SunTrust 2015 Annual Report Download - page 168

Download and view the complete annual report

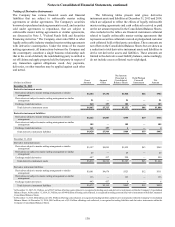

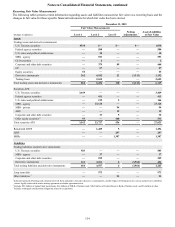

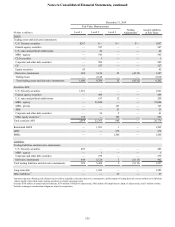

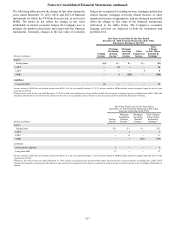

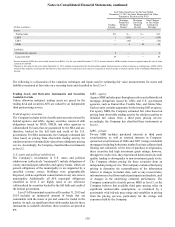

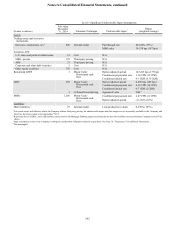

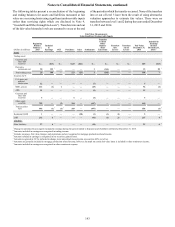

Please find page 168 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

140

Company elected to measure these loans at fair value since they

are actively traded. For the years ended December 31, 2015,

2014, and 2013, the Company recognized an immaterial amount

of gains/(losses) in the Consolidated Statements of Income due

to changes in fair value attributable to instrument-specific credit

risk. The Company is able to obtain fair value estimates for

substantially all of these loans through a third party valuation

service that is broadly used by market participants. While most

of the loans are traded in the market, the Company does not

believe that trading activity qualifies the loans as level 1

instruments, as the volume and level of trading activity is subject

to variability and the loans are not exchange-traded. At

December 31, 2015 and 2014, $356 million and $284 million,

respectively, of loans related to the Company’s trading business

were held in inventory.

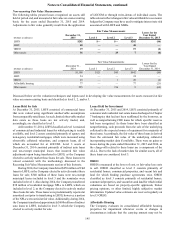

Loans Held for Sale and Loans Held for Investment

Residential LHFS

The Company values certain newly-originated mortgage LHFS

predominantly at fair value based upon defined product criteria.

The Company chooses to fair value these mortgage LHFS to

eliminate the complexities and inherent difficulties of achieving

hedge accounting and to better align reported results with the

underlying economic changes in value of the loans and related

hedge instruments. Origination fees are recognized within

mortgage production related income in the Consolidated

Statements of Income when earned at the time of closing. The

servicing value is included in the fair value of the loan and

initially recognized at the time the Company enters into IRLCs

with borrowers. The Company uses derivative instruments to

economically hedge changes in interest rates and the related

impact on servicing value in the fair value of the loan. The mark-

to-market adjustments related to LHFS and the associated

economic hedges are captured in mortgage production related

income.

LHFS classified as level 2 are primarily agency loans which

trade in active secondary markets and are priced using current

market pricing for similar securities, adjusted for servicing,

interest rate risk, and credit risk. Non-agency residential

mortgages are also included in level 2 LHFS. Transfers of certain

mortgage LHFS into level 3 during the years ended December

31, 2015 and 2014 were largely due to borrower defaults or the

identification of other loan defects impacting the marketability

of the loans.

For residential loans that the Company has elected to

measure at fair value, the Company considers the component of

the fair value changes due to instrument-specific credit risk,

which is intended to be an approximation of the fair value change

attributable to changes in borrower-specific credit risk. For the

years ended December 31, 2015, 2014, and 2013, the Company

recognized an immaterial amount of gains/(losses) in the

Consolidated Statements of Income due to changes in fair value

attributable to borrower-specific credit risk. In addition to

borrower-specific credit risk, there are other, more significant,

variables that drive changes in the fair values of the loans,

including interest rates and general conditions in the markets for

the loans.

LHFI

LHFI classified as level 3 includes predominantly mortgage

loans that are not marketable, largely due to the identification of

loan defects. The Company chooses to measure these mortgage

LHFI at fair value to better align reported results with the

underlying economic changes in value of the loans and any

related hedging instruments. The Company values these loans

using a discounted cash flow approach based on assumptions

that are generally not observable in current markets, such as

prepayment speeds, default rates, loss severity rates, and

discount rates. These assumptions have an inverse relationship

to the overall fair value. Level 3 LHFI also includes mortgage

loans that are valued using collateral based pricing. Changes in

the applicable housing price index since the time of the loan

origination are considered and applied to the loan's collateral

value. An additional discount representing the return that a buyer

would require is also considered in the overall fair value.

Mortgage Servicing Rights

The Company records MSR assets at fair value using a

discounted cash flow approach. The fair values of MSRs are

impacted by a variety of factors, including prepayment

assumptions, spreads, delinquency rates, contractually specified

servicing fees, servicing costs, and underlying portfolio

characteristics. The underlying assumptions and estimated

values are corroborated by values received from independent

third parties based on their review of the servicing portfolio, and

comparisons to market transactions. Because these inputs are not

transparent in market trades, MSRs are classified as level 3

assets. For additional information see Note 9, "Goodwill and

Other Intangible Assets."

Liabilities

Trading liabilities and derivative instruments

Trading liabilities are primarily comprised of derivative

contracts, but also include various contracts (primarily U.S.

Treasury securities, corporate and other debt securities) that the

Company uses in certain of its trading businesses. The

Company's valuation methodologies for these derivative

contracts and securities are consistent with those discussed

within the corresponding sections herein under “Trading Assets

and Derivative Instruments and Securities Available for Sale.”

During the second quarter of 2009, in connection with its

sale of Visa Class B shares, the Company entered into a derivative

contract whereby the ultimate cash payments received or paid,

if any, under the contract are based on the ultimate resolution of

litigation involving Visa. The value of the derivative was

estimated based on the Company’s expectations regarding the

ultimate resolution of that litigation, which involved a high

degree of judgment and subjectivity. Accordingly, the value of

the related derivative liability is classified as a level 3 instrument.

See Note 16, "Guarantees," for a discussion of the valuation

assumptions.

Long-term debt

The Company has elected to measure at fair value certain fixed

rate debt issuances of public debt which are valued by obtaining

price indications from a third party pricing service and utilizing

broker quotes to corroborate the reasonableness of those marks.

Additionally, information from market data of recent observable