SunTrust 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

93

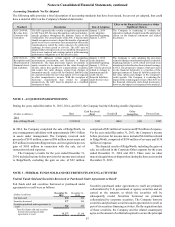

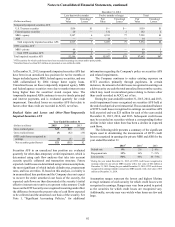

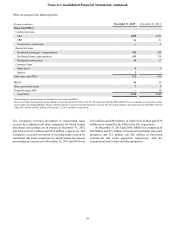

NOTE 6 - LOANS

Composition of Loan Portfolio

(Dollars in millions)

December 31,

2015

December 31,

2014

Commercial loans:

C&I $67,062 $65,440

CRE 6,236 6,741

Commercial construction 1,954 1,211

Total commercial loans 75,252 73,392

Residential loans:

Residential mortgages -

guaranteed 629 632

Residential mortgages -

nonguaranteed 124,744 23,443

Residential home equity

products 13,171 14,264

Residential construction 384 436

Total residential loans 38,928 38,775

Consumer loans:

Guaranteed student 4,922 4,827

Other direct 6,127 4,573

Indirect 10,127 10,644

Credit cards 1,086 901

Total consumer loans 22,262 20,945

LHFI $136,442 $133,112

LHFS 2$1,838 $3,232

1 Includes $257 million and $272 million of LHFI measured at fair value at

December 31, 2015 and 2014, respectively.

2 Includes $1.5 billion and $1.9 billion of LHFS measured at fair value at

December 31, 2015 and 2014, respectively.

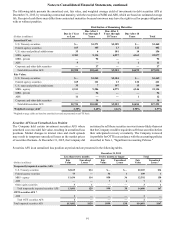

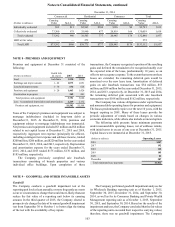

During the years ended December 31, 2015 and 2014, the

Company transferred $1.8 billion and $3.3 billion in LHFI to

LHFS, and $741 million and $44 million in LHFS to LHFI,

respectively. In addition to sales of mortgage LHFS in the normal

course of business, the Company sold $2.1 billion and $4.0

billion in loans and leases for gains of $22 million and $83

million, during the years ended December 31, 2015 and 2014,

respectively.

At December 31, 2015 and 2014, the Company had $23.6

billion and $26.5 billion of net eligible loan collateral pledged

to the Federal Reserve discount window to support $17.2 billion

and $18.4 billion of available, unused borrowing capacity,

respectively.

At December 31, 2015 and 2014, the Company had $33.7

billion and $31.2 billion of net eligible loan collateral pledged

to the FHLB of Atlanta to support $28.5 billion and $24.3 billion

of available borrowing capacity, respectively. The available

FHLB borrowing capacity at December 31, 2015 was used to

support $408 million of long-term debt and $6.7 billion of letters

of credit issued on the Company's behalf. At December 31, 2014,

the available FHLB borrowing capacity was used to support $4.0

billion of long-term debt, $4.0 billion of short-term debt, and

$7.9 billion of letters of credit issued on the Company's behalf.

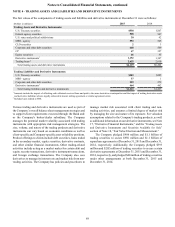

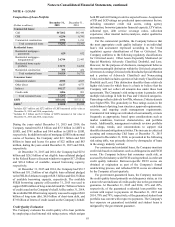

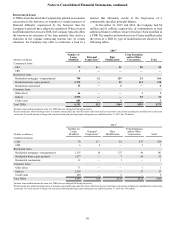

Credit Quality Evaluation

The Company evaluates the credit quality of its loan portfolio

by employing a dual internal risk rating system, which assigns

both PD and LGD ratings to derive expected losses. Assignment

of PD and LGD ratings are predicated upon numerous factors,

including consumer credit risk scores, rating agency

information, borrower/guarantor financial capacity, LTV ratios,

collateral type, debt service coverage ratios, collection

experience, other internal metrics/analyses, and/or qualitative

assessments.

For the commercial portfolio, the Company believes that

the most appropriate credit quality indicator is an individual

loan’s risk assessment expressed according to the broad

regulatory agency classifications of Pass or Criticized. The

Company conforms to the following regulatory classifications

for Criticized assets: Other Assets Especially Mentioned (or

Special Mention), Adversely Classified, Doubtful, and Loss.

However, for the purposes of disclosure, management believes

the most meaningful distinction within the Criticized categories

is between Accruing Criticized (which includes Special Mention

and a portion of Adversely Classified) and Nonaccruing

Criticized (which includes a portion of Adversely Classified and

Doubtful and Loss). This distinction identifies those relatively

higher risk loans for which there is a basis to believe that the

Company will not collect all amounts due under those loan

agreements. The Company's risk rating system is granular, with

multiple risk ratings in both the Pass and Criticized categories.

Pass ratings reflect relatively low PDs, whereas, Criticized assets

have higher PDs. The granularity in Pass ratings assists in the

establishment of pricing, loan structures, approval requirements,

reserves, and ongoing credit management requirements.

Commercial risk ratings are refreshed at least annually, or more

frequently as appropriate, based upon considerations such as

market conditions, borrower characteristics, and portfolio

trends. Additionally, management routinely reviews portfolio

risk ratings, trends, and concentrations to support risk

identification and mitigation activities. The increase in criticized

accruing and nonaccruing C&I loans at December 31, 2015

compared to December 31, 2014, as presented in the following

risk rating table, was primarily driven by downgrades of loans

in the energy industry vertical.

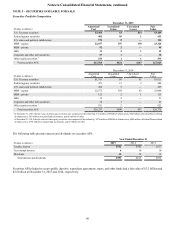

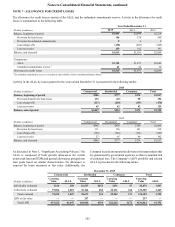

For consumer and residential loans, the Company monitors

credit risk based on indicators such as delinquencies and FICO

scores. The Company believes that consumer credit risk, as

assessed by the industry-wide FICO scoring method, is a relevant

credit quality indicator. Borrower-specific FICO scores are

obtained at origination as part of the Company’s formal

underwriting process, and refreshed FICO scores are obtained

by the Company at least quarterly.

For government-guaranteed loans, the Company monitors

the credit quality based primarily on delinquency status, as it is

a more relevant indicator of credit quality due to the government

guarantee. At December 31, 2015 and 2014, 31% and 28%,

respectively, of the guaranteed residential loan portfolio was

current with respect to payments. At December 31, 2015 and

2014, 78% and 79%, respectively, of the guaranteed student loan

portfolio was current with respect to payments. The Company's

loss exposure on guaranteed residential and student loans is

mitigated by the government guarantee.