SunTrust 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

127

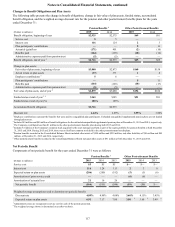

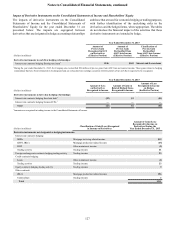

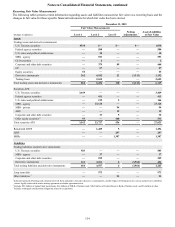

Impact of Derivative Instruments on the Consolidated Statements of Income and Shareholders’ Equity

The impacts of derivative instruments on the Consolidated

Statements of Income and the Consolidated Statements of

Shareholders’ Equity for the year ended December 31 are

presented below. The impacts are segregated between

derivatives that are designated in hedge accounting relationships

and those that are used for economic hedging or trading purposes,

with further identification of the underlying risks in the

derivatives and the hedged items, where appropriate. The tables

do not disclose the financial impact of the activities that these

derivative instruments are intended to hedge.

Year Ended December 31, 2015

(Dollars in millions)

Amount of

Pre-tax Gain

Recognized in OCI

on Derivatives

(Effective Portion)

Amount of

Pre-tax Gain

Reclassified from

AOCI into Income

(Effective Portion)

Classification of

Pre-tax Gain

Reclassified

from AOCI into Income

(Effective Portion)

Derivative instruments in cash flow hedging relationships:

Interest rate contracts hedging floating rate loans 1 $246 $169 Interest and fees on loans

1 During the year ended December 31, 2015, the Company also reclassified $92 million of pre-tax gains from AOCI into net interest income. These gains related to hedging

relationships that have been terminated or de-designated and are reclassified into earnings consistent with the pattern of net cash flows expected to be recognized.

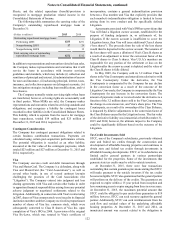

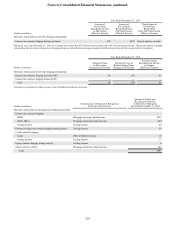

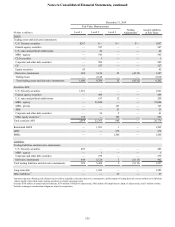

Year Ended December 31, 2015

(Dollars in millions)

Amount of Loss

on Derivatives

Recognized in Income

Amount of Gain on

Related Hedged Items

Recognized in Income

Amount of Loss

Recognized in Income

on Hedges

(Ineffective Portion)

Derivative instruments in fair value hedging relationships:

Interest rate contracts hedging fixed rate debt 1($2) $1 ($1)

Interest rate contracts hedging brokered CDs 1— — —

Total ($2) $1 ($1)

1 Amounts are recognized in trading income in the Consolidated Statements of Income.

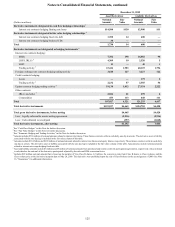

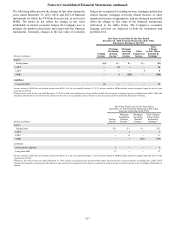

(Dollars in millions)

Classification of Gain/(Loss) Recognized

in Income on Derivatives

Amount of Gain/(Loss)

Recognized in Income on

Derivatives During the

Year Ended December 31, 2015

Derivative instruments not designated as hedging instruments:

Interest rate contracts hedging:

MSRs Mortgage servicing related income $19

LHFS, IRLCs Mortgage production related income (45)

LHFI Other noninterest income (1)

Trading activity Trading income 61

Foreign exchange rate contracts hedging trading activity Trading income 93

Credit contracts hedging:

Loans Other noninterest income (1)

Trading activity Trading income 23

Equity contracts hedging trading activity Trading income 4

Other contracts:

IRLCs Mortgage production related income 156

Commodities Trading income 2

Total $311