SunTrust 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

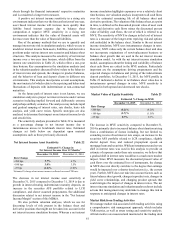

Total noninterest income was $460 million, a decrease of

$13 million, or 3%, compared to 2014. The decrease was

primarily driven by gains on the sale of government-guaranteed

residential loans in the second and third quarters of 2014 and a

decline in mortgage servicing income, partially offset by higher

mortgage production income. Mortgage servicing income was

$169 million, a decrease of $27 million, or 14%, driven by higher

prepayments, partially offset by higher servicing fees. Total loans

serviced for others were $121.0 billion at December 31, 2015,

compared to $115.5 billion at December 31, 2014. The 5%

increase was largely attributable to the purchase of MSRs in

2015. Mortgage production related income increased $69

million, compared to 2014, due to higher gain on sale revenue,

a decline in the repurchase provision, and higher production

related fee income. Loan originations were $22.7 billion for the

year ended December 31, 2015, compared to $16.4 billion for

2014, an increase of $6.3 billion, or 38%. Other income

decreased $54 million, predominantly driven by the

aforementioned gains on the sale of government-guaranteed

residential loans in 2014, partially offset by gains on loan sales

in 2015.

Total noninterest expense was $682 million, a decline of

$367 million, or 35%, compared to 2014. The decrease was

primarily attributable to a $387 million decline in operating

losses driven by mortgage-related legal matters recognized in

2014. In 2015, higher mortgage production volumes resulted in

increases in staff expenses and outside processing costs and

credit services, compared to 2014.

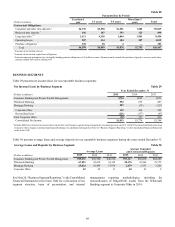

Corporate Other

Corporate Other net income for the year ended December 31,

2015 was $159 million, a decrease of $275 million, or 63%,

compared to 2014. The decrease in net income was primarily

due to the $105 million gain on sale of RidgeWorth in 2014 and

a decline in net interest income, partially offset by lower

noninterest expenses.

Net interest income for the year ended December 31, 2015

was $150 million, a decrease of $129 million, or 46%, compared

to 2014. The decrease was primarily due to a $125 million decline

in commercial loan related swap income. Additionally, growth

in client deposits during 2015 enabled reductions of $3.7 billion,

or 66%, and $1.4 billion, or 12%, in average short-term

borrowings and average long-term debt, respectively.

Total noninterest income was $99 million, a decrease of

$139 million, or 58%, compared to 2014. The decrease was

primarily due to the gain on the sale of RidgeWorth in 2014,

foregone trust and investment management income as a result

of the sale of RidgeWorth, partially offset by higher 2015 mark-

to-market valuation gains on public debt measured at fair value

and net gains on the sale of securities AFS of $21 million in 2015,

compared to losses of $15 million on the sale of securities AFS

in 2014.

Total noninterest expense was $15 million, a decline of $77

million compared to 2014. The decline was primarily due to

expense reductions resulting from the sale of RidgeWorth, and

a decline in severance costs, compared to 2014. These declines

were partially offset by the $24 million of debt extinguishment

costs, net of related hedges, associated with balance sheet

repositioning during 2015.

Year Ended December 31, 2014 vs. 2013

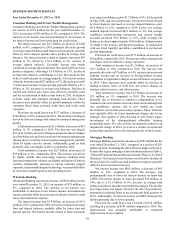

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported

net income of $695 million for the year ended December 31,

2014, an increase of $42 million, or 6%, compared to 2013. The

increase in net income was primarily driven by increased total

revenue and continued improvement in credit quality resulting

in lower provision for credit losses, which in aggregate more

than offset a 3% increase in expenses.

Net interest income was $2.6 billion, an increase of $34

million, or 1%, compared to 2013, driven by increased average

deposit and loan balances, partially offset by lower rate spreads.

Net interest income related to deposits increased $14 million, or

1%, driven by a $1.8 billion, or 2%, increase in average deposit

balances, partially offset by a three basis point decrease in deposit

spreads. Favorable deposit mix trends continued as average

deposit balances increased in all lower cost account categories,

offsetting a $2.0 billion, or 15%, decline in average time deposits.

Net interest income related to loans increased $3 million, driven

by a $1.2 billion increase in average loan balances, partially

offset by a six basis point decrease in loan spreads. The increase

in average loans was primarily driven by growth in consumer

loans, which more than offset home equity line paydowns and a

decline in nonaccrual loans. Other funding costs related to other

assets improved by $19 million, driven primarily by a decline in

funding rates.

Provision for credit losses was $191 million, a decrease of

$70 million, or 27%, compared to 2013. The decrease was

primarily driven by declines in home equity line and commercial

loan net charge-offs, partially offset by an increase in

nonguaranteed student loan net charge-offs.

Total noninterest income was $1.5 billion, an increase of

$45 million, or 3%, compared to 2013, driven by an increase in

retail investment income, trust and investment management,

card fees and insurance income, partially offset by a decrease in

service charges on deposits.

Total noninterest expense was $2.9 billion, an increase of

$83 million, or 3%, compared to 2013. The increase was driven

by higher staff expenses related to investment in revenue

generating positions, primarily in wealth management-related

businesses to help fulfill more of our clients’ wealth and

investment management needs. Additionally, higher operating

losses were partially offset by a decrease in other operating

expenses.

Wholesale Banking

Wholesale Banking reported net income of $875 million for the

year ended December 31, 2014, an increase of $68 million, or

8%, compared to 2013. The increase in net income was

attributable to an increase in net interest income and a decrease

in provision for credit losses, partially offset by an increase in

noninterest expense.

Net interest income was $1.8 billion, a $127 million, or 8%,

increase compared to 2013, driven by increases in average loan

and deposit balances, partially offset by lower rate spreads. Net

interest income related to loans increased, as average loan

balances grew $8.5 billion, or 16%, led by C&I, CRE, and tax-

exempt loans. Net interest income related to client deposits

increased as average deposit balances grew $4.0 billion, or 10%,