SunTrust 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

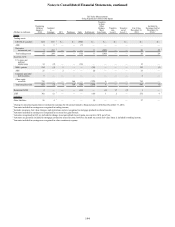

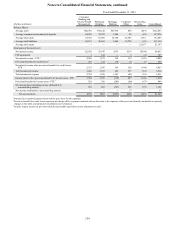

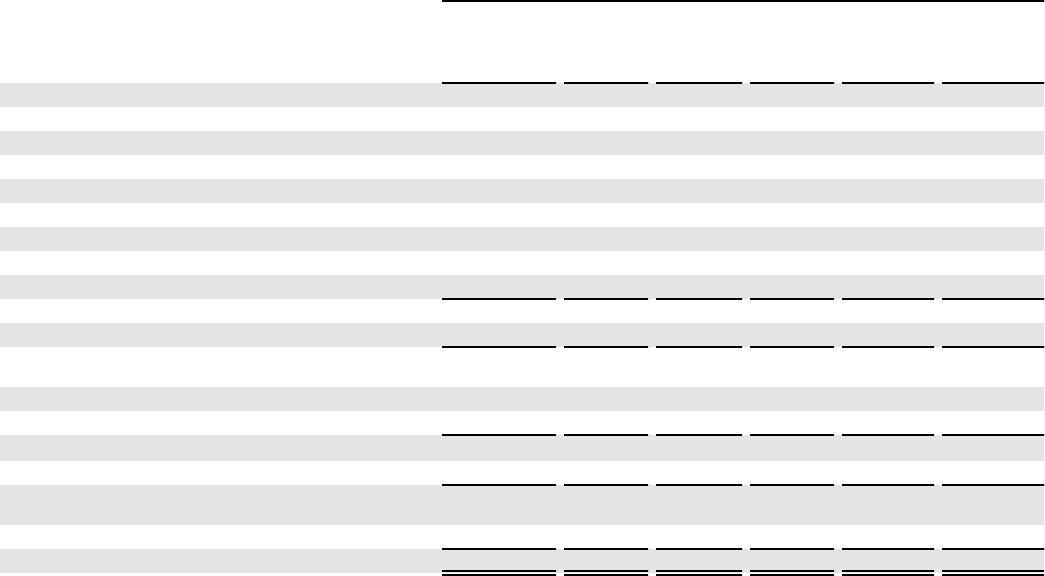

Notes to Consolidated Financial Statements, continued

154

Year Ended December 31, 2013

(Dollars in millions)

Consumer

Banking and

Private Wealth

Management

Wholesale

Banking

Mortgage

Banking

Corporate

Other

Reconciling

Items Consolidated

Balance Sheets:

Average loans $40,510 $54,142 $27,974 $50 ($19) $122,657

Average consumer and commercial deposits 84,289 39,572 3,206 98 (89) 127,076

Average total assets 45,538 66,095 32,708 26,505 1,651 172,497

Average total liabilities 85,167 46,693 3,845 15,720 (95) 151,330

Average total equity — — — — 21,167 21,167

Statements of Income/(Loss):

Net interest income $2,595 $1,547 $539 $316 ($144) $4,853

FTE adjustment 1 124 — 3 (1) 127

Net interest income - FTE 12,596 1,671 539 319 (145) 4,980

Provision/(benefit) for credit losses 2261 124 170 (1) (1) 553

Net interest income after provision/(benefit) for credit losses -

FTE 2,335 1,547 369 320 (144) 4,427

Total noninterest income 1,482 1,103 402 237 (10) 3,214

Total noninterest expense 2,783 1,455 1,503 100 (10) 5,831

Income/(loss) before provision/(benefit) for income taxes - FTE 1,034 1,195 (732) 457 (144) 1,810

Provision/(benefit) for income taxes - FTE 3381 388 (205) (68) (47) 449

Net income/(loss) including income attributable to

noncontrolling interest 653 807 (527) 525 (97) 1,361

Net income attributable to noncontrolling interest — — — 17 — 17

Net income/(loss) $653 $807 ($527) $508 ($97) $1,344

1 Presented on a matched maturity funds transfer price basis for the segments.

2 Provision/(benefit) for credit losses represents net charge-offs by segment combined with an allocation to the segments of the provision/(benefit) attributable to quarterly

changes in the ALLL and unfunded commitment reserve balances.

3 Includes regular income tax provision/(benefit) and taxable-equivalent income adjustment reversal.