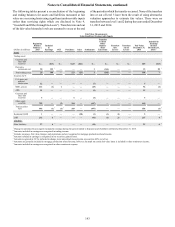

SunTrust 2015 Annual Report Download - page 167

Download and view the complete annual report

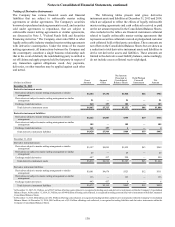

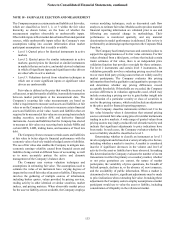

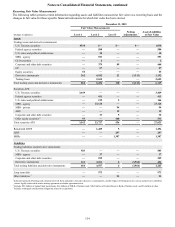

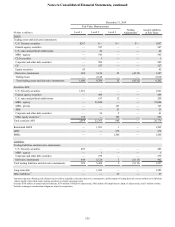

Please find page 167 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

139

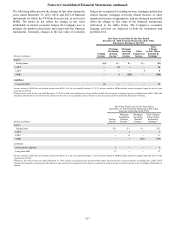

CLO Securities

CLO preference share exposure is estimated at fair value based

on pricing from observable trading activity for similar securities.

Accordingly, the Company has classified these instruments as

level 2.

Asset-Backed Securities

ABS classified as securities AFS includes purchased interests in

third party securitizations collateralized by home equity loans

and are valued based on third party pricing with significant

unobservable assumptions; as such, they are classified as level

3.

Corporate and other debt securities

Corporate debt securities are predominantly comprised of senior

and subordinate debt obligations of domestic corporations and

are classified as level 2. Other debt securities in level 3 primarily

include bonds that are not actively traded in the market. As such,

valuation judgments are highly subjective. The Company

estimates the fair value of these bonds using market comparable

bond index yields as limited observable market data exists.

Commercial Paper

From time to time, the Company acquires third party CP that is

generally short-term in nature (less than 30 days) and highly

rated. The Company estimates the fair value of this CP based on

observable pricing from executed trades of similar instruments;

as such, CP is classified as level 2.

Equity securities

Equity securities classified as securities AFS primarily include

FHLB of Atlanta stock and Federal Reserve Bank of Atlanta

stock, which are redeemable with the issuer at cost and cannot

be traded in the market. As such, observable market data for these

instruments is not available and they are classified as level 3.

The Company accounts for the stock based on industry guidance

that requires these investments be carried at cost and evaluated

for impairment based on the ultimate recovery of cost.

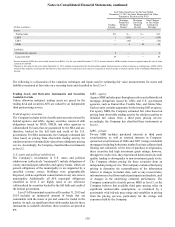

Derivative instruments

The Company holds derivative instruments for both trading and

risk management purposes. Level 1 derivative instruments

generally include exchange-traded futures or option contracts for

which pricing is readily available. The Company’s level 2

instruments are predominantly OTC swaps, options, and

forwards, measured using observable market assumptions for

interest rates, foreign exchange, equity, and credit. Because fair

values for OTC contracts are not readily available, the Company

estimates fair values using internal, but standard, valuation

models. The selection of valuation models is driven by the type

of contract: for option-based products, the Company uses an

appropriate option pricing model such as Black-Scholes. For

forward-based products, the Company’s valuation methodology

is generally a discounted cash flow approach.

The Company's derivative instruments classified as level 2

are primarily transacted in the institutional dealer market and

priced with observable market assumptions at a mid-market

valuation point, with appropriate valuation adjustments for

liquidity and credit risk. To this end, the Company has evaluated

liquidity premiums required by market participants, as well as

the credit risk of its counterparties and its own credit. The

Company has considered factors such as the likelihood of default

by itself and its counterparties, its net exposures, and remaining

maturities in determining the appropriate fair value adjustments

to record. See Note 17, “Derivative Financial Instruments,” for

additional information on the Company's derivative instruments.

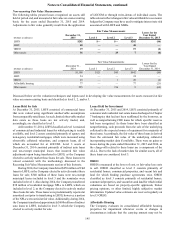

The Company's derivative instruments classified as level 3

include IRLCs that satisfy the criteria to be treated as derivative

financial instruments. The fair value of IRLCs on residential

LHFS, while based on interest rates observable in the market, is

highly dependent on the ultimate closing of the loans. These

“pull-through” rates are based on the Company’s historical data

and reflect the Company’s best estimate of the likelihood that a

commitment will result in a closed loan. As pull-through rates

increase, the fair value of IRLCs also increases. Servicing value

is included in the fair value of IRLCs, and the fair value of

servicing is determined by projecting cash flows, which are then

discounted to estimate an expected fair value. The fair value of

servicing is impacted by a variety of factors, including

prepayment assumptions, discount rates, delinquency rates,

contractually specified servicing fees, servicing costs, and

underlying portfolio characteristics. Because these inputs are not

transparent in market trades, IRLCs are considered to be level 3

assets. During the years ended December 31, 2015 and 2014, the

Company transferred $161 million and $245 million,

respectively, of net IRLCs out of level 3 as the associated loans

were closed.

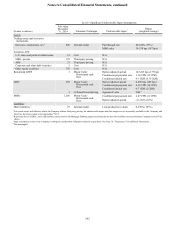

Trading loans

The Company engages in certain businesses whereby the

election to measure loans at fair value for financial reporting

aligns with the underlying business purpose. Specifically, the

loans that are included within this classification are: (i) loans

made, or acquired, in connection with the Company’s TRS

business, (ii) loans backed by the SBA, and (iii) the loan sales

and trading business within the Company’s Wholesale Banking

segment. See Note 10, "Certain Transfers of Financial Assets

and Variable Interest Entities," and Note 17, “Derivative

Financial Instruments,” for further discussion of this business.

All of these loans are classified as level 2, due to the market data

that the Company uses in the estimate of fair value.

The loans made in connection with the Company’s TRS

business are short-term, senior demand loans that are

collateralized by cash. While these loans do not trade in the

market, the Company believes that the par amount of the loans

approximates fair value and no unobservable assumptions are

used by the Company to value these loans. At December 31, 2015

and 2014, the Company had outstanding $2.2 billion and $2.3

billion, respectively, of these short-term loans measured at fair

value.

SBA loans are similar to SBA securities discussed herein

under “Federal agency securities,” except for their legal form.

In both cases, the Company trades instruments that are fully

guaranteed by the U.S. government as to contractual principal

and interest and there is sufficient observable trading activity

upon which to base the estimate of fair value. As these SBA loans

are fully guaranteed, the changes in fair value are attributable to

factors other than instrument-specific credit risk.

The loans from the Company’s sales and trading business

are commercial and corporate leveraged loans that are either

traded in the market or for which similar loans trade. The