SunTrust 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

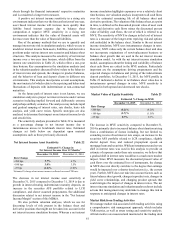

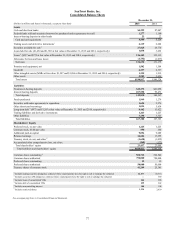

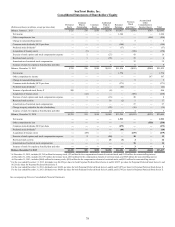

Table 28

Payments Due by Period

(Dollars in millions)

Less than 1

year 1-3 years 3-5 years More than 5

years Total

Contractual Obligations:

Consumer and other time deposits 1$4,736 $3,250 $1,451 $382 $9,819

Brokered time deposits 1196 187 393 123 899

Long-term debt 1, 2 1,111 4,318 1,044 1,981 8,454

Operating leases 207 314 184 307 1,012

Purchase obligations 3349 30 4 — 383

Total $6,599 $8,099 $3,076 $2,793 $20,567

1 Amounts do not include interest.

2 Amounts do not include capital lease obligations.

3 Amounts represent termination fees for legally binding purchase obligations of $5 million or more. Payments made towards the purchase of goods or services under these

contracts totaled $243 million during 2015.

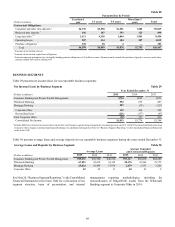

BUSINESS SEGMENTS

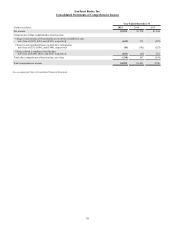

Table 29 presents net income/(loss) for our reportable business segments:

Net Income/(Loss) by Business Segment Table 29

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Consumer Banking and Private Wealth Management $754 $695 $653

Wholesale Banking 954 875 807

Mortgage Banking 287 (53) (527)

Corporate Other 159 434 508

Reconciling Items 1(221) (177) (97)

Total Corporate Other (62) 257 411

Consolidated Net Income $1,933 $1,774 $1,344

1 Includes differences between net income/(loss) reported for each business segment using management accounting practices and U.S. GAAP. Prior period information has been

restated to reflect changes in internal reporting methodology. See additional information in Note 20, "Business Segment Reporting," to the Consolidated Financial Statements

in this Form 10-K.

Table 30 presents average loans and average deposits for our reportable business segments during the years ended December 31:

Average Loans and Deposits by Business Segment Table 30

Average Loans Average Consumer

and Commercial Deposits

(Dollars in millions) 2015 2014 2013 2015 2014 2013

Consumer Banking and Private Wealth Management $40,632 $41,700 $40,510 $91,127 $86,070 $84,289

Wholesale Banking 67,853 62,638 54,142 50,376 43,566 39,572

Mortgage Banking 25,024 26,494 27,974 2,679 2,333 3,206

Corporate Other 49 42 31 20 43 9

See Note 20, “Business Segment Reporting,” to the Consolidated

Financial Statements in this Form 10-K for a discussion of our

segment structure, basis of presentation, and internal

management reporting methodologies, including the

reclassification of RidgeWorth results from the Wholesale

Banking segment to Corporate Other in 2014.