SunTrust 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

Notes to Consolidated Financial Statements, continued

90

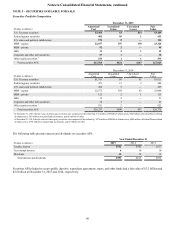

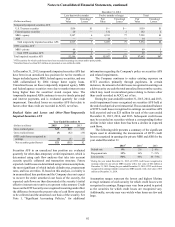

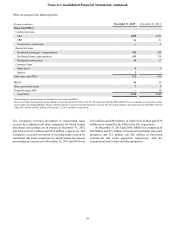

NOTE 5 – SECURITIES AVAILABLE FOR SALE

Securities Portfolio Composition

December 31, 2015

(Dollars in millions)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $3,460 $3 $14 $3,449

Federal agency securities 402 10 1 411

U.S. states and political subdivisions 156 8 — 164

MBS - agency 22,877 397 150 23,124

MBS - private 92 2 — 94

ABS 11 2 1 12

Corporate and other debt securities 37 1 — 38

Other equity securities 1533 1 1 533

Total securities AFS $27,568 $424 $167 $27,825

December 31, 2014

(Dollars in millions) Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury securities $1,913 $9 $1 $1,921

Federal agency securities 471 15 2 484

U.S. states and political subdivisions 200 9 — 209

MBS - agency 22,573 558 83 23,048

MBS - private 122 2 1 123

ABS 19 2 — 21

Corporate and other debt securities 38 3 — 41

Other equity securities 1921 2 — 923

Total securities AFS $26,257 $600 $87 $26,770

1 At December 31, 2015, the fair value of other equity securities was comprised of the following: $32 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank

of Atlanta stock, $93 million of mutual fund investments, and $6 million of other.

At December 31, 2014, the fair value of other equity securities was comprised of the following: $376 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank

of Atlanta stock, $138 million of mutual fund investments, and $7 million of other.

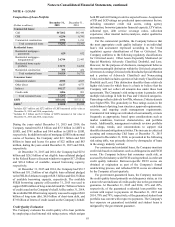

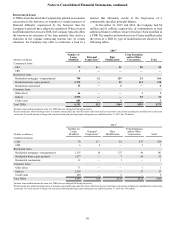

The following table presents interest and dividends on securities AFS:

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Taxable interest $552 $565 $537

Tax-exempt interest 610 10

Dividends 35 38 32

Total interest and dividends $593 $613 $579

Securities AFS pledged to secure public deposits, repurchase agreements, trusts, and other funds had a fair value of $3.2 billion and

$2.6 billion at December 31, 2015 and 2014, respectively.