SunTrust 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.69

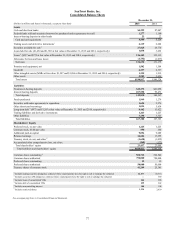

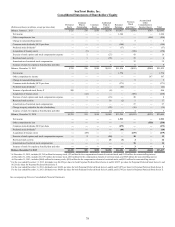

BUSINESS SEGMENT RESULTS

Year Ended December 31, 2015 vs. 2014

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported

net income of $754 million for the year ended December 31,

2015, an increase of $59 million, or 8%, compared to 2014. The

increase in net income was driven primarily by an increase in

net interest income and lower provision for credit losses.

Net interest income was $2.7 billion, an increase of $100

million, or 4%, compared to 2014, primarily driven by growth

in average deposit balances and improved loan spreads, partially

offset by lower deposit spreads and a decline in average loan

balances. Net interest income related to deposits increased $58

million, or 3%, driven by a $5.1 billion, or 6%, increase in

average deposit balances. Favorable deposit mix trends

continued as average deposit balances increased in all lower cost

product categories, offsetting a $1.4 billion, or 13%, decline in

average time deposits, contributing to a two basis point decline

in the overall rate paid on average deposits. Net interest income

related to loans increased $27 million, or 3%, driven by an overall

13 basis point increase in loan spreads, partially offset by a $1.1

billion, or 3%, decrease in average loan balances. Declines in

student and indirect auto loans were driven by portfolio sales

and the securitization of indirect auto loans in 2015, in addition

to home equity and consumer mortgage loan attrition. These

decreases were partially offset by growth primarily within the

consumer direct loans, personal credit lines, and credit cards

categories.

Provision for credit losses was $137 million, a decrease of

$54 million, or 28%, compared to 2014. The decrease was largely

driven by lower net charge-offs related to continued strong asset

quality.

Total noninterest income was $1.5 billion, a decrease of $19

million, or 1%, compared to 2014. The decrease was largely

driven by declines in service charges on deposits (due to changes

in client behavior) and lower trust and investment management

income (due to a decline in assets under management), partially

offset by higher card fee income. Additionally, gains on loan

portfolio sales were higher in 2015 compared to 2014.

Total noninterest expense was $2.9 billion, an increase of

$36 million, or 1%, compared to 2014. The increase was driven

by higher outside data processing expenses resulting from

increased transaction volumes and higher utilization of outside

vendors. Additionally, increases in various corporate support

expenses, such as marketing and technology, were partially offset

by decreases in staff expenses and operating losses.

Wholesale Banking

Wholesale Banking reported net income of $954 million for the

year ended December 31, 2015, an increase of $79 million, or

9%, compared to 2014. The increase in net income was

attributable to increases in net interest income and noninterest

income, partially offset by an increase in the provision for credit

losses and noninterest expense.

Net interest income was $1.9 billion, an increase of $111

million, or 6%, compared to 2014, driven by increases in average

loan and deposit balances, partially offset by lower loan and

deposit spreads. Net interest income related to loans increased,

as average loan balances grew $5.2 billion, or 8%, led by growth

in C&I, CRE, and tax-exempt loans. Net interest income related

to client deposits increased as average deposit balances grew

$6.8 billion, or 16%, compared to 2014. Lower cost average

demand deposits increased $415 million, or 2%, and average

combined interest-bearing transaction and money market

accounts increased $6.6 billion, or 32%, while average CD

balances declined approximately $169 million. Enhancements

we made to our treasury and payment products, in conjunction

with our client liquidity specialists, contributed to our deposit

growth momentum.

Provision for credit losses was $137 million, an increase of

$66 million, compared to 2014. The increase reflects loan growth

and higher reserves related to energy exposures.

Total noninterest income was $1.2 billion, an increase of

$111 million, or 10%, compared to 2014. The increase was

primarily driven by a $57 million, or 14%, increase in investment

banking income and an increase in leasing-related revenue

attributable to impairment charges on aircraft leases recognized

in 2014. These increases were partially offset by declines in

trading revenues, letter of credit fees, net service charges on

treasury related services, and other income.

Total noninterest expense was $1.6 billion, an increase of

$23 million, or 1%, compared to 2014. The increase was

primarily due to increases in employee compensation as we

continue to invest in talent to meet our clients' needs and augment

our capabilities, expense tied to new market tax credit

investments, and outside processing expenses. These increases

were partially offset by lower impairment charges due to our

strategic, first quarter of 2014 decision to sell certain legacy

investments of the aforementioned affordable housing

partnership assets. The sale of these investments resulted in an

impairment charge in 2014, as well as a decline in associated

partnership expenses due to the subsequent sale of those assets.

Mortgage Banking

Mortgage Banking reported net income was $287 million for the

year ended December 31, 2015, compared to a net loss of $53

million in 2014. Excluding the 2014 after-tax impact of Form 8-

K and other legacy mortgage-related items presented in Table 1,

"Selected Financial Data and Reconcilement of Non-U.S. GAAP

Measures," the increase in net income was driven by declines in

the provision for credit losses and noninterest expense, partially

offset by lower net interest income.

Net interest income was $483 million, a decrease of $69

million, or 13%, compared to 2014. The decrease was

predominantly due to lower net interest income on loans and

LHFS. Net interest income on loans decreased $58 million, or

14%, due to a $1.5 billion, or 6%, decrease in average loan

balances and lower spreads on residential mortgages. The decline

in average loans was largely driven by the sale of government-

guaranteed residential loans in the second and third quarters of

2014. Additionally, net interest income on LHFS decreased $6

million primarily due to lower spreads.

Provision for credit losses was a benefit of $110 million,

resulting in a decrease of $191 million compared to 2014. The

improvement was primarily attributable to continued

improvement in asset quality.