Duke Energy 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264

|

|

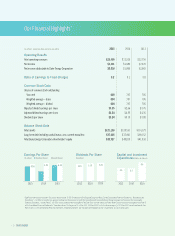

2015 ANNUAL REPORT / 5 /

“ Doubling the dividend

growth rate in 2015

is another important

way we’re committed

to meeting investors’

expectations.”

Steve Young

Executive Vice President

and Chief Financial Ofcer

Driving predictable

nancial results

As a sign of condence in the company’s

nancial health, our Board of Directors in

2015 doubled the annual growth rate of

our dividend to approximately 4 percent.

We now pay more than $2.2 billion

annually in dividends and have paid

a quarterly dividend on our common

stock for 90 consecutive years.

In 2015, we delivered adjusted diluted

earnings per share of $4.54, a penny

below our guidance range of $4.55

to $4.65 per share. For reasons cited

earlier, Duke Energy International

contributed only about 65 percent of

the net income we originally expected.

The strength in our core businesses,

as well as early execution on a number

of strategic initiatives, helped us offset

this weakness.

Our total shareholder return was negative

10.8 percent in 2015, following a very

strong year in 2014 when the total

return was 26.4 percent. The utility

industry signicantly underperformed the

broad market in 2015, in part, because

of the expectation of rising interest rates

and the premium valuations from

the prior year’s robust performance.

The total shareholder return of the

Philadelphia Utility Index (UTY)

was negative 6.3 percent in 2015,

compared with 28.9 percent in

2014. The uncertainty around our

international business and the impact

to our long-term growth rate impacted

our overall performance in 2015

and, to a lesser extent, 2014.

As noted, we have announced our

intent to exit this business and will

work to achieve an orderly sale of

these high-quality assets.

This February, we announced our

2016 adjusted diluted earnings guidance

range of $4.50 to $4.70 per share. We

are well-positioned to meet our long-term

4 to 6 percent annual growth objective

from 2016 to 2020. This is driven

by our growth capital plan to invest

approximately $25 billion to $30 billion

in our core businesses over the ve years,

by projected annual retail load growth

of 0.50 percent, and by expansion of

wholesale power. We also plan to

hold our operating and maintenance

expenses at through 2020.