Duke Energy 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

8

Potential Plant Retirements

The Subsidiary Registrants periodically file Integrated Resource Plans

(IRP) with state regulatory commissions. The IRPs provide a view of forecasted

energy needs over a long term (10 to 20 years) and options being considered

to meet those needs. Recent IRPs filed by the Subsidiary Registrants included

planning assumptions to potentially retire certain coal-fired generating

facilities earlier than their current estimated useful lives. These facilities do

not have the requisite emission control equipment, primarily to meet United

States Environmental Protection Agency (EPA) regulations recently approved or

proposed. Duke Energy continues to evaluate the potential need to retire these

coal-fired generating facilities earlier than the current estimated useful lives,

and plans to seek regulatory recovery for amounts that would not be otherwise

recovered when any of these assets are retired. For additional information

related to potential plant retirements see Note 4 to the Consolidated Financial

Statements, “Regulatory Matters.”

On October 23, 2015, the EPA published in the Federal Register the

Clean Power Plan (CPP) rule for regulating carbon dioxide (CO2) emissions from

existing fossil fuel-fired electric generating units (EGUs). The CPP establishes

CO2 emission rates and mass cap goals that apply to fossil fuel-fired generation.

Under the CPP, states are required to develop and submit a final compliance

plan, or an initial plan with an extension request, to the EPA by September 2016,

or no later than September 2018 with an approved extension. These state plans

are subject to EPA approval, with a federal plan applied to states that fail to

submit a plan to the EPA or if a state plan is not approved. Legal challenges to

the CPP have been filed by stakeholders and motions to stay the requirements

of the rule pending the outcome of the litigation have been filed. The U.S.

Supreme Court granted a Motion to Stay in February 2016, effectively blocking

enforcement of the rule until legal challenges are resolved. Final resolution of

these legal challenges could take several years. Compliance with CPP could

cause the industry to replace coal generation with natural gas and renewables,

especially in states that have significant CO2 reduction targets under the rule.

Costs to operate coal-fired generation plants continue to grow due to increasing

environmental compliance requirements, including ash management costs

unrelated to CPP, and this may result in the retirement of coal-fired generation

plants earlier than the current useful lives. Duke Energy continues to evaluate

the need to retire generating facilities and plans to seek regulatory recovery,

where appropriate, for amounts that have not been recovered upon asset

retirements. However, recovery is subject to future regulatory approval, including

the recovery of carrying costs on remaining book values, and therefore cannot

be assured.

Sources of Electricity

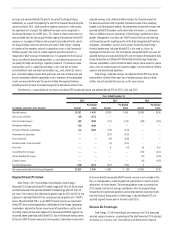

Regulated Utilities relies principally on coal, natural gas and nuclear fuel for its generation of electricity. The following table lists sources of electricity and fuel

costs for the three years ended December 31, 2015.

Generation by Source(d)

Cost of Delivered Fuel per Net

Kilowatt-hour Generated (Cents)(d)

2015 2014(e) 2013(e) 2015 2014 2013

Coal(a) 29.0% 33.5% 32.8% 3.24 3.54 3.67

Nuclear(a) 27.0% 26.1% 26.3% 0.65 0.65 0.66

Natural gas and oil(a) 23.1% 19.0% 19.5% 3.74 4.70 4.18

All fuels (cost-based on weighted average)(a) 79.1% 78.6% 78.6% 2.50 2.86 2.79

Hydroelectric and solar(b) 0.8% 0.8% 1.3%

Total generation 79.9% 79.4% 79.9%

Purchased power and net interchange(c) 20.1% 20.6% 20.1%

Total sources of energy 100.0% 100.0% 100.0%

(a) Statistics related to all fuels reflect Regulated Utilities’ ownership interest in jointly owned generation facilities.

(b) Generating figures are net of output required to replenish pumped storage facilities during off-peak periods.

(c) Purchased power includes renewable energy purchases.

(d) Includes the effect of the Joint Dispatch Agreement (JDA).

(e) Amounts for 2014 and 2013 have been adjusted to reflect the inclusion of Duke Energy Ohio auction purchases from PJM and Purchased power and net interchange.

Coal

Regulated Utilities meets its coal demand through a portfolio of long-

term purchase contracts and short-term spot market purchase agreements.

Large amounts of coal are purchased under long-term contracts with mining

operators who mine both underground and at the surface. Regulated Utilities

uses spot market purchases to meet coal requirements not met by long-term

contracts. Expiration dates for its long-term contracts, which have various price

adjustment provisions and market re-openers, range from 2016 to 2017 for

Duke Energy Carolinas, 2016 to 2018 for Duke Energy Progress, 2016 to 2017

for Duke Energy Florida, and 2016 to 2025 for Duke Energy Indiana. Regulated

Utilities expects to renew these contracts or enter into similar contracts with

other suppliers as existing contracts expire, though prices will fluctuate over

time as coal markets change. Coal purchased for the Carolinas is primarily

produced from mines in Central Appalachia, Northern Appalachia and the Illinois

Basin. Coal purchased for Florida is primarily produced from mines in Colorado

and the Illinois Basin. Coal purchased for Indiana is primarily produced in

Indiana and Illinois. Regulated Utilities has an adequate supply of coal under

contract to fuel its projected 2016 operations and a significant portion of supply

to fuel its projected 2017 operations. As a result of lower natural gas prices

and less coal-fired dispatch within the generation fleet, coal inventories may

periodically exceed production requirements and result in higher inventory

levels. In these circumstances, Regulated Utilities has worked with suppliers

to defer contracted deliveries, renegotiate existing contract volumes or has

received regulatory support to adjust generation dispatch to reduce the inventory

levels.

The current average sulfur content of coal purchased by Regulated

Utilities is between 1.5 percent and 2 percent for Duke Energy Carolinas,

between 1.5 percent and 2 percent for Duke Energy Progress, between

1 percent and 2.5 percent for Duke Energy Florida, and between 2 percent and

3 percent for Duke Energy Indiana. Regulated Utilities’ environmental controls,

in combination with the use of sulfur dioxide (SO2) emission allowances,

enable Regulated Utilities to satisfy current SO2 emission limitations for its

existing facilities.