SunTrust 2015 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

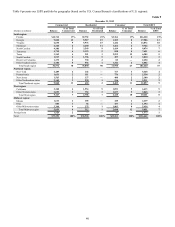

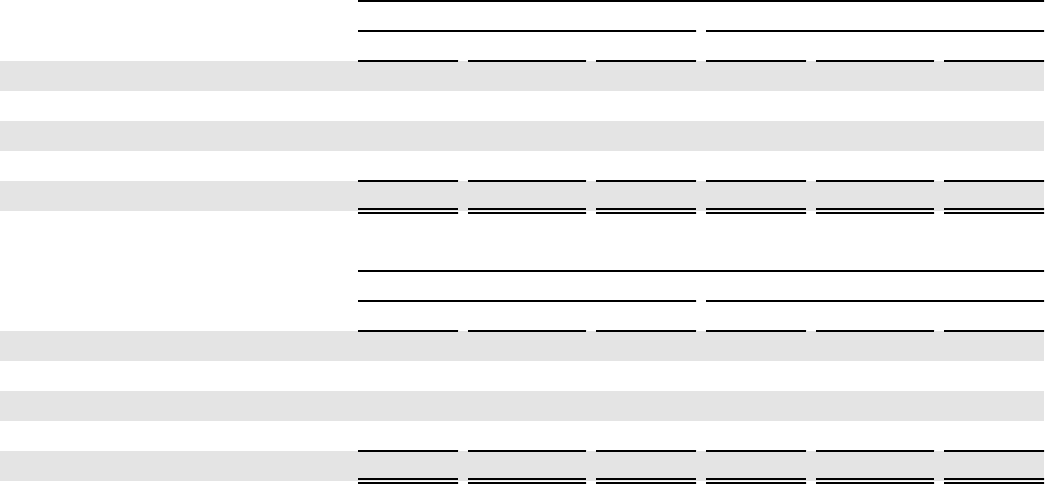

Table 13 presents our residential real estate TDR portfolio by modification type and payment status. Guaranteed loans that have been

repurchased from Ginnie Mae under an early buyout clause and subsequently modified have been excluded from the table. Such

loans totaled approximately $61 million and $49 million at December 31, 2015 and 2014, respectively.

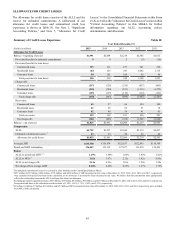

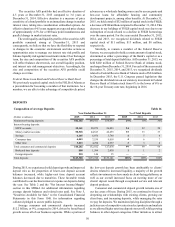

Selected Residential TDR Data Table 13

December 31, 2015

Accruing TDRs Nonaccruing TDRs

(Dollars in millions) Current Delinquent 1Total Current Delinquent 1Total

Rate reduction $961 $69 $1,030 $15 $39 $54

Term extension 10 2 12 — 1 1

Rate reduction and term extension 1,108 83 1,191 7 53 60

Other 2178 11 189 8 21 29

Total $2,257 $165 $2,422 $30 $114 $144

December 31, 2014

Accruing TDRs Nonaccruing TDRs

(Dollars in millions) Current Delinquent 1 Total Current Delinquent 1 Total

Rate reduction $784 $69 $853 $16 $40 $56

Term extension 13 4 17 1 1 2

Rate reduction and term extension 1,251 103 1,354 30 68 98

Other 2173 11 184 12 26 38

Total $2,221 $187 $2,408 $59 $135 $194

1 TDRs considered delinquent for purposes of this table were those at least thirty days past due.

2 Primarily consists of extensions and deficiency notes.

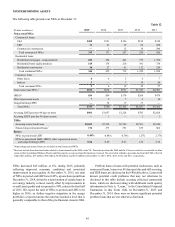

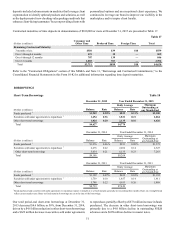

At December 31, 2015, our total TDR portfolio was $2.8 billion

and was composed of $2.6 billion, or 92%, of residential loans

(predominantly first and second lien residential mortgages and

home equity lines of credit), $131 million, or 5%, of consumer

loans, and $74 million, or 3%, of commercial loans

(predominantly income-producing properties). Total TDRs

decreased $86 million, or 3%, from December 31, 2014.

Nonaccruing TDRs decreased $97 million, or 36%, and accruing

TDRs increased $11 million from December 31, 2014.

Generally, interest income on restructured loans that have

met sustained performance criteria and returned to accruing

status, is recognized according to the terms of the restructuring.

Such recognized interest income was $115 million and $118

million during 2015 and 2014, respectively. If all such loans had

been accruing interest according to their original contractual

terms, estimated interest income of $146 million and $153

million during 2015 and 2014, respectively, would have been

recognized.

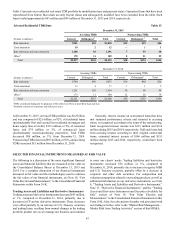

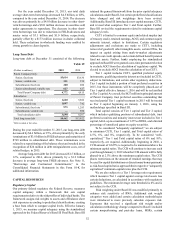

SELECTED FINANCIAL INSTRUMENTS MEASURED AT FAIR VALUE

The following is a discussion of the more significant financial

assets and financial liabilities that are measured at fair value on

the Consolidated Balance Sheets at December 31, 2015 and

2014. For a complete discussion of our financial instruments

measured at fair value and the methodologies used to estimate

the fair values of our financial instruments, see Note 18, “Fair

Value Election and Measurement,” to the Consolidated Financial

Statements in this Form 10-K.

Trading Assets and Liabilities and Derivative Instruments

Trading assets and derivative instruments decreased $83 million,

or 1%, compared to December 31, 2014, primarily due to

decreases in CP and net derivative instruments. These decreases

were offset partially by an increase in U.S. Treasury securities

and trading loans, resulting from normal changes in the trading

portfolio product mix as we manage our business and continue

to meet our clients' needs. Trading liabilities and derivative

instruments increased $36 million, or 3%, compared to

December 31, 2014, primarily due to increases in agency MBS

and U.S. Treasury securities, partially offset by a decrease in

corporate and other debt securities. For composition and

valuation assumptions related to our trading products, as well as

additional information on our derivative instruments, see Note

4, “Trading Assets and Liabilities and Derivative Instruments,”

Note 17, “Derivative Financial Instruments,” and the “Trading

Assets and Derivative Instruments and Securities Available for

Sale” section of Note 18, “Fair Value Election and

Measurement,” to the Consolidated Financial Statements in this

Form 10-K. Also, for a discussion of market risk associated with

our trading activities, refer to the “Market Risk Management—

Market Risk from Trading Activities” section of this MD&A.