SunTrust 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

102

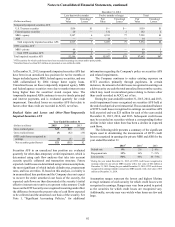

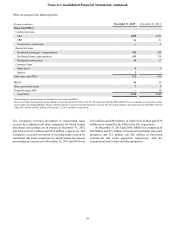

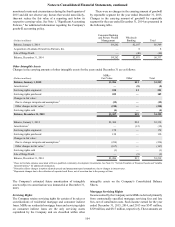

NOTE 7 - ALLOWANCE FOR CREDIT LOSSES

The allowance for credit losses consists of the ALLL and the unfunded commitments reserve. Activity in the allowance for credit

losses is summarized in the following table:

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Balance, beginning of period $1,991 $2,094 $2,219

Provision for loan losses 156 338 548

Provision for unfunded commitments 94 5

Loan charge-offs (470) (607) (869)

Loan recoveries 129 162 191

Balance, end of period $1,815 $1,991 $2,094

Components:

ALLL $1,752 $1,937 $2,044

Unfunded commitments reserve 163 54 50

Allowance for credit losses $1,815 $1,991 $2,094

1 The unfunded commitments reserve is recorded in other liabilities in the Consolidated Balance Sheets.

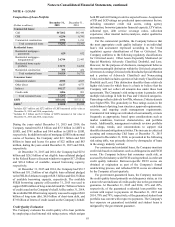

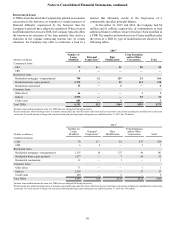

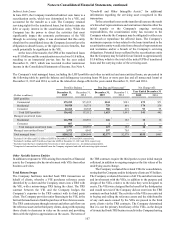

Activity in the ALLL by loan segment for the years ended December 31 is presented in the following tables:

2015

(Dollars in millions) Commercial Residential Consumer Total

Balance, beginning of period $986 $777 $174 $1,937

Provision/(benefit) for loan losses 133 (67) 90 156

Loan charge-offs (117) (218) (135) (470)

Loan recoveries 45 42 42 129

Balance, end of period $1,047 $534 $171 $1,752

2014

(Dollars in millions) Commercial Residential Consumer Total

Balance, beginning of period $946 $930 $168 $2,044

Provision for loan losses 111 126 101 338

Loan charge-offs (128) (344) (135) (607)

Loan recoveries 57 65 40 162

Balance, end of period $986 $777 $174 $1,937

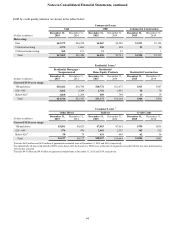

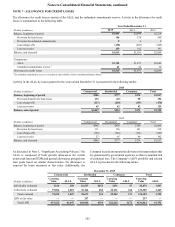

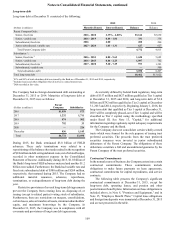

As discussed in Note 1, “Significant Accounting Policies,” the

ALLL is composed of both specific allowances for certain

nonaccrual loans and TDRs and general allowances grouped into

loan pools based on similar characteristics. No allowance is

required for loans measured at fair value. Additionally, the

Company records an immaterial allowance for loan products that

are guaranteed by government agencies, as there is nominal risk

of principal loss. The Company’s LHFI portfolio and related

ALLL is presented in the following tables.

December 31, 2015

Commercial Residential Consumer Total

(Dollars in millions)

Carrying

Value ALLL

Carrying

Value ALLL

Carrying

Value ALLL

Carrying

Value ALLL

Individually evaluated $218 $28 $2,527 $252 $131 $7 $2,876 $287

Collectively evaluated 75,034 1,019 36,144 282 22,131 164 133,309 1,465

Total evaluated 75,252 1,047 38,671 534 22,262 171 136,185 1,752

LHFI at fair value — — 257 — — — 257 —

Total LHFI $75,252 $1,047 $38,928 $534 $22,262 $171 $136,442 $1,752