SunTrust 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

unfunded commitments, derivatives, securitizations, and certain

commercial and CRE loans.

A transition period applies to certain capital elements and

risk weighted assets. One of the more significant transitions

required by the Basel III Final Rule relates to the risk weighting

applied to MSRs, which will impact the CET1 ratio during the

transition period when compared to the CET1 ratio that is

calculated on a fully phased-in basis. Specifically, the fully

phased-in risk weight of MSRs is 250%, while the risk weight

to be applied during the transition period is 100%. The transition

period is applicable from January 1, 2015 through December 31,

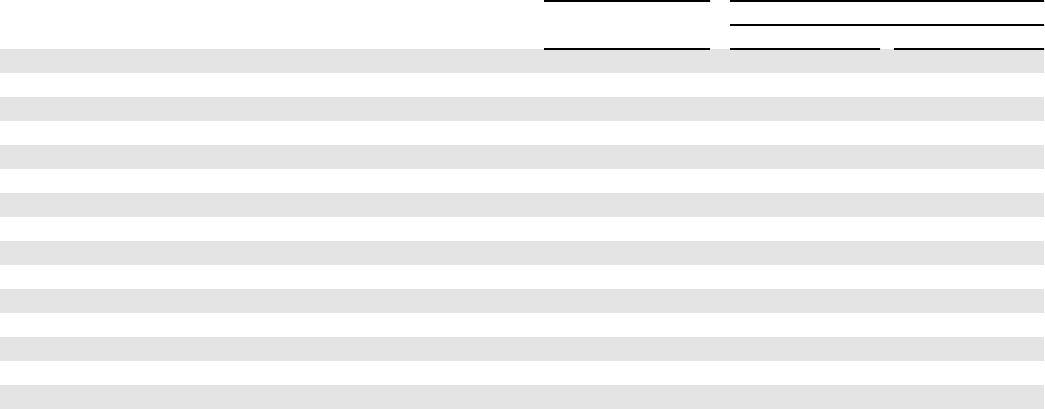

2017. Table 20 presents transitional Basel III regulatory capital

metrics at December 31, 2015, and Basel I regulatory capital

metrics at December 31, 2014.

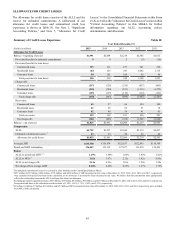

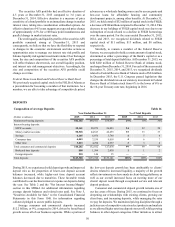

Regulatory Capital Metrics Table 20

Under Basel III 1 Under Basel I 1

December 31, 2015

December 31

(Dollars in millions) 2014 2013

Regulatory capital:

CET1 $16,421 N/A N/A

Tier 1 common equity N/A $15,594 $14,602

Tier 1 capital $17,804 17,554 16,073

Total capital 20,668 20,338 19,052

Assets:

RWA $164,851 $162,516 $148,746

Average total assets for leverage ratio 183,763 182,186 167,848

Risk-based ratios:

CET1 9.96% N/A N/A

CET1 - fully phased-in 29.80 N/A N/A

Tier 1 common equity N/A 9.60% 9.82%

Tier 1 capital 10.80% 10.80 10.81

Total capital 12.54 12.51 12.81

Leverage 9.69 9.64 9.58

Total shareholders’ equity to assets 12.28 12.09 12.22

1 Basel III Final Rules became effective for us on January 1, 2015; thus, CET1 is not applicable ("N/A") under the previous Basel I capital rules to which we were subject at

December 31, 2014 and 2013. Tier 1 common equity under Basel I represents the portion of Tier 1 capital that is attributable to common shareholders. We calculated this,

together with the Tier 1 common equity ratio, using the methodology specified by our primary regulator. Our calculation of these measures may differ from those of other

financial services companies that calculate similar metrics.

2 The CET1 ratio on a fully phased-in basis at December 31, 2015 is estimated. See Table 1, "Selected Financial Data and Reconcilement of Non-U.S. GAAP Measures," in this

MD&A for a reconciliation of our transitional CET1 ratio to our fully phased-in, estimated CET1 ratio.

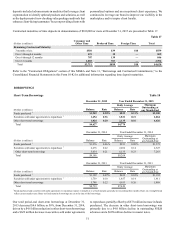

The Tier 1 capital and Total capital ratios remained stable

compared to December 31, 2014, inclusive of the transition to

Basel III. Tier 1 capital and Total capital were impacted by an

increase in retained earnings, while RWA was modestly higher

due to increased on- and off-balance sheet exposures. At

December 31, 2015, our capital ratios were well above current

regulatory requirements.

Our estimate of the fully phased-in CET1 ratio of 9.80% at

December 31, 2015 considers a 250% risk-weighting for MSRs,

which is the primary driver for the difference in the CET1 ratio

at December 31, 2015 compared to the estimated fully phased-

in ratio in the same period. Our estimated fully phased-in ratio

is in excess of the 4.5% minimum CET1 ratio, and is also in

excess of the 7.0% limit that includes the minimum level of 4.5%

plus the 2.5% fully phased-in CCB. See Table 1, "Selected

Financial Data and Reconcilement of Non-U.S. GAAP

Measures," in this MD&A for a reconciliation of our fully

phased-in CET1 ratio. Also see Note 13, "Capital," to the

Consolidated Financial Statements in this Form 10-K for

additional information regarding our regulatory capital adequacy

requirements and metrics.

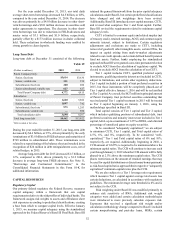

Capital Actions

The Board approved a 20% increase in our quarterly common

stock dividend from $0.20 per share to $0.24 per share, beginning

in the second quarter of 2015. We declared and paid common

dividends of $475 million, or $0.92 per common share during

the year ended December 31, 2015, compared to $371 million,

or $0.70 per common share during the year ended December 31,

2014, and $188 million, or $0.35 per common share during the

year ended December 31, 2013. Additionally, we recognized

dividends on our preferred stock of $64 million, $42 million, and

$37 million during the years ended December 31, 2015, 2014,

and 2013, respectively. The increase in preferred stock dividends

compared to 2014 was driven by an increase in the average

balance of our preferred stock to $1.2 billion in 2015 from $800

million in 2014 due to our issuance of the Series F Preferred

Stock at the end of 2014.

Various regulations administered by federal and state bank

regulatory authorities restrict the Bank's ability to distribute its

retained earnings. At December 31, 2015, 2014, and 2013, the

Bank's capacity to pay cash dividends to the Parent Company

under these regulations totaled approximately $2.7 billion, $2.9

billion, and $2.6 billion, respectively.

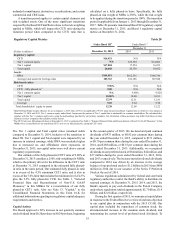

During the first quarter of 2015, we announced capital plans

in response to the Federal Reserve's review of and non-objection

to our capital plan in conjunction with the 2015 CCAR. Our

capital plan included the repurchase of common stock, the

aforementioned increase in the common stock dividend, and

maintaining the current level of preferred stock dividends. To