Duke Energy 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. •

DUKE ENERGY PROGRESS, LLC. • DUKE ENERGY FLORIDA, LLC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

In preparing financial statements that conform to generally accepted

accounting principles (GAAP) in the U.S., the Duke Energy Registrants must

make estimates and assumptions that affect the reported amounts of assets

and liabilities, the reported amounts of revenues and expenses and the

disclosure of contingent assets and liabilities at the date of the financial

statements. Actual results could differ from those estimates.

Regulatory Accounting

The majority of the Duke Energy Registrants’ operations are subject to

price regulation for the sale of electricity and gas by state utility commissions

or FERC. When prices are set on the basis of specific costs of the regulated

operations and an effective franchise is in place such that sufficient gas or

electric services can be sold to recover those costs, the Duke Energy Registrants

apply regulatory accounting. Regulatory accounting changes the timing of the

recognition of costs or revenues relative to a company that does not apply

regulatory accounting. As a result, Regulatory assets and Regulatory liabilities

are recognized on the Consolidated Balance Sheets. Regulatory assets and

liabilities are amortized consistent with the treatment of the related cost in the

ratemaking process. See Note 4 for further information.

Regulatory accounting rules also require recognition of a disallowance

(also called “impairment”) loss if it becomes probable that part of the cost

of a plant under construction (or a recently completed plant or an abandoned

plant) will be disallowed for ratemaking purposes and a reasonable estimate of

the amount of the disallowance can be made. Other disallowances can require

judgments on allowed future rate recovery.

When it becomes probable that regulated generation, transmission or

distribution assets will be abandoned, the cost of the asset is removed from

plant in service. The value that may be retained as a regulatory asset on the

balance sheet for the abandoned property is dependent upon amounts that

may be recovered through regulated rates, including any return. As such, an

impairment charge could be offset by the establishment of a regulatory asset

if rate recovery is probable. The impairment for a disallowance of costs for

regulated plants under construction, recently completed or abandoned is based

on discounted cash flows.

Regulated Fuel Costs and Purchased Power

The Duke Energy Registrants utilize cost-tracking mechanisms, commonly

referred to as fuel adjustment clauses. These clauses allow for the recovery

of fuel and fuel-related costs and portions of purchased power costs through

surcharges on customer rates. The difference between the costs incurred

and the surcharge revenues is recorded either as an adjustment to Operating

Revenues – Regulated electric or Operating Expenses – Fuel used in electric

generation on the Consolidated Statements of Operations with an off-setting

impact on regulatory assets or liabilities.

Cash and Cash Equivalents

All highly liquid investments with maturities of three months or less

at the date of acquisition are considered cash equivalents. At December 31,

2015, $534 million of Duke Energy’s total cash and cash equivalents is held

by entities domiciled in foreign jurisdictions. During the fourth quarter of 2014,

Duke Energy declared a taxable dividend of historical foreign earnings in the

form of notes payable that will result in the repatriation of approximately $2.7

billion in cash held and expected to be generated by International Energy over

a period of up to eight years. Approximately $1.5 billion was remitted in 2015.

See Note 22 to the Consolidated Financial Statements, “Income Taxes,” for

additional information.

Restricted Cash

The Duke Energy Registrants have restricted cash related primarily

to collateral assets, escrow deposits and variable interest entities (VIEs).

Restricted cash balances are reflected in Other within Current Assets and in

Other within Investments and Other Assets on the Consolidated Balance

Sheets. At December 31, 2015 and 2014, Duke Energy had restricted cash

totaling $108 million and $298 million, respectively.

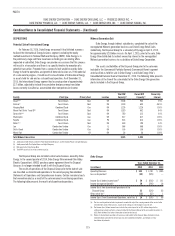

Inventory

Inventory is used for operations and is recorded primarily using the average cost method. Inventory related to regulated operations is valued at historical

cost. Inventory related to nonregulated operations is valued at the lower of cost or market. Materials and supplies are recorded as inventory when purchased and

subsequently charged to expense or capitalized to property, plant and equipment when installed. Reserves are established for excess and obsolete inventory. Inventory

reserves were not material at December 31, 2015 and 2014. The components of inventory are presented in the tables below.

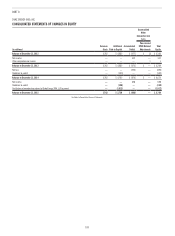

December 31, 2015

(in millions)

Duke

Energy

Duke

Energy

Carolinas

Progress

Energy

Duke

Energy

Progress

Duke

Energy

Florida

Duke

Energy

Ohio

Duke

Energy

Indiana

Materials and supplies $ 2,389 $ 785 $ 1,133 $ 776 $ 357 $ 81 $ 301

Coal held for electric generation 1,114 451 370 192 178 16 267

Oil, gas and other fuel held for electric generation 307 40 248 120 128 8 2

Total inventory $ 3,810 $ 1,276 $ 1,751 $ 1,088 $ 663 $ 105 $ 570