SunTrust 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

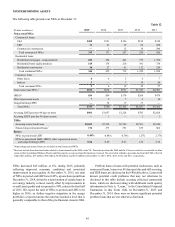

For the year ended December 31, 2015, our total daily

average short-term borrowings decreased $4.5 billion, or 48%,

compared to the year ended December 31, 2014. The decrease

was driven primarily by a $4.0 billion decrease in other short-

term borrowings and a $381 million decrease in securities sold

under agreements to repurchase. The decrease in other short-

term borrowings was due to reductions in FHLB advances and

master notes of $3.1 billion and $1.0 billion, respectively,

partially offset by a $173 million increase in dealer collateral

held. These reductions in wholesale funding were enabled by

strong growth in client deposits.

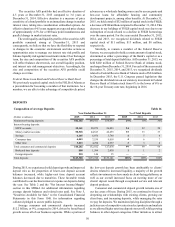

Long-Term Debt

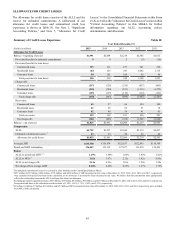

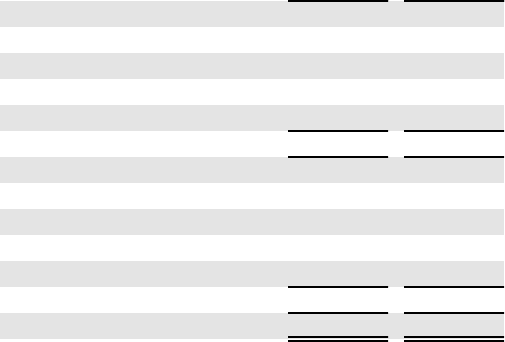

Long-term debt at December 31 consisted of the following:

Table 19

(Dollars in millions) 2015 2014

Parent Company Only:

Senior, fixed rate $3,614 $3,630

Senior, variable rate 331 358

Subordinated, fixed rate 200 200

Junior subordinated, variable rate 627 627

Total Parent Company debt 4,772 4,815

Subsidiaries:

Senior, fixed rate 1,620 5,682

Senior, variable rate 1,097 742

Subordinated, fixed rate 1973 1,283

Subordinated, variable rate —500

Total subsidiaries debt 3,690 8,207

Total long-term debt $8,462 $13,022

1 Debt recorded at fair value.

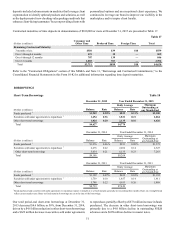

During the year ended December 31, 2015, our long-term debt

decreased by $4.6 billion, or 35%, driven primarily by the early

terminations of $3.8 billion in FHLB advances and maturities of

$769 million in subordinated debt. These terminations were

related to a repositioning of the balance sheet and resulted in the

recognition of $24 million in debt extinguishment costs, net of

related hedges, in 2015.

Average long-term debt for 2015 decreased $1.5 billion, or

12%, compared to 2014, driven primarily by a $1.2 billion

decrease in average long-term FHLB advances. See Note 11,

“Borrowings and Contractual Commitments,” to the

Consolidated Financial Statements in this Form 10-K for

additional information.

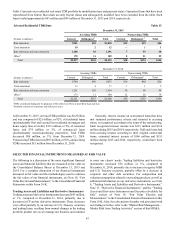

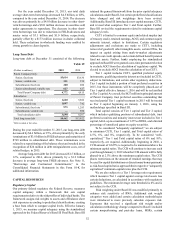

CAPITAL RESOURCES

Regulatory Capital

Our primary federal regulator, the Federal Reserve, measures

capital adequacy within a framework that sets capital

requirements relative to the risk profiles of individual banks. The

framework assigns risk weights to assets and off-balance sheet

risk exposures according to predefined classifications, creating

a base from which to compare capital levels. Effective January

1, 2015, we measure capital adequacy using the standardized

approach to the Federal Reserve's Basel III Final Rule. Basel III

retained the general framework from the prior capital adequacy

calculations under Basel I, but certain predefined classifications

have changed and risk weightings have been revised.

Additionally, Basel III introduced a new capital measure, CET1,

and revised what comprises Tier 1 and Total capital. Further,

Basel III revised the requirements related to minimum capital

adequacy levels.

CET1 is limited to common equity and related surplus (net

of treasury stock), retained earnings, AOCI, and common equity

minority interest, subject to limitations. Certain regulatory

adjustments and exclusions are made to CET1, including

removal of goodwill, other intangible assets, certain DTAs, the

impact on capital arising from mark-to-market adjustments

related to our credit spreads, and certain defined benefit pension

fund net assets. Further, banks employing the standardized

approach to Basel III were granted a one-time permanent election

to exclude AOCI from the calculation of regulatory capital. We

elected to exclude AOCI from the calculation of our CET1.

Tier 1 capital includes CET1, qualified preferred equity

instruments, qualifying minority interest not included in CET1,

subject to limitations, and certain other regulatory deductions.

Tier 1 capital included a portion of trust preferred securities in

2015, but those instruments will be completely phased-out of

Tier 1 capital effective January 1, 2016 and will be reclassified

as Tier 2 capital. As a result, the $627 million in principal amount

of Parent Company trust preferred securities outstanding that

received partial Tier 1 capital treatment in 2015 will be treated

as Tier 2 capital beginning on January 1, 2016, using the

methodology specified in Basel III.

Total capital consists of Tier 1 capital and Tier 2 capital,

which includes qualifying portions of subordinated debt, trust

preferred securities and minority interest not included in Tier 1

capital, ALLL up to a maximum of 1.25% of RWA, and a limited

percentage of unrealized gains on equity securities.

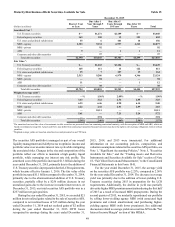

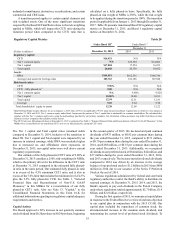

To be considered "adequately capitalized," we are subject

to minimum CET1, Tier 1 capital, and Total capital ratios of

4.5%, 6%, and 8%, respectively. To be considered “well-

capitalized,” Tier 1 and Total capital ratios of 6% and 10%,

respectively, are required. Additionally, beginning in 2016, a

CCB amount of 0.625% is required to be maintained above the

minimum capital ratios. The CCB will continue to increase each

year through January 1, 2019 when the CCB amount will be fully

phased-in at 2.5% above the minimum capital ratios. The CCB

places restrictions on the amount of retained earnings that may

be used for capital distributions or discretionary bonus payments

as risk-based capital ratios approach their respective “adequately

capitalized” minimum capital ratios plus the CCB.

We are also subject to a Tier 1 leverage ratio requirement,

which measures Tier 1 capital against average total assets less

certain deductions, as calculated in accordance with regulatory

guidelines. The minimum leverage ratio threshold is 4% and is

not subject to the CCB.

Risk weighting under Basel III was modified primarily to

enhance risk sensitivity of RWA. Additional risk weight

categories were added and certain calculation methodologies

were introduced to more precisely calculate exposure risk.

Exposures that received a significant risk weight and/or

calculation methodology change compared to Basel I included

certain nonperforming and past-due loans, MSRs, certain