SunTrust 2015 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

150

regarding certain mortgage servicing claims, discussed below at

“United States Mortgage Servicing Settlement.” SunTrust

continues its engagement with the FRB to demonstrate

compliance with its commitments under the Consent Order.

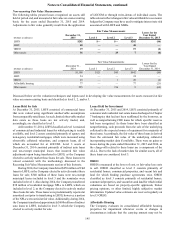

United States Mortgage Servicing Settlement

In the second quarter of 2014, STM and the U.S., through the

DOJ, HUD, and Attorneys General for several states, reached a

final settlement agreement related to the National Mortgage

Servicing Settlement. The settlement agreement became

effective on September 30, 2014 when the court entered the

Consent Judgment. Pursuant to the settlements, STM made $50

million in cash payments and committed to provide $500 million

of consumer relief by the fourth quarter of 2017 and to implement

certain mortgage servicing standards. While subject to

confirmation by the independent Office of Mortgage Settlement

Oversight (“OMSO”) appointed to review and certify

compliance with the provisions of the settlement, the Company

believes it has fulfilled its consumer relief commitments. STM

also implemented all of the prescribed servicing standards within

the required timeframes. Compliance with the servicing

standards continues to be monitored, tested, and reported

quarterly by an internal review group and semi-annually by the

OMSO. As a result, the Company does not expect to incur

additional costs in satisfying its consumer relief obligations or

implementation of the servicing standards associated with the

settlement.

DOJ Investigation of GSE Loan Origination Practices

In January 2014, STM received notice from the DOJ of an

investigation regarding the origination and underwriting of

single family residential mortgage loans sold by STM to Fannie

Mae and Freddie Mac. The DOJ and STM have not yet engaged

in any material dialogue about how this matter may proceed and

no allegations have been raised against STM. STM continues to

cooperate with the investigation.

Mortgage Modification Investigation

In the third quarter of 2014, STM resolved claims by the United

States Attorney’s Office for the Western District of Virginia and

the Office of the Special Inspector General for the Troubled Asset

Relief Program relating to STM's administration of HAMP.

Pursuant to the settlement, the Company paid $46 million,

including $20 million to fund housing counseling for

homeowners, $10 million in restitution to Fannie Mae and

Freddie Mac, and $16 million to the U.S. Treasury, and

transferred its minimum consumer remediation obligation of

$179 million (which may increase to a maximum of $274

million) to the required deposit account to be controlled by a

third party claims administrator. The Company incurred a $204

million pre-tax charge in the second quarter of 2014 in

connection with this matter, which included its estimate of the

consumer remediation obligation. STM continues to cooperate

with the government and the claims administrator regarding

administration of the consumer remediation payment process,

which currently is expected to resolve in early 2016. The

Company does not currently anticipate it will exceed the $179

million minimum consumer remediation obligation.

Residential Funding Company, LLC v. SunTrust Mortgage,

Inc.

STM has been named as a defendant in a complaint filed

December 17, 2013 in the Southern District of New York by

Residential Funding Company, LLC ("RFC"), a Chapter 11

debtor-affiliate of GMAC Mortgage, LLC, alleging breaches of

representations and warranties made in connection with loan

sales and seeking indemnification against losses allegedly

suffered by RFC as a result of such alleged breaches. The case

was transferred to the United States Bankruptcy Court for the

Southern District of New York. The litigation remains active in

the Bankruptcy Court and discovery has commenced.

SunTrust Mortgage Reinsurance Class Actions

STM and Twin Rivers Insurance Company ("Twin Rivers") have

been named as defendants in two putative class actions alleging

that the companies entered into illegal “captive reinsurance”

arrangements with private mortgage insurers. More specifically,

plaintiffs allege that SunTrust’s selection of private mortgage

insurers who agree to reinsure with Twin Rivers certain loans

referred to them by SunTrust results in illegal “kickbacks” in the

form of the insurance premiums paid to Twin Rivers. Plaintiffs

contend that this arrangement violates the Real Estate Settlement

Procedures Act (“RESPA”) and results in unjust enrichment to

the detriment of borrowers. The first of these cases, Thurmond,

Christopher, et al. v. SunTrust Banks, Inc. et al., was filed in

February 2011 in the U.S. District Court for the Eastern District

of Pennsylvania. This case was stayed by the Court pending the

outcome of Edwards v. First American Financial Corporation,

a captive reinsurance case that was pending before the U.S.

Supreme Court at the time. The second of these cases, Acosta,

Lemuel & Maria Ventrella et al. v. SunTrust Bank, SunTrust

Mortgage, Inc., et al., was filed in the U.S. District Court for the

Central District of California in December 2011. This case was

stayed pending a decision in the Edwards case also. In June 2012,

the U.S. Supreme Court withdrew its grant of certiorari in

Edwards and, as a result, the stays in these cases were lifted.

SunTrust has filed a motion to dismiss the Thurmond case which

was granted in part and denied in part, allowing limited discovery

surrounding the argument that the statute of limitations for

certain claims should be equitably tolled. Thurmond has been

stayed pending a ruling in a similar case currently before the

Third Circuit. The Acosta plaintiffs have voluntarily dismissed

their case.

United States Attorney’s Office for the Southern District of

New York Foreclosure Expense Investigation

STM has been cooperating with the United States Attorney's

Office for the Southern District of New York (the "Southern

District") in a broad-based industry investigation regarding

claims for foreclosure-related expenses charged by law firms in

connection with the foreclosure of loans guaranteed or insured

by Fannie Mae, Freddie Mac, or FHA. The investigation relates

to a private litigant qui tam lawsuit filed under seal and remains

in early stages. The Southern District has not yet advised STM

how it will proceed in this matter. The Southern District and STM

engaged in dialogue regarding potential resolution of this matter

as part of the National Mortgage Servicing Settlement, but were

unable to reach agreement.