Duke Energy 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

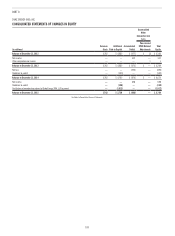

December 31, 2014

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 2,102 $ 719 $ 981 $ 676 $ 305 $ 67 $ 258

Coal held for electric generation 997 362 329 150 178 21 275

Oil, gas and other fuel held for electric generation 360 43 280 140 140 9 4

Total inventory $ 3,459 $ 1,124 $ 1,590 $ 966 $ 623 $ 97 $ 537

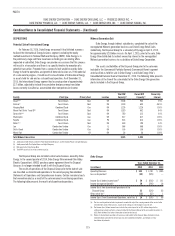

Investments in Debt and Equity Securities

The Duke Energy Registrants classify investments into two categories –

trading and available-for-sale. Both categories are recorded at fair value on

the Consolidated Balance Sheets. Realized and unrealized gains and losses

on trading securities are included in earnings. For certain investments of

regulated operations such as the Nuclear Decommissioning Trust Fund (NDTF),

realized and unrealized gains and losses (including any other-than-temporary

impairments) on available-for-sale securities are recorded as a regulatory asset

or liability. Otherwise, unrealized gains and losses are included in Accumulated

Other Comprehensive Income (AOCI), unless other-than-temporarily impaired.

Other-than-temporary impairments for equity securities and the credit loss

portion of debt securities of nonregulated operations are included in earnings.

Investments in debt and equity securities are classified as either current or

noncurrent based on management’s intent and ability to sell these securities,

taking into consideration current market liquidity. See Note 15 for further

information.

Goodwill and Intangible Assets

Goodwill

Duke Energy, Progress Energy and Duke Energy Ohio perform annual

goodwill impairment tests as of August 31 each year at the reporting unit level,

which is determined to be an operating segment or one level below. Duke Energy,

Progress Energy and Duke Energy Ohio update these tests between annual tests

if events or circumstances occur that would more likely than not reduce the fair

value of a reporting unit below its carrying value.

Intangible Assets

Intangible assets are included in Other in Investments and Other Assets

on the Consolidated Balance Sheets. Generally, intangible assets are amortized

using an amortization method that reflects the pattern in which the economic

benefits of the intangible asset are consumed, or on a straight-line basis if that

pattern is not readily determinable. Amortization of intangibles is reflected in

Depreciation and amortization on the Consolidated Statements of Operations.

Intangible assets are subject to impairment testing and if impaired, the carrying

value is accordingly reduced.

Emission allowances permit the holder of the allowance to emit certain

gaseous byproducts of fossil fuel combustion, including sulfur dioxide (SO2)

and nitrogen oxide (NOX). Allowances are issued by the U.S. Environmental

Protection Agency (EPA) at zero cost and may also be bought and sold via

third-party transactions. Allowances allocated to or acquired by the Duke Energy

Registrants are held primarily for consumption. Carrying amounts for emission

allowances are based on the cost to acquire the allowances or, in the case

of a business combination, on the fair value assigned in the allocation of the

purchase price of the acquired business. Emission allowances are expensed

to Fuel used in electric generation and purchased power – regulated on the

Consolidated Statements of Operations.

Renewable energy certificates are used to measure compliance with

renewable energy standards and are held primarily for consumption. See Note

11 for further information.

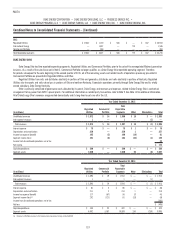

Long-Lived Asset Impairments

The Duke Energy Registrants evaluate long-lived assets, excluding

goodwill, for impairment when circumstances indicate the carrying value of

those assets may not be recoverable. An impairment exists when a long-lived

asset’s carrying value exceeds the estimated undiscounted cash flows expected

to result from the use and eventual disposition of the asset. The estimated

cash flows may be based on alternative expected outcomes that are probability

weighted. If the carrying value of the long-lived asset is not recoverable

based on these estimated future undiscounted cash flows, the carrying value

of the asset is written-down to its then-current estimated fair value and an

impairment charge is recognized.

The Duke Energy Registrants assess fair value of long-lived assets

using various methods, including recent comparable third-party sales,

internally developed discounted cash flow analysis and analysis from outside

advisers. Significant changes in commodity prices, the condition of an asset or

management’s interest in selling the asset are generally viewed as triggering

events to reassess cash flows.

Property, Plant and Equipment

Property, plant and equipment are stated at the lower of depreciated

historical cost net of any disallowances or fair value, if impaired. The Duke Energy

Registrants capitalize all construction-related direct labor and material costs,

as well as indirect construction costs such as general engineering, taxes and

financing costs. See “Allowance for Funds Used During Construction (AFUDC)

and Interest Capitalized” for information on capitalized financing costs. Costs

of renewals and betterments that extend the useful life of property, plant and

equipment are also capitalized. The cost of repairs, replacements and major

maintenance projects, which do not extend the useful life or increase the expected

output of the asset, are expensed as incurred. Depreciation is generally computed

over the estimated useful life of the asset using the composite straight-line

method. Depreciation studies are conducted periodically to update composite

rates and are approved by state utility commissions and/or the FERC when

required. The composite weighted average depreciation rates, excluding nuclear

fuel, are included in the table that follows.