SunTrust 2015 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

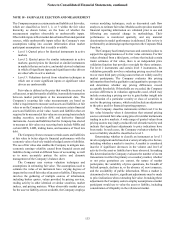

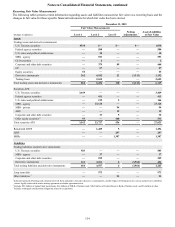

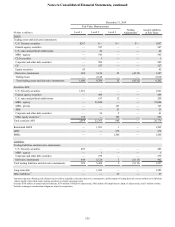

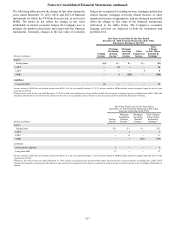

Notes to Consolidated Financial Statements, continued

142

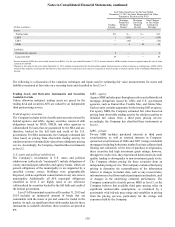

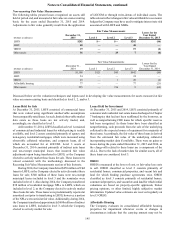

Level 3 Significant Unobservable Input Assumptions

(Dollars in millions)

Fair value

December

31, 2014 Valuation Technique Unobservable Input 1Range

(weighted average)

Assets

Trading assets and derivative

instruments:

Derivative instruments, net 2$20 Internal model Pull through rate 40-100% (75%)

MSR value 39-218 bps (107 bps)

Securities AFS:

U.S. states and political subdivisions 12 Cost N/A

MBS - private 123 Third party pricing N/A

ABS 21 Third party pricing N/A

Corporate and other debt securities 5 Cost N/A

Other equity securities 785 Cost N/A

Residential LHFS 1 Monte Carlo/

Discounted cash

flow

Option adjusted spread 145-225 bps (157 bps)

Conditional prepayment rate 1-30 CPR (15 CPR)

Conditional default rate 0-3 CDR (0.75 CDR)

LHFI 269 Monte Carlo/

Discounted cash

flow

Option adjusted spread 0-450 bps (286 bps)

Conditional prepayment rate 4-30 CPR (14 CPR)

Conditional default rate 0-7 CDR (2 CDR)

3 Collateral based pricing Appraised value NM 4

MSRs 1,206 Monte Carlo/

Discounted cash

flow

Conditional prepayment rate 2-47 CPR (11 CPR)

Option adjusted spread (1)-122% (10%)

Liabilities

Other liabilities 327 Internal model Loan production volume 0-150% (107%)

1 For certain assets and liabilities where the Company utilizes third party pricing, the unobservable inputs and their ranges are not reasonably available to the Company, and

therefore, have been noted as not applicable ("N/A").

2 Represents the net of IRLC assets and liabilities entered into by the Mortgage Banking segment and includes the derivative liability associated with the Company's sale of Visa

shares.

3 Input assumptions relate to the Company's contingent consideration obligations related to acquisitions. See Note 16, "Guarantees," for additional information.

4 Not meaningful.