SunTrust 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements, continued

82

residential mortgages continue to accrue interest regardless of

delinquency status because collection of principal and interest

is reasonably assured by the government. Nonguaranteed

residential mortgages and residential construction loans are

generally placed on nonaccrual when three payments are past

due. Residential home equity products are generally placed on

nonaccrual when payments are 90 days past due. The exceptions

for nonguaranteed residential mortgages, residential

construction loans, and residential home equity products are: (i)

when the borrower has declared bankruptcy, in which case, they

are moved to nonaccrual status once they become 60 days past

due, (ii) loans discharged in Chapter 7 bankruptcy that have not

been reaffirmed by the borrower, in which case, they are

reclassified as TDRs and moved to nonaccrual status, and (iii)

second lien loans, which are classified as nonaccrual when the

first lien loan is classified as nonaccrual, even if the second lien

loan is performing. When a loan is placed on nonaccrual, accrued

interest is reversed against interest income. Interest income on

nonaccrual loans is recognized on a cash basis. Nonaccrual

residential loans are typically returned to accrual status once they

no longer meet the delinquency threshold that resulted in them

initially being moved to nonaccrual status, with the exception of

the aforementioned Chapter 7 bankruptcy loans, which remain

on nonaccrual until there is six months of payment performance

following discharge by the bankruptcy court.

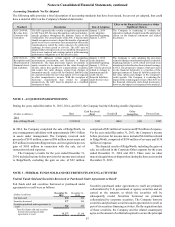

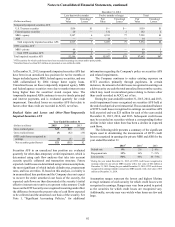

TDRs are loans in which the borrower is experiencing

financial difficulty at the time of restructure and the borrower

received an economic concession either from the Company or

as the product of a bankruptcy court order. To date, the

Company’s TDRs have been predominantly first and second lien

residential mortgages and home equity lines of credit. Prior to

granting a modification of a borrower’s loan terms, the Company

performs an evaluation of the borrower’s financial condition and

ability to service under the potential modified loan terms. The

types of concessions generally granted are extensions of the loan

maturity date and/or reductions in the original contractual

interest rate. Typically, if a loan is accruing interest at the time

of modification, the loan remains on accrual status and is subject

to the Company’s charge-off and nonaccrual policies. See the

“Allowance for Credit Losses” section below for further

information regarding these policies. If a loan is on nonaccrual

before it is determined to be a TDR then the loan remains on

nonaccrual. Typically, TDRs may be returned to accrual status

if there has been at least a six month sustained period of

repayment performance by the borrower. Generally, once a loan

becomes a TDR, the Company expects that the loan will continue

to be reported as a TDR for its remaining life, even after returning

to accruing status, unless the modified rates and terms at the time

of modification were available to the borrower in the market or

the loan is subsequently restructured with no concession to the

borrower and the borrower is no longer in financial difficulty.

Interest income recognition on impaired loans is dependent upon

accrual status, TDR designation, and loan type as discussed

above.

For loans accounted for at amortized cost, fees and

incremental direct costs associated with the loan origination and

pricing process, as well as premiums and discounts, are deferred

and amortized as level yield adjustments over the respective loan

terms. Fees received for providing loan commitments that result

in funded loans are recognized over the term of the loan as an

adjustment of the yield. If a loan is never funded, the commitment

fee is recognized in noninterest income at the expiration of the

commitment period. Origination fees and costs are recognized

in noninterest income and expense at the time of origination for

newly-originated loans that are accounted for at fair value. For

additional information on the Company's loans activities, see

Note 6, “Loans.”

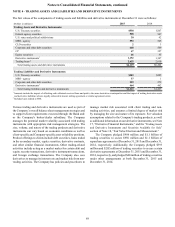

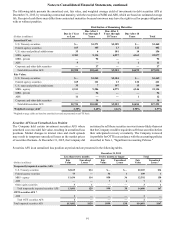

Allowance for Credit Losses

The allowance for credit losses is composed of the ALLL and

the reserve for unfunded commitments. The Company’s ALLL

is the amount considered appropriate to absorb probable current

inherent losses in the LHFI portfolio based on management’s

evaluation of the size and current risk characteristics of the loan

portfolio. In addition to the review of credit quality through

ongoing credit review processes, the Company employs a variety

of modeling and estimation techniques to measure credit risk and

construct an appropriate and adequate ALLL. Quantitative and

qualitative asset quality measures are considered in estimating

the ALLL. Such evaluation considers a number of factors for

each of the loan portfolio segments, including, but not limited

to, net charge-off trends, internal risk ratings, changes in internal

risk ratings, loss forecasts, collateral values, geographic location,

delinquency rates, nonperforming and restructured loan status,

origination channel, product mix, underwriting practices,

industry conditions, and economic trends. Additionally,

refreshed FICO scores are considered for consumer and

residential loans and single name borrower concentration is

considered for commercial loans. These credit quality factors are

incorporated into various loss estimation models and analytical

tools utilized in the ALLL process and/or are qualitatively

considered in evaluating the overall reasonableness of the ALLL.

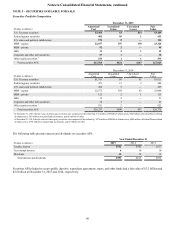

Large commercial (all loan classes) nonaccrual loans and

certain consumer (other direct, indirect, and credit card),

residential (nonguaranteed residential mortgages, residential

home equity products, and residential construction), and certain

commercial (all classes) loans whose terms have been modified

in a TDR are reviewed to determine the amount of specific

allowance required in accordance with applicable accounting

guidance. A loan is considered impaired when, based on current

information and events, it is probable that the Company will be

unable to collect all amounts due, including principal and

interest, according to the contractual terms of the agreement. If

necessary, an allowance is established for these specifically

evaluated impaired loans. The specific allowance established for

these loans is based on a thorough analysis of the most probable

source of repayment, including the present value of the loan’s

expected future cash flows, the loan’s estimated market value,

or the estimated fair value of the underlying collateral. Any

change in the present value attributable to the passage of time is

recognized through the provision for credit losses.

General allowances are established for loans and leases

grouped into pools based on similar characteristics. In this

process, general allowance factors are based on an analysis of

historical charge-off experience, expected loss factors derived

from the Company's internal risk rating process, portfolio trends,

and regional and national economic conditions. Other

adjustments may be made to the ALLL after an assessment of

internal and external influences on credit quality that may not be

fully reflected in the historical loss or risk rating data. These