SunTrust 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

112

In December 2012, the Company authorized 5,000 shares

and issued 4,500 shares of Perpetual Preferred Stock, Series E,

no par value and $100,000 liquidation preference per share (the

Series E Preferred Stock). The Series E Preferred Stock has no

stated maturity and will not be subject to any sinking fund or

other obligation of the Company to redeem, repurchase, or retire

the shares. Dividends on the shares are noncumulative and, if

declared, will accrue and be payable quarterly at a rate per annum

of 5.875%. Shares of the Series E Preferred Stock have priority

over the Company's common stock with regard to the payment

of dividends and rank equally with the Company's outstanding

Perpetual Preferred Stock, Series A and Series B and, as such,

the Company may not pay dividends on or repurchase, redeem,

or otherwise acquire for consideration shares of its common

stock unless dividends for the Series E Preferred Stock have been

declared for that period and sufficient funds have been set aside

to make payment. The Series E Preferred Stock is redeemable,

at the option of the Company, on any dividend payment date

occurring on or after March 15, 2018, at a redemption price equal

to $100,000 per share, plus any declared and unpaid dividends,

without regard to any undeclared dividends. Except in certain

limited circumstances, the Series E Preferred Stock does not have

any voting rights.

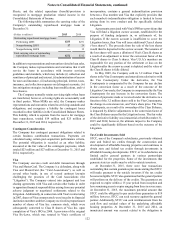

In November 2014, the Company issued depositary shares

representing ownership interest in 5,000 shares of Perpetual

Preferred Stock, Series F, with no par value and $100,000

liquidation preference per share (the "Series F Preferred Stock").

As a result of this issuance, the Company received net proceeds

of $496 million after the underwriting discount, but before

expenses, and used the net proceeds for general corporate

purposes. The Series F Preferred Stock has no stated maturity

and will not be subject to any sinking fund or other obligation

of the Company to redeem, repurchase, or retire the shares.

Dividends for the shares are noncumulative and, if declared, will

be payable semi-annually beginning on June 15, 2015 through

December 15, 2019 at a rate per annum of 5.625%, and payable

quarterly beginning on March 15, 2020 at a rate per annum equal

to the three-month LIBOR plus 3.86%. By its terms, the

Company may redeem the Series F Preferred Stock on any

dividend payment date occurring on or after December 15, 2019

or at any time within 90 days following a regulatory capital event,

at a redemption price of $100,000 per share plus any declared

and unpaid dividends. Except in certain limited circumstances,

the Series F Preferred Stock does not have any voting rights.

In 2008, the Company issued to the U.S. Treasury as part of

the CPP, Series C and D Fixed Rate Cumulative Perpetual

Preferred Stock and Series A and B warrants to purchase a total

of 17.9 million shares of the Company's common stock. The

Series A warrants entitle the holder to purchase 6 million shares

of the Company's common stock at an exercise price of $33.70

per share, while the Series B warrants entitle the holder to

purchase 11.9 million shares of the Company's common stock

at an exercise price of $44.15 per share. The Series A and B

warrants have expiration dates of December 2018 and November

2018, respectively.

In March 2011, the Company repurchased its Series C and

D Preferred Stock from the U.S. Treasury. In September 2011,

the U.S. Treasury held a public auction to sell the warrants to

purchase the 17.9 million shares of the Company's common

stock. In conjunction with the U.S. Treasury's auction, the

Company acquired 4 million of the stock purchase warrants,

Series A, for $11 million, which were then retired.

At December 31, 2015, 13.9 million warrants remained

outstanding and the Company had authority from its Board to

repurchase all of these outstanding stock purchase warrants;

however, any such repurchase would be subject to the non-

objection of the Federal Reserve through the capital planning

and stress testing process.

NOTE 14 - INCOME TAXES

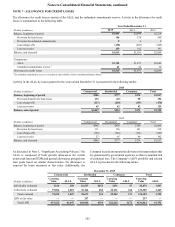

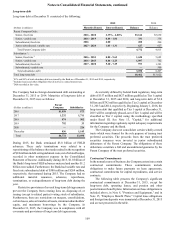

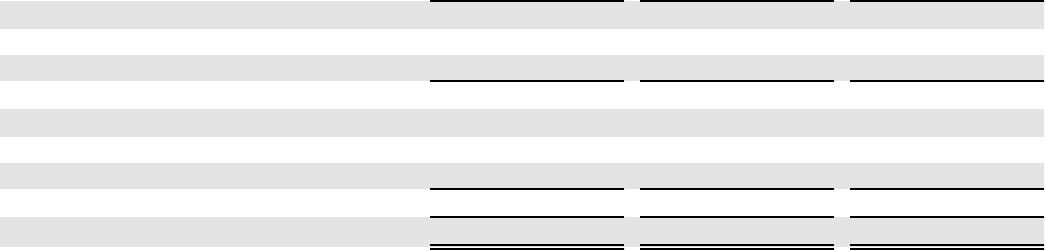

The components of income tax provision included in the Consolidated Statements of Income during the years ended December 31

were as follows:

(Dollars in millions) 2015 2014 2013

Current income tax provision/(benefit):

Federal $707 $365 ($158)

State 36 29 (15)

Total 743 394 (173)

Deferred income tax provision/(benefit):

Federal 27 99 444

State (6) — 51

Total 21 99 495

Total provision for income taxes 1$764 $493 $322

1 Amortization expense related to qualified affordable housing investment costs is recognized in the provision for income taxes for each of the periods presented as

allowed by an accounting standard adopted in 2014. Prior to 2014, these amounts were recognized in other noninterest expense.

The provision for income taxes does not reflect the tax effects of unrealized gains and losses and other income and expenses recorded

in AOCI. For additional information on AOCI, see Note 21, “Accumulated Other Comprehensive (Loss)/Income.”