Duke Energy 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

PART II

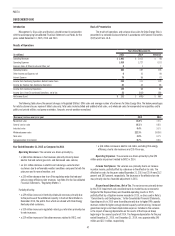

Operating Expenses. The variance was driven primarily by:

• a $61 million increase in depreciation and amortization expenses primarily

due to higher depreciation related to additional plant in service; and

• an $18 million reversal in 2014 of a prior-year impairment. These

charges related to planned transmission projects for which recovery

is not expected, and certain cost associated with mitigation sales

pursuant to merger settlement agreements with the FERC.

Partially offset by:

• a $34 million decrease in property and other taxes primarily due to the

termination of the collection of the North Carolina gross receipts tax as

mentioned above; and

• an $18 million decrease in operations and maintenance expenses,

primarily due to a 2014 litigation reserve related to the criminal

investigation of the management of North Carolina coal ash basins, lower

storm restoration costs and a favorable pension expense adjustment

recorded in 2015, partially offset by higher nuclear refueling outage

expenses, including the prior-year benefit of the adoption of nuclear

outage levelization, due to three refueling outages in 2015 compared to

one outage during the same period in 2014, higher nuclear costs related

to additional ownership interest in assets acquired from NCEMPA, and

severance expenses in 2015 related to cost savings initiatives.

Other Income and Expenses, net. The variance is due to higher AFUDC

equity, primarily due to nuclear plant expenditures.

Income Tax Expense. The effective tax rates for the years ended

December 31, 2015 and 2014 were 34.2 percent and 37.9 percent, respectively.

The decrease in the effective tax rate was primarily due to the non-deductible

litigation reserve related to the criminal investigation of the management of the

coal ash basins in 2014, an increase in AFUDC equity, and the reduction of the

North Carolina statutory corporate state income tax rate.

Matters Impacting Future Results

Duke Energy Progress is a party to multiple lawsuits and subject to

fines and other penalties related to operations at certain North Carolina

facilities with ash basins. The outcome of these lawsuits, fines and penalties

could have an adverse impact on Duke Energy Progress’ financial position,

results of operations and cash flows. See Note 5 to the Consolidated Financial

Statements, “Commitments and Contingencies,” for additional information.

An order from regulatory authorities disallowing recovery of costs related

to closure of ash impoundments could have an adverse impact on Duke Energy

Progress’ financial position, results of operations and cash flows. See Notes 4

and 9 to the Consolidated Financial Statements, “Regulatory Matters” and

“Asset Retirement Obligations,” respectively, for additional information.

On October 23, 2015, the EPA published in the Federal Register the

CPP rule for regulating CO2 emissions from existing fossil fuel-fired EGUs. The

CPP establishes CO2 emission rates and mass cap goals that apply to fossil

fuel-fired generation. Under the CPP, states are required to develop and submit

a final compliance plan, or an initial plan with an extension request, to the EPA

by September 6, 2016, or no later than September 6, 2018, with an approved

extension. These state plans are subject to EPA approval, with a federal plan

applied to states that fail to submit a plan to the EPA or if a state plan is

not approved. Legal challenges to the CPP have been filed by stakeholders

and motions to stay the requirements of the rule pending the outcome of the

litigation have been filed. The U.S. Supreme Court granted a Motion to Stay in

February 2016, effectively blocking enforcement of the rule until legal challenges

are resolved. Final resolution of these legal challenges could take several years.

Compliance with CPP could cause the industry to replace coal generation with

natural gas and renewables, especially in states that have significant CO2

reduction targets under the rule. Costs to operate coal-fired generation plants

continue to grow due to increasing environmental compliance requirements,

including ash management costs unrelated to CPP, and this may result in

the retirement of coal-fired generation plants earlier than the current useful

lives. Duke Energy Progress continues to evaluate the need to retire generating

facilities and plans to seek regulatory recovery, where appropriate, for amounts

that have not been recovered upon asset retirements. However, recovery is

subject to future regulatory approval, including the recovery of carrying costs

on remaining book values, and therefore cannot be assured. In addition, Duke

Energy Progress could incur increased fuel, purchased power, operation and

maintenance, and other costs for replacement generation as a result of this rule.

Duke Energy Progress cannot predict the outcome of these matters.

DUKE ENERGY FLORIDA

Introduction

Management’s Discussion and Analysis should be read in conjunction

with the accompanying Consolidated Financial Statements and Notes for the

years ended December 31, 2015, 2014 and 2013.

Basis of Presentation

The results of operations and variance discussion for Duke Energy

Florida is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

Results of Operations

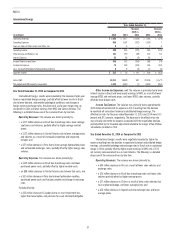

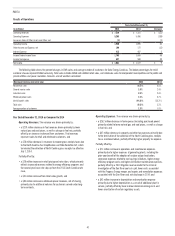

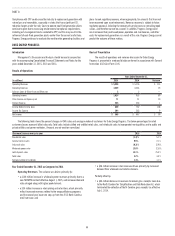

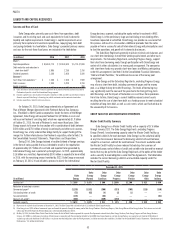

Years Ended December 31,

(in millions) 2015 2014 Variance

Operating Revenues $ 4,977 $ 4,975 $ 2

Operating Expenses 3,862 3,898 (36)

Gains on Sales of Other Asset and Other, net —1 (1)

Operating Income 1,115 1,078 37

Other Income and Expense, net 24 20 4

Interest Expense 198 201 (3)

Income Before Income Taxes 941 897 44

Income Tax Expense 342 349 (7)

Net Income $ 599 $ 548 $ 51