Duke Energy 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

PART II

Income Tax Expense. The variance was primarily due to an increase in

the pretax income. The effective tax rates for the years ended December 31,

2015 and 2014 were 36.3 percent and 36.8 percent, respectively.

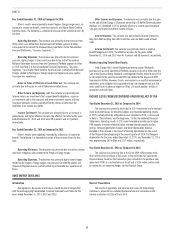

Year Ended December 31, 2014 as Compared to 2013

Regulated Utilities’ results were positively impacted by higher retail

pricing and rate riders, favorable weather, an increase in wholesale power

margins, retail sales growth, and 2013 impairments and other charges. These

impacts were partially offset by higher depreciation and amortization expense,

higher operation and maintenance costs, higher interest expense, and higher

income tax expense. The following is a detailed discussion of the variance

drivers by line item.

Operating Revenues. The variance was driven primarily by:

• a $614 million increase in fuel revenues driven primarily by increased

demand from electric retail customers resulting from favorable weather

conditions, and higher fuel rates for electric retail customers for all

jurisdictions, except North Carolina. Fuel revenues represent sales to

retail and wholesale customers;

• a $556 million net increase in retail pricing primarily due to retail rate

changes and updated rate riders;

• a $216 million increase in electric sales (net of fuel revenue) to retail

customers due to more favorable weather conditions across the service

territory. Compared to normal, weather was favorable in the Carolinas

and Florida service territories, while weather in the Midwest was

essentially normal;

• a $63 million increase in wholesale power revenues, net of sharing,

primarily due to additional volumes and capacity charges for customers

served under long-term contracts; and

• a $21 million increase from retail sales growth (net of fuel revenue)

reflecting increased demand.

Partially offset by:

• a $139 million decrease in gross receipts tax revenue due to the NC Tax

Simplification and Rate Reduction Act which terminated the collection

of the North Carolina gross receipts tax effective July 1, 2014.

Operating Expenses. The variance was driven primarily by:

• a $611 million increase in fuel expense (including purchased power and

natural gas purchases for resale) primarily related to (i) higher volumes

of coal, and oil used in electric generation due primarily to increased

generation resulting from favorable weather conditions, (ii) higher

natural gas prices, and (iii) the application of the Nuclear Electric

Insurance Limited (NEIL) settlement proceeds in 2013 for Duke Energy

Florida;

• a $436 million increase in depreciation and amortization expense

primarily due to increases in depreciation as a result of additional

plant in service and amortization of regulatory assets, and higher 2013

reductions to cost of removal reserves in accordance with regulatory

orders; and

• a $292 million increase in operating and maintenance expense

primarily due to a litigation reserve related to the criminal investigation

of the Dan River coal ash spill (see Note 5 to the Consolidated Financial

Statements, “Commitments and Contingencies,” for additional

information), higher storm costs, repairs and remediation expenses

associated with the Dan River coal ash discharge and other ash basin

related assessment costs, and higher nuclear costs, including nuclear

outage levelization costs, and higher environmental and operational

costs that are recoverable in rates; partially offset by a 2013 Crystal

River Unit 3 related settlement matter, decreased benefits costs

and 2013 donations for low-income customers and job training in

accordance with 2013 NCUC and PSCSC rate case orders.

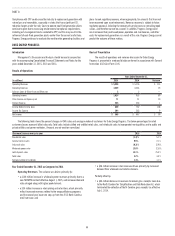

Partially offset by:

• a $346 million decrease due to the 2013 impairment and other charges

primarily related to Crystal River Unit 3 and the proposed Levy Nuclear

Station (Levy). See Note 4 to the Consolidated Financial Statements,

“Regulatory Matters,” for additional information;

• a $42 million decrease in property and other taxes primarily due to the

termination of the collection of the North Carolina gross receipts tax as

mentioned above; partially offset by a sales tax reserve as a result of

an Indiana sales tax audit, and higher property taxes; and

• a $22 million decrease due to the 2013 impairment resulting from the

decision to suspend the application for two proposed nuclear units at

Shearon Harris Nuclear Plant (Harris).

Other Income and Expenses, net. The variance is primarily due

to recognition of post in-service equity returns for projects that had been

completed prior to being reflected in customer rates, partially offset by lower

Allowance for Funds Used During Construction (AFUDC) equity, primarily due to

placing the Sutton Plant into service in late 2013.

Interest Expense. The variance was primarily due to no longer recording

post in-service debt returns on projects reflected in customer rates and a

reduction in debt return on the Crystal River Unit 3 regulatory asset recovered

through fuel revenues.

Income Tax Expense. The variance was primarily due to higher pretax

income, partially offset by a lower effective tax rate of 36.8 percent compared to

37.8 percent, respectively, for the years ended December 31, 2014 and 2013.

The decrease in effective tax rate is primarily due to favorable audit settlements,

a higher manufacturing deduction due to prior year limitations based on

taxable income, and changes in income apportionment for state income tax,

partially offset by the non-deductible litigation reserve related to the criminal

investigation of the Dan River coal ash spill.

Matters Impacting Future Regulated Utilities Results

Duke Energy is a party to multiple lawsuits and could be subject to fines

and other penalties related to the Dan River coal ash release and operations at

other North Carolina facilities with ash basins. The outcome of these lawsuits

and potential fines and penalties could have an adverse impact on Regulated

Utilities’ financial position, results of operations and cash flows. See Note 5 to

the Consolidated Financial Statements, “Commitments and Contingencies,” for

additional information.