Duke Energy 2015 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

capacity from Duke Energy Carolinas to Duke Energy Progress during summer

off-peak hours. FERC also ordered that Duke Energy operate certain phase

shifters to create additional import capability and that such operation be

monitored by an independent monitor. Duke Energy does not expect the costs to

comply with this order to be material. FERC also referred Duke Energy’s failure

to expressly designate the phase shifter reactivation as a mitigation project in

Duke Energy’s original mitigation plan filing in March 2012 to the FERC Office of

Enforcement for further inquiry. Duke Energy cannot predict the outcome of this

additional inquiry.

Potential Coal Plant Retirements

The Subsidiary Registrants periodically file Integrated Resource Plans

(IRP) with their state regulatory commissions. The IRPs provide a view of

forecasted energy needs over a long term (10 to 20 years), and options being

considered to meet those needs. Recent IRPs filed by the Subsidiary Registrants

included planning assumptions to potentially retire certain coal-fired generating

facilities in Florida and Indiana earlier than their current estimated useful lives.

These facilities do not have the requisite emission control equipment, primarily

to meet EPA regulations recently approved or proposed.

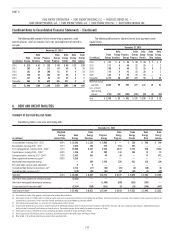

The table below contains the net carrying value of generating facilities

planned for retirement or included in recent IRPs as evaluated for potential

retirement due to a lack of requisite environmental control equipment. Dollar

amounts in the table below are included in Net property, plant and equipment on

the Consolidated Balance Sheets.

December 31, 2015

Duke

Energy

Duke Energy

Florida(b)

Duke Energy

Indiana(c)

Capacity (in MW) 1,821 873 948

Remaining net book value

(in millions)(a) $ 352 $ 131 $ 221

(a) Remaining net book value amounts presented exclude any capitalized asset retirement costs related to

closure of ash basins.

(b) Includes Crystal River Units 1 and 2. Progress Energy amounts are equal to Duke Energy Florida amounts.

(c) Includes Wabash River Units 2 through 6 and Gallagher Units 2 and 4. Wabash River Unit 6 is being

evaluated for potential conversion to natural gas. Duke Energy Indiana committed to retire or convert the

Wabash River Units 2 through 6 by June 2018 in conjunction with a settlement agreement associated

with the Edwardsport air permit. Duke Energy Indiana committed to either retire or stop burning coal

at Gallagher Units 2 and 4 by December 31, 2022, as part of the proposed settlement of Edwardsport

IGCC matters.

On October 23, 2015, the EPA published in the Federal Register the

Clean Power Plan (CPP) rule for regulating carbon dioxide (CO2) emissions from

existing fossil fuel-fired electric generating units (EGUs). The CPP establishes

CO2 emission rates and mass cap goals that apply to fossil fuel-fired generation.

Under the CPP, states are required to develop and submit a final compliance

plan, or an initial plan with an extension request, to the EPA by September 6,

2016, or no later than September 6, 2018, with an approved extension. These

state plans are subject to EPA approval, with a federal plan applied to states

that fail to submit a plan to the EPA or if a state plan is not approved. Legal

challenges to the CPP have been filed by stakeholders and motions to stay the

requirements of the rule pending the outcome of the litigation were granted

by the U.S. Supreme Court in February 2016. Final resolution of these legal

challenges could take several years. Compliance with CPP could cause the

industry to replace coal generation with natural gas and renewables, especially

in states that have significant CO2 reduction targets under the rule. Costs

to operate coal-fired generation plants continue to grow due to increasing

environmental compliance requirements, including ash management costs

unrelated to CPP, and this may result in the retirement of coal-fired generation

plants earlier than the current useful lives. Duke Energy continues to evaluate

the need to retire generating facilities and plans to seek regulatory recovery,

where appropriate, for amounts that have not been recovered upon asset

retirements. However, recovery is subject to future regulatory approval, including

the recovery of carrying costs on remaining book values, and therefore cannot

be assured.

Refer to the “Western Carolinas Modernization Plan” discussion above for

details of Duke Energy Progress’ planned retirements.

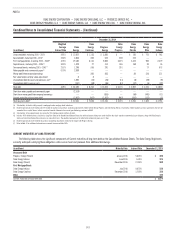

5. COMMITMENTS AND CONTINGENCIES

GENERAL INSURANCE

The Duke Energy Registrants have insurance and reinsurance coverage

either directly or through indemnification from Duke Energy’s captive insurance

company, Bison, and its affiliates, consistent with companies engaged in

similar commercial operations with similar type properties. The Duke Energy

Registrants’ coverage includes (i) commercial general liability coverage

for liabilities arising to third parties for bodily injury and property damage;

(ii) workers’ compensation; (iii) automobile liability coverage; and (iv) property

coverage for all real and personal property damage. Real and personal property

damage coverage excludes electric transmission and distribution lines, but

includes damages arising from boiler and machinery breakdowns, earthquakes,

flood damage and extra expense, but not outage or replacement power

coverage. All coverage is subject to certain deductibles or retentions, sublimits,

exclusions, terms and conditions common for companies with similar types of

operations.

The Duke Energy Registrants self-insure their electric transmission and

distribution lines against loss due to storm damage and other natural disasters.

As discussed further in Note 4, Duke Energy Florida maintains a storm damage

reserve and has a regulatory mechanism to recover the cost of named storms

on an expedited basis.

The cost of the Duke Energy Registrants’ coverage can fluctuate year to

year reflecting claims history and conditions of the insurance and reinsurance

markets.

In the event of a loss, terms and amounts of insurance and reinsurance

available might not be adequate to cover claims and other expenses incurred.

Uninsured losses and other expenses, to the extent not recovered by other

sources, could have a material effect on the Duke Energy Registrants’ results of

operations, cash flows or financial position. Each company is responsible to the

extent losses may be excluded or exceed limits of the coverage available.

NUCLEAR INSURANCE

Duke Energy Carolinas owns and operates the McGuire Nuclear Station

(McGuire) and the Oconee Nuclear Station (Oconee) and operates and has a

partial ownership interest in the Catawba Nuclear Station (Catawba). McGuire

and Catawba each have two reactors. Oconee has three reactors. The other

joint owners of Catawba reimburse Duke Energy Carolinas for certain expenses

associated with nuclear insurance per the Catawba joint owner agreements.

Duke Energy Progress owns and operates the Robinson Nuclear Plant

(Robinson), Brunswick and Harris. Robinson and Harris each have one reactor.

Brunswick has two reactors.

Duke Energy Florida manages and has a partial ownership interest in

Crystal River Unit 3, which has been retired. The other joint owner of Crystal

River Unit 3 reimburses Duke Energy Florida for certain expenses associated

with nuclear insurance per the Crystal River Unit 3 joint owner agreement.