Duke Energy 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

PART II

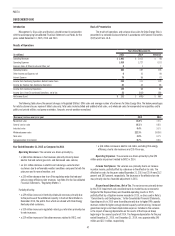

Other Income and Expenses, net. The variance was primarily due to a

decrease in recognition of post in-service equity returns for projects that had

been completed prior to being reflected in customer rates.

Income Tax Expense. The variance is primarily due to an increase in

the effective tax rate and higher pretax income. The effective tax rates for the

years ended December 31, 2015 and 2014 were 36.7 percent and 35.4 percent,

respectively. The increase in the effective tax rate is primarily due to favorable

audit settlements and changes in apportionment related to state income

tax recorded in 2014, and a lower tax benefit related to the manufacturing

deduction in 2015 as compared to 2014, partially offset by the non-deductible

litigation reserve related to the criminal investigation of the Dan River coal ash

spill recorded in 2014.

Matters Impacting Future Results

Duke Energy Carolinas is a party to multiple lawsuits and subject to fines

and other penalties related to the Dan River coal ash release and operations at

other North Carolina facilities with ash basins. The outcome of these lawsuits,

fines and penalties could have an adverse impact on Duke Energy Carolinas’

financial position, results of operations and cash flows. See Note 5 to the

Consolidated Financial Statements, “Commitments and Contingencies,” for

additional information.

An order from regulatory authorities disallowing recovery of costs related

to closure of ash impoundments could have an adverse impact on Duke Energy

Carolinas’ financial position, results of operations and cash flows. See Notes

4 and 9 to the Consolidated Financial Statements, “Regulatory Matters” and

“Asset Retirement Obligations,” respectively, for additional information.

On October 23, 2015, the EPA published in the Federal Register the

CPP rule for regulating CO2 emissions from existing fossil fuel-fired EGUs. The

CPP establishes CO2 emission rates and mass cap goals that apply to fossil

fuel-fired generation. Under the CPP, states are required to develop and submit

a final compliance plan, or an initial plan with an extension request, to the EPA

by September 6, 2016, or no later than September 6, 2018, with an approved

extension. These state plans are subject to EPA approval, with a federal plan

applied to states that fail to submit a plan to the EPA or if a state plan is

not approved. Legal challenges to the CPP have been filed by stakeholders

and motions to stay the requirements of the rule pending the outcome of the

litigation have been filed. The U.S. Supreme Court granted a Motion to Stay in

February 2016, effectively blocking enforcement of the rule until legal challenges

are resolved. Final resolution of these legal challenges could take several years.

Compliance with CPP could cause the industry to replace coal generation with

natural gas and renewables, especially in states that have significant CO2

reduction targets under the rule. Costs to operate coal-fired generation plants

continue to grow due to increasing environmental compliance requirements,

including ash management costs unrelated to CPP, and this may result in the

retirement of coal-fired generation plants earlier than the current useful lives.

Duke Energy Carolinas continues to evaluate the need to retire generating

facilities and plans to seek regulatory recovery, where appropriate, for amounts

that have not been recovered upon asset retirements. However, recovery is

subject to future regulatory approval, including the recovery of carrying costs

on remaining book values, and therefore cannot be assured. In addition, Duke

Energy Carolinas could incur increased fuel, purchased power, operation and

maintenance, and other costs for replacement generation as a result of this rule.

Duke Energy Carolinas cannot predict the outcome of these matters.

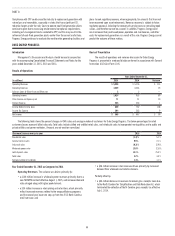

PROGRESS ENERGY

Introduction

Management’s Discussion and Analysis should be read in conjunction

with the accompanying Consolidated Financial Statements and Notes for the

years ended December 31, 2015, 2014 and 2013.

Basis of Presentation

The results of operations and variance discussion for Progress Energy is

presented in a reduced disclosure format in accordance with General Instruction

(I)(2)(a) of Form 10-K.

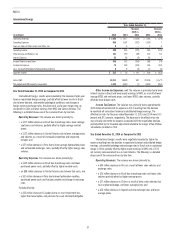

Results of Operations

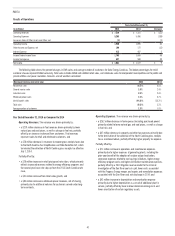

Years Ended December 31,

(in millions) 2015 2014 Variance

Operating Revenues $10,277 $10,166 $ 111

Operating Expenses 8,142 8,159 (17)

Gains on Sales of Other Assets and Other, net 25 11 14

Operating Income 2,160 2,018 142

Other Income and Expense, net 97 77 20

Interest Expense 670 675 (5)

Income Before Income Taxes 1,587 1,420 167

Income Tax Expense 522 540 (18)

Income from Continuing Operations 1,065 880 185

Loss from Discontinued Operations, net of tax (3) (6) 3

Net Income 1,062 874 188

Less: Net Income Attributable to Noncontrolling Interests 11 5 6

Net Income Attributable to Parent $ 1,051 $ 869 $ 182