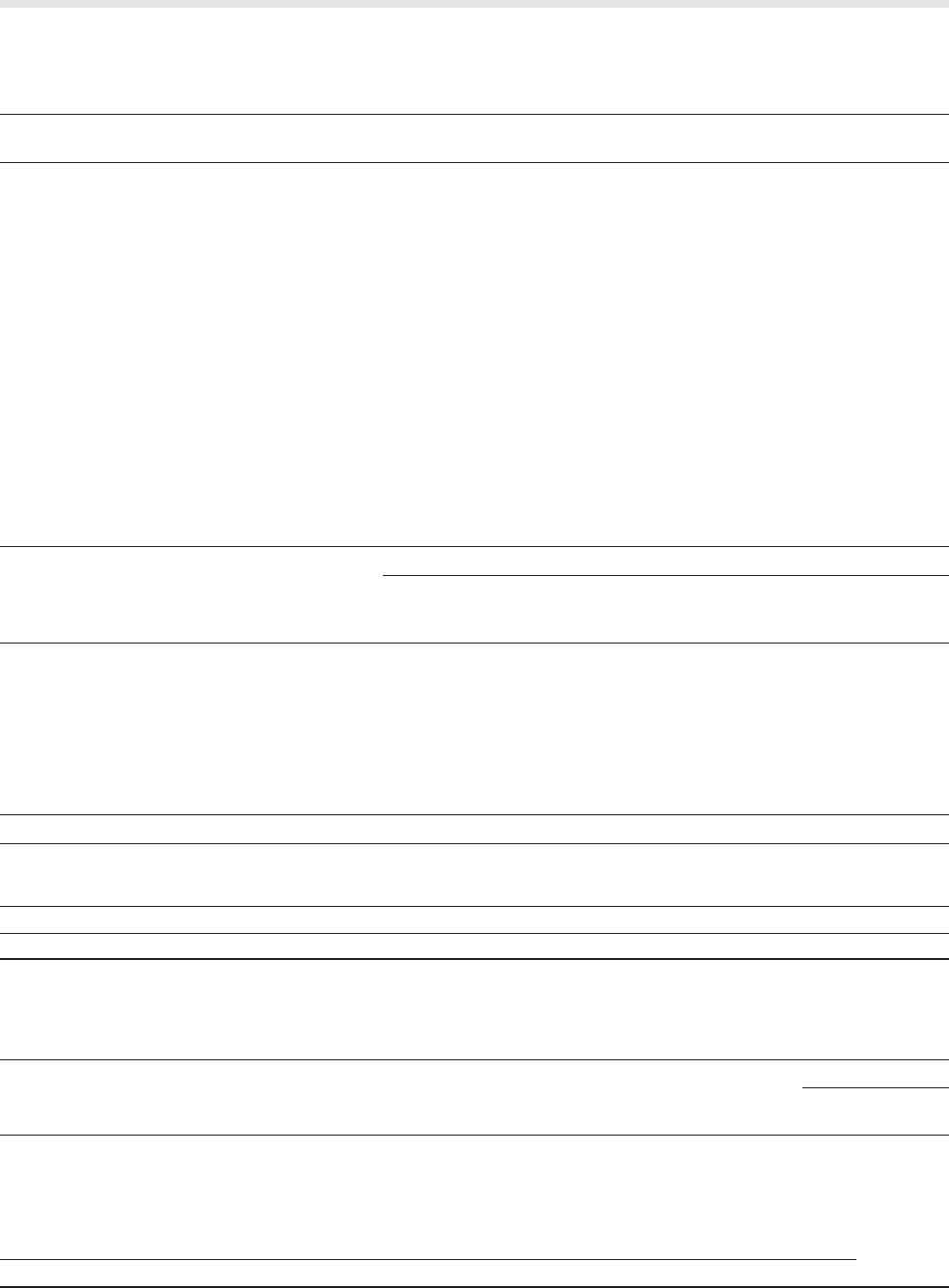

DEFERRED TAXES

Net Deferred Income Tax Liability Components

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Deferred credits and other liabilities $ 245 $ 38 $ 115 $ 25 $ 66 $ 29 $ 5

Capital lease obligations 63 9 — — — — 2

Pension, post-retirement and other employee benefits 580 46 186 92 82 24 40

Progress Energy merger purchase accounting adjustments(a) 1,009 — — — — — —

Tax credits and NOL carryforwards 3,719 170 997 163 177 25 215

Investments and other assets — — — — — 3 —

Other 206 20 48 2 46 37 20

Valuation allowance (160) — (38) — — — —

Total deferred income tax assets 5,662 283 1,308 282 371 118 282

Investments and other assets (1,584) (1,057) (412) (228) (201) — (7)

Accelerated depreciation rates (13,070) (4,429) (4,169) (2,325) (1,868) (1,356) (1,797)

Regulatory assets and deferred debits, net (3,633) (943) (1,517) (756) (762) (169) (135)

Total deferred income tax liabilities (18,287) (6,429) (6,098) (3,309) (2,831) (1,525) (1,939)

Net deferred income tax liabilities $(12,625) $(6,146) $(4,790) $(3,027) $(2,460) $(1,407) $(1,657)

(a) Primarily related to capital lease obligations and debt fair value adjustments.

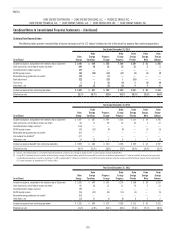

The following table presents the expiration of tax credits and NOL carryforwards.

December 31, 2015

(in millions) Amount

Expiration

Year

Investment tax credits $ 864 2029 – 2035

Alternative minimum tax credits 1,121 Indefinite

Federal NOL carryforwards 484 2030 – 2033

State NOL carryforwards and credits(a) 299 2016 – 2035

Foreign NOL carryforwards(b) 100 2026 – 2034

Foreign Tax Credits 851 2024

Total tax credits and NOL carryforwards $ 3,719

(a) A valuation allowance of $81 million has been recorded on the state Net Operating Loss carryforwards, as presented in the Net Deferred Income Tax Liability Components table.

(b) A valuation allowance of $79 million has been recorded on the foreign Net Operating Loss carryforwards, as presented in the Net Deferred Income Tax Liability Components table.