SunTrust 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

143

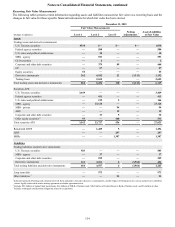

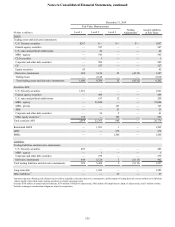

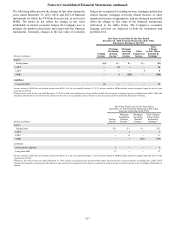

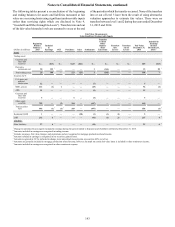

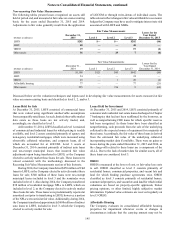

The following tables present a reconciliation of the beginning

and ending balances for assets and liabilities measured at fair

value on a recurring basis using significant unobservable inputs

(other than servicing rights which are disclosed in Note 9,

“Goodwill and Other Intangible Assets”). Transfers into and out

of the fair value hierarchy levels are assumed to occur at the end

of the period in which the transfer occurred. None of the transfers

into or out of level 3 have been the result of using alternative

valuation approaches to estimate fair values. There were no

transfers between level 1 and 2 during the years ended December

31, 2015 and 2014.

Fair Value Measurements

Using Significant Unobservable Inputs

(Dollars in millions)

Beginning

Balance

January 1,

2015

Included

in

Earnings OCI Purchases Sales Settlements

Transfers

to/from

Other

Balance

Sheet

Line Items

Transfers

into

Level 3

Transfers

out of

Level 3

Fair Value

December 31,

2015

Included in

Earnings

(held at

December 31,

2015) 1

Assets

Trading assets:

Corporate and

other debt

securities $— ($13)

2

$— $123 ($21) $— $— $— $— $89 ($13)

2

Derivative

instruments, net 20 153 3— — — 3 (161) — — 15 20 3

Total trading assets 20 140 — 123 (21) 3 (161) — — 104 7

Securities AFS:

U.S. states and

political

subdivisions 12 — — — — (7) — — — 5 —

MBS - private 123 (1) 1 — — (29) — — — 94 (1)

ABS 21 — — — — (9) — — — 12 —

Corporate and

other debt

securities 5 — — 5 — (5) — — — 5 —

Other equity

securities 785 — (2) 104 — (447) — — — 440 —

Total securities

AFS 946 (1) 4(1) 5109 — (497) — — — 556 (1) 4

Residential LHFS 1 — — — (20) (1)(1) 26 — 5 —

LHFI 272 6 6— — — (41)(1) 21 — 257 4 6

Liabilities

Other liabilities 27 6 7— — — (10) — — — 23 6 7

1 Change in unrealized (losses)/gains included in earnings during the period related to financial assets/liabilities still held at December 31, 2015.

2 Amounts included in earnings are recognized in trading income.

3 Includes issuances, fair value changes, and expirations and are recognized in mortgage production related income.

4 Amount included in earnings is recognized in net securities gains/(losses).

5 Amount recognized in OCI is included in change in net unrealized (losses)/gains on securities AFS, net of tax.

6 Amounts are generally included in mortgage production related income; however, the mark on certain fair value loans is included in other noninterest income.

7 Amounts included in earnings are recognized in other noninterest expense.