SunTrust 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

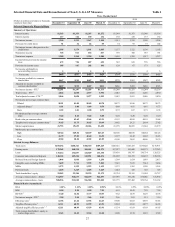

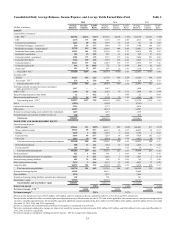

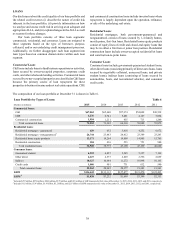

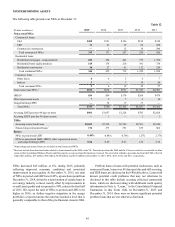

NONINTEREST INCOME

Table 4

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Service charges on deposit accounts $622 $645 $657

Other charges and fees 377 368 369

Card fees 329 320 310

Investment banking income 461 404 356

Trading income 181 182 182

Trust and investment management income 334 423 518

Retail investment services 300 297 267

Mortgage production related income 270 201 314

Mortgage servicing related income 169 196 87

Gain on sale of subsidiary —105 —

Net securities gains/(losses) 21 (15) 2

Other noninterest income 204 197 152

Total noninterest income $3,268 $3,323 $3,214

Adjusted noninterest income 1 $3,268 $3,218 $3,277

1 See Table 1 in this MD&A for a reconcilement of non-U.S. GAAP measures and additional information.

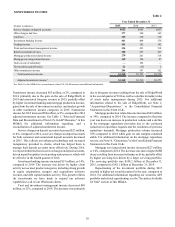

Noninterest income decreased $55 million, or 2%, compared to

2014, primarily due to the gain on the sale of RidgeWorth in

2014 and associated foregone revenue in 2015, partially offset

by higher investment banking and mortgage production income,

gains from the sale of investment securities, and modest growth

in other noninterest income categories in 2015. Noninterest

income for 2015 increased $50 million, or 2%, compared to 2014

adjusted noninterest income. See Table 1, "Selected Financial

Data and Reconcilement of Non-U.S. GAAP Measures," in this

MD&A for additional information regarding, and a

reconciliation of, adjusted noninterest income.

Service charges on deposit accounts decreased $23 million,

or 4%, compared to 2014, as service charges on deposit accounts

for both consumer and commercial deposit accounts decreased

in 2015. This reflects our enhanced technology and increased

transparency provided to clients, which has helped them to

manage their deposit accounts more effectively. During 2016,

we expect further declines in service charges on deposit accounts,

driven in part by updates to our posting order process, which will

be effective in the fourth quarter of 2016.

Investment banking income increased $57 million, or 14%,

compared to 2014. The increase was driven by higher client

activity across most product categories, including strong growth

in equity originations, mergers and acquisitions advisory

revenue, and debt capital markets activity. This growth reflects

the investments we have made to expand our advisory

capabilities to all of our Wholesale clients.

Trust and investment management income decreased $89

million, or 21%, compared to 2014. The decrease was primarily

due to foregone revenue resulting from the sale of RidgeWorth

in the second quarter of 2014 as well as a decline in market value

of assets under management during 2015. For additional

information related to the sale of RidgeWorth, see Note 2,

"Acquisitions/Dispositions," to the Consolidated Financial

Statements in this Form 10-K.

Mortgage production related income increased $69 million,

or 34%, compared to 2014. The increase compared to the prior

year was due to an increase in production volume and a decline

in the mortgage repurchase provision due to the continued

reduction in repurchase requests and the resolution of previous

repurchase demands. Mortgage production volume increased

38% compared to 2014 while gain on sale margins remained

stable. For additional information on the mortgage repurchase

reserve, see Note 16, "Guarantees," to the Consolidated Financial

Statements in this Form 10-K.

Mortgage servicing related income decreased $27 million,

or 14%, compared to 2014. The decrease was due to higher MSR

decay resulting from increased refinance activity, partially offset

by higher servicing fees driven by a larger servicing portfolio.

The servicing portfolio was $148.2 billion at December 31,

2015, compared to $142.1 billion at December 31, 2014.

Repositioning of the investment portfolio during 2015

resulted in higher net securities gains for the year, compared to

2014. For additional information regarding our securities AFS

portfolio and related repositioning, see the "Securities Available

for Sale" section of this MD&A.