Duke Energy 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC • DUKE ENERGY FLORIDA, LLC • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

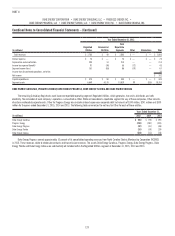

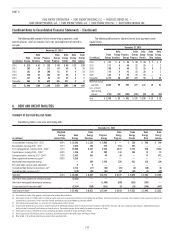

Combined Notes to Consolidated Financial Statements – (Continued)

Grid Infrastructure Improvement Plan

On August 29, 2014, pursuant to a new statute, Duke Energy Indiana

filed a seven-year grid infrastructure improvement plan with the IURC with

an estimated cost of $1.9 billion, focusing on the reliability, integrity and

modernization of the transmission and distribution system. In May 2015, the

IURC denied the original proposal due to an insufficient level of detailed projects

and cost estimates in the plan. On December 7, 2015, Duke Energy Indiana filed

a revised infrastructure improvement plan with an estimated cost of $1.8 billion

in response to guidance from IURC orders and the Indiana Court of Appeals

decisions related to this new statute. The revised plan uses a combination

of advanced technology and infrastructure upgrades to improve service to

customers and provide them with better information about their energy use.

The plan is subject to approval of the IURC, with an order expected in July 2016.

Duke Energy Indiana cannot predict the outcome of this matter.

Other Regulatory Matters

Atlantic Coast Pipeline

On September 2, 2014, Duke Energy, Dominion Resources (Dominion),

Piedmont and AGL Resources announced the formation of a company, ACP, to

build and own the proposed Atlantic Coast Pipeline (the pipeline), a 564-mile

interstate natural gas pipeline. The pipeline is designed to meet the needs

identified in requests for proposals by Duke Energy Carolinas, Duke Energy

Progress and Piedmont. Dominion will build and operate the pipeline and has

a 45 percent ownership percentage in ACP. Duke Energy has a 40 percent

ownership interest in ACP through its Commercial Portfolio segment. Piedmont

owns 10 percent and the remaining share is owned by AGL Resources. Duke

Energy Carolinas and Duke Energy Progress, among others, will be customers of

the pipeline. Purchases will be made under several 20-year supply contracts,

subject to state regulatory approval. In October 2014, the NCUC and PSCSC

approved the Duke Energy Carolinas and Duke Energy Progress requests to enter

into certain affiliate agreements, pay compensation to ACP and to grant a waiver

of certain Code of Conduct provisions relating to contractual and jurisdictional

matters. On September 18, 2015, ACP filed an application with the FERC

requesting a CPCN authorizing ACP to construct the pipeline. ACP requested

approval of the application by July 1, 2016, to enable construction to begin by

September 2016, with an in-service date of on or before November 1, 2018.

ACP is working with various agencies to develop the final pipeline route. ACP

also requested approval of an open access tariff and the precedent agreements

it entered into with future pipeline customers, including Duke Energy Carolinas

and Duke Energy Progress.

On October 24, 2015, Duke Energy entered into a Merger Agreement

with Piedmont. The ACP partnership agreement includes provisions to allow

Dominion an option to purchase additional ownership interest in ACP to

maintain a leading ownership percentage. Any change in ownership interests

is not expected to be material to Duke Energy. Refer to Note 2 for further

information related to Duke Energy’s proposed acquisition of Piedmont.

Sabal Trail Transmission, LLC (Sabal Trail) Pipeline

On May 4, 2015, Duke Energy acquired a 7.5 percent ownership interest

from Spectra Energy in the proposed 500-mile Sabal Trail natural gas pipeline.

Spectra Energy will continue to own 59.5 percent of the Sabal Trail pipeline

and NextEra Energy will own the remaining 33 percent. The Sabal Trail pipeline

will traverse Alabama, Georgia and Florida to meet rapidly growing demand for

natural gas in those states. The primary customers of the Sabal Trail pipeline,

Duke Energy Florida and Florida Power & Light Company, have each contracted

to buy pipeline capacity for 25-year initial terms. On February 3, 2016, the FERC

issued an order granting the request for a CPCN to construct and operate the

pipeline. The Sabal Trail pipeline requires additional regulatory approvals and is

scheduled to begin service in 2017.

NC WARN FERC Complaint

On December 16, 2014, North Carolina Waste Awareness and Reduction

Network (NC WARN) filed a complaint with the FERC against Duke Energy

Carolinas and Duke Energy Progress that alleged (i) Duke Energy Carolinas

and Duke Energy Progress manipulated the electricity market by constructing

costly and unneeded generation facilities leading to unjust and unreasonable

rates; (ii) Duke Energy Carolinas and Duke Energy Progress failed to comply

with Order 1000 by not effectively connecting their transmission systems

with neighboring utilities which also have excess capacity; (iii) the plans of

Duke Energy Carolinas and Duke Energy Progress for unrealistic future growth

lead to unnecessary and expensive generating plants; (iv) the FERC should

investigate the practices of Duke Energy Carolinas and Duke Energy Progress

and the potential benefits of having them enter into a regional transmission

organization; and (v) the FERC should force Duke Energy Carolinas and Duke

Energy Progress to purchase power from other utilities rather than construct

wasteful and redundant power plants. NC WARN also filed a copy of the

complaint with the PSCSC on January 6, 2015. In April 2015, the FERC and the

PSCSC issued separate orders dismissing the NC WARN petition. On May 14,

2015, NC WARN filed with FERC a motion for reconsideration which the FERC

denied on November 19, 2015. This matter is now closed.

Progress Energy Merger FERC Mitigation

In June 2012, the FERC approved the merger with Progress Energy,

including Duke Energy and Progress Energy’s revised market power mitigation

plan, the Joint Dispatch Agreement (JDA) and the joint Open Access

Transmission Tariff. Several intervenors filed requests for rehearing challenging

various aspects of the FERC approval. On October 29, 2014, FERC denied all of

the requests for rehearing.

The revised market power mitigation plan provided for the acceleration

of one transmission project and the completion of seven other transmission

projects (Long-Term FERC Mitigation) and interim firm power sale agreements

during the completion of the transmission projects (Interim FERC Mitigation).

The Long-Term FERC Mitigation was expected to increase power imported

into the Duke Energy Carolinas and Duke Energy Progress service areas and

enhance competitive power supply options in the service areas. All of these

projects were completed in or before 2014. On May 30, 2014, the Independent

Monitor filed with FERC a final report stating that the Long-Term FERC Mitigation

is complete. Therefore, Duke Energy Carolinas’ and Duke Energy Progress’

obligations associated with the Interim FERC Mitigation have terminated. In the

second quarter of 2014, Duke Energy Progress recorded an $18 million partial

reversal of an impairment recorded in the third quarter of 2012. This reversal

adjusts the initial disallowance from the Long-Term FERC mitigation and reflects

updated information on the construction costs and in-service dates of the

transmission projects.

Following the closing of the merger, outside counsel reviewed Duke

Energy’s mitigation plan and discovered a technical error in the calculations.

On December 6, 2013, Duke Energy submitted a filing to the FERC disclosing

the error and arguing that no additional mitigation is necessary. The city of

New Bern filed a protest and requested that FERC order additional mitigation.

On October 29, 2014, FERC ordered that the amount of the stub mitigation

be increased from 25 MW to 129 MW. The stub mitigation is Duke Energy’s

commitment to set aside for third parties a certain quantity of firm transmission