SunTrust 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

101

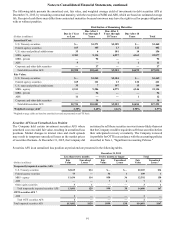

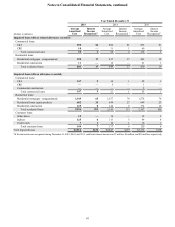

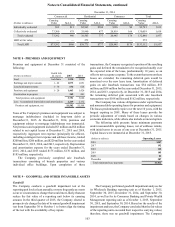

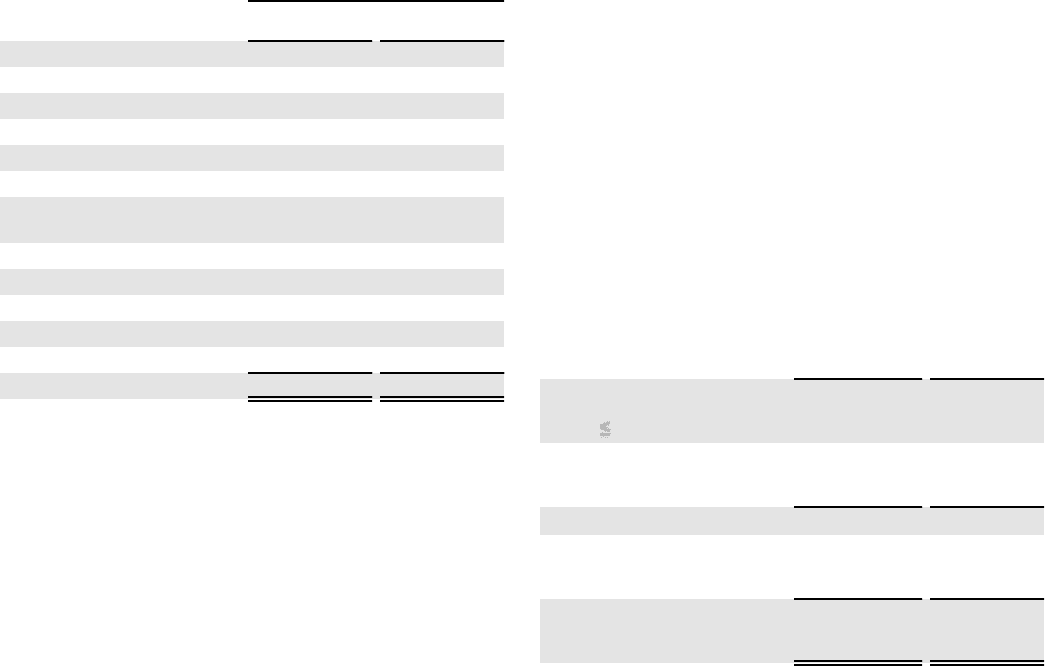

For the year ended December 31, 2013, the following table

represents defaults on loans that were first modified between the

periods January 1, 2012 and December 31, 2013 that became 90

days or more delinquent or were charged-off during the period.

Year Ended December 31, 2013

(Dollars in millions) Number of

Loans

Amortized

Cost

Commercial loans:

C&I 55 $5

CRE 5 3

Commercial construction 1 —

Residential loans:

Residential mortgages 287 23

Residential home equity

products 188 10

Residential construction 48 3

Consumer loans:

Other direct 15 1

Indirect 207 2

Credit cards 169 1

Total TDRs 975 $48

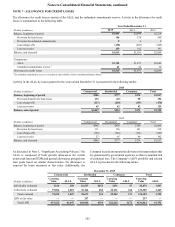

The majority of loans that were modified and subsequently

became 90 days or more delinquent have remained on nonaccrual

status since the time of delinquency.

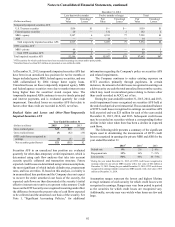

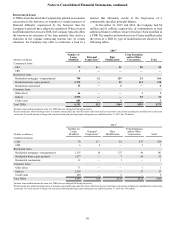

Concentrations of Credit Risk

The Company does not have a significant concentration of risk

to any individual client except for the U.S. government and its

agencies. However, a geographic concentration arises because

the Company operates primarily within Florida, Georgia,

Maryland, North Carolina, South Carolina, Tennessee, Virginia,

and the District of Columbia. The Company engages in limited

international banking activities. The Company’s total cross-

border outstanding loans were $1.6 billion and $1.3 billion at

December 31, 2015 and 2014, respectively.

With respect to collateral concentration, at December 31,

2015, the Company owned $38.9 billion in loans secured by

residential real estate, representing 29% of total LHFI.

Additionally, the Company had $10.5 billion in commitments to

extend credit on home equity lines and $3.2 billion in mortgage

loan commitments at December 31, 2015. At December 31,

2014, the Company owned $38.8 billion in loans secured by

residential real estate, representing 29% of total LHFI, and had

$10.9 billion in commitments to extend credit on home equity

lines and $3.3 billion in mortgage loan commitments. At both

December 31, 2015 and December 31, 2014, 2% of residential

loans owned were guaranteed by a federal agency or a GSE.

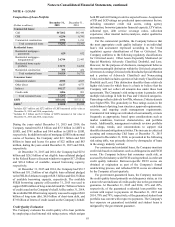

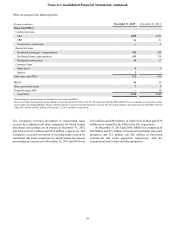

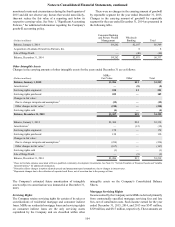

The following table presents loans in the residential

mortgage portfolio that included a high original LTV ratio (in

excess of 80%), an interest only feature, and/or a second lien

position that may increase the Company’s exposure to credit risk

and result in a concentration of credit risk. At December 31, 2015

and December 31, 2014, borrowers' current weighted average

FICO score on these loans was 745 and 738, respectively.

(Dollars in millions)

December 31,

2015

December 31,

2014

Interest only mortgages with MI

or with combined original

LTV 80% 1 $1,563 $3,180

Interest only mortgages with no

MI and with combined

original LTV > 80% 1 547 873

Total interest only mortgages 12,110 4,053

Amortizing mortgages with

combined original LTV > 80%

and/or second liens 28,366 7,368

Total mortgages with

potential concentration of

credit risk $10,476 $11,421

1 Comprised of first and/or second liens, primarily with an initial 10 year interest only

period.

2 Comprised of loans with no MI.