SunTrust 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

92

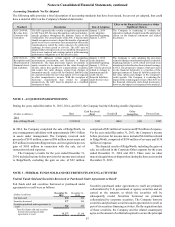

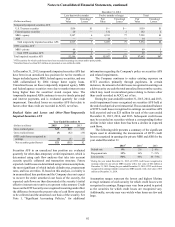

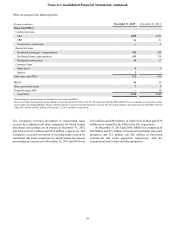

December 31, 2014

Less than twelve months Twelve months or longer Total

(Dollars in millions)

Fair

Value

Unrealized

Losses 2Fair

Value

Unrealized

Losses 2Fair

Value

Unrealized

Losses 2

Temporarily impaired securities AFS:

U.S. Treasury securities $150 $1 $— $— $150 $1

Federal agency securities 20 — 132 2 152 2

MBS - agency 2,347 6 4,911 77 7,258 83

ABS — — 14 — 14 —

Total temporarily impaired securities AFS 2,517 7 5,057 79 7,574 86

OTTI securities AFS 1:

MBS - private 69 1 — — 69 1

Total OTTI securities AFS 69 1 — — 69 1

Total impaired securities AFS $2,586 $8 $5,057 $79 $7,643 $87

1 OTTI securities for which credit losses have been recorded in earnings in current and/or prior periods.

2 Unrealized losses less than $0.5 million are presented as zero within the table.

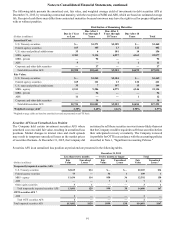

At December 31, 2015, temporarily impaired securities AFS that

have been in an unrealized loss position for twelve months or

longer included agency MBS, federal agency securities, and one

ABS collateralized by 2004 vintage home equity loans.

Unrealized losses on these temporarily impaired agency MBS

and federal agency securities were due to market interest rates

being higher than the securities' stated coupon rates. The

temporarily impaired ABS continues to receive timely principal

and interest payments, and is evaluated quarterly for credit

impairment. Unrealized losses on securities AFS that relate to

factors other than credit are recorded in AOCI, net of tax.

Realized Gains and Losses and Other-Than-Temporarily

Impaired Securities AFS

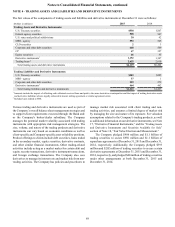

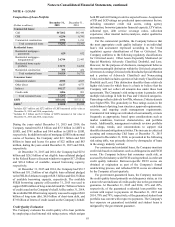

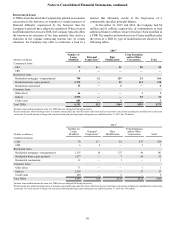

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Gross realized gains $25 $28 $39

Gross realized losses (3) (42) (36)

OTTI credit losses recognized in

earnings (1) (1) (1)

Net securities gains/(losses) $21 ($15) $2

Securities AFS in an unrealized loss position are evaluated

quarterly for other-than-temporary credit impairment, which is

determined using cash flow analyses that take into account

security specific collateral and transaction structure. Future

expected credit losses are determined using various assumptions,

the most significant of which include default rates, prepayment

rates, and loss severities. If, based on this analysis, a security is

in an unrealized loss position and the Company does not expect

to recover the entire amortized cost basis of the security, the

expected cash flows are then discounted at the security’s initial

effective interest rate to arrive at a present value amount. Credit

losses on the OTTI security are recognized in earnings and reflect

the difference between the present value of cash flows expected

to be collected and the amortized cost basis of the security. See

Note 1, "Significant Accounting Policies," for additional

information regarding the Company's policy on securities AFS

and related impairments.

The Company continues to reduce existing exposure on

OTTI securities primarily through paydowns. In certain

instances, the amount of credit losses recognized in earnings on

a debt security exceeds the total unrealized losses on the security,

which may result in unrealized gains relating to factors other

than credit recorded in AOCI, net of tax.

During the years ended December 31, 2015, 2014, and 2013,

credit impairment losses recognized on securities AFS held at

the end of each period were immaterial. The accumulated balance

of OTTI credit losses recognized in earnings on securities AFS

held at period end was $25 million for each of the years ended

December 31, 2015, 2014, and 2013. Subsequent credit losses

may be recorded on securities without a corresponding further

decline in fair value when there has been a decline in expected

cash flows.

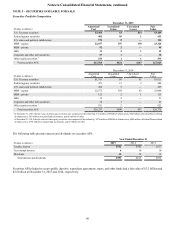

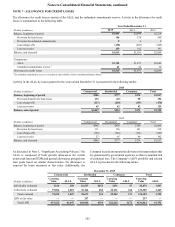

The following table presents a summary of the significant

inputs used in determining the measurement of OTTI credit

losses recognized in earnings for private MBS and ABS for the

year ended December 31:

2015 12014 12013

Default rate 9% 2% 2 - 9%

Prepayment rate 13% 16% 7 - 21%

Loss severity 56% 46% 46 - 74%

1 During the year ended December 31, 2015, all OTTI credit losses recognized in

earnings related to one private MBS security with a fair value of $20 million at

December 31, 2015. During the year ended December 31, 2014, OTTI credit losses

recognized in earnings related to one private MBS security with a fair value of $16

million at December 31, 2014.

Assumption ranges represent the lowest and highest lifetime

average estimates of each security for which credit losses were

recognized in earnings. Ranges may vary from period to period

as the securities for which credit losses are recognized vary.

Additionally, severity may vary widely when losses are few and

large.