Duke Energy 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

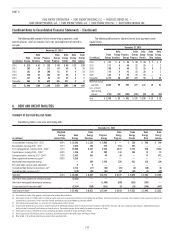

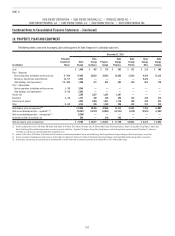

The following table presents future minimum lease payments under

operating leases, which at inception had a non-cancelable term of more than

one year.

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2016 $ 219 $ 41 $ 132 $ 66 $ 66 $ 13 $20

2017 182 33 111 63 48 9 15

2018 161 24 108 61 47 6 12

2019 146 21 102 56 46 4 8

2020 127 16 93 48 45 3 5

Thereafter 864 51 622 365 257 5 8

Total $ 1,699 $186 $ 1,168 $659 $509 $ 40 $68

The following table presents future minimum lease payments under

capital leases.

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

2016 $ 173 $ 6 $ 46 $ 20 $ 26 $ 7 $ 3

2017 171 6 46 21 25 1 1

2018 180 6 46 21 25 5 2

2019 178 6 45 22 25 1 1

2020 182 5 46 21 25 — 1

Thereafter 1,176 30 367 272 95 1 43

Minimum annual

payments 2,060 59 596 377 221 15 51

Less: amount

representing

interest (724) (35) (295) (230) (65) (2) (38)

Total $ 1,336 $ 24 $ 301 $ 147 $ 156 $ 13 $ 13

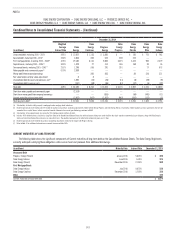

6. DEBT AND CREDIT FACILITIES

SUMMARY OF DEBT AND RELATED TERMS

The following tables summarize outstanding debt.

December 31, 2015

(in millions)

Weighted

Average

Interest Rate

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Unsecured debt, maturing 2016 - 2073 4.99% $ 13,392 $ 1,152 $ 3,850 $ — $ 150 $ 765 $ 740

Secured debt, maturing 2016 - 2037 2.57% 2,635 425 479 254 225 — —

First mortgage bonds, maturing 2016 - 2045(a) 4.74% 18,980 6,161 9,750 5,975 3,775 750 2,319

Capital leases, maturing 2016 - 2051(b) 5.38% 1,336 24 300 144 156 13 14

Tax-exempt bonds, maturing 2017 - 2041(c) 2.59% 1,053 355 48 48 — 77 572

Notes payable and commercial paper(d) 0.88% 4,258 — — — — — —

Money pool/intercompany borrowings — 300 1,458 359 813 128 150

Fair value hedge carrying value adjustment 6 6 — — — — —

Unamortized debt discount and premium, net(e) 1,712 (17) (28) (16) (8) (28) (8)

Unamortized debt issuance costs(f) (170) (39) (85) (37) (32) (4) (19)

Total debt 4.25% $ 43,202 $ 8,367 $ 15,772 $ 6,727 $ 5,079 $ 1,701 $ 3,768

Short-term notes payable and commercial paper (3,633) — — — — — —

Short-term money pool/intercompany borrowings — — (1,308) (209) (813) (103) —

Current maturities of long-term debt(g) (2,074) (356) (315) (2) (13) (106) (547)

Total long-term debt(g) $ 37,495 $ 8,011 $ 14,149 $ 6,516 $ 4,253 $ 1,492 $ 3,221

(a) Substantially all electric utility property is mortgaged under mortgage bond indentures.

(b) Duke Energy includes $114 million and $731 million of capital lease purchase accounting adjustments related to Duke Energy Progress and Duke Energy Florida, respectively, related to power purchase agreements that are not

accounted for as capital leases in their respective financial statements because of grandfathering provisions in GAAP.

(c) Substantially all tax-exempt bonds are secured by first mortgage bonds or letters of credit.

(d) Includes $625 million that was classified as Long-Term Debt on the Consolidated Balance Sheets due to the existence of long-term credit facilities that back-stop these commercial paper balances, along with Duke Energy’s

ability and intent to refinance these balances on a long-term basis. The weighted average days to maturity for commercial paper was 15 days.

(e) Duke Energy includes $1,798 million in purchase accounting adjustments related to the merger with Progress Energy.

(f) Duke Energy includes $59 million in purchase accounting adjustments primarily related to the merger with Progress Energy.

(g) Refer to Note 17 for additional information on amounts from consolidated VIEs.