SunTrust 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

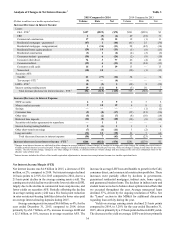

in certain areas, remains challenging overall. Nonetheless, we

remain firmly committed to our long-term efficiency target of

below 60%, and will continue to diligently manage expenses

while also investing in strategic, revenue generating initiatives,

as achieving these objectives will be critical to delivering

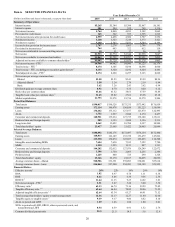

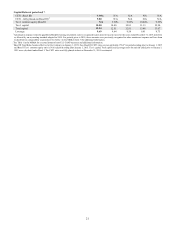

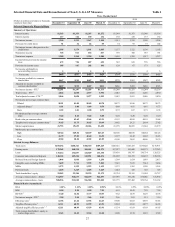

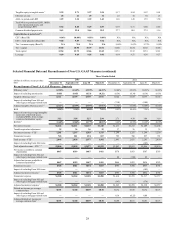

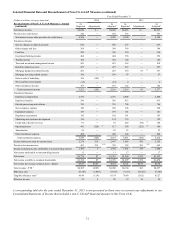

additional value to our shareholders. See Table 1, "Selected

Financial Data and Reconcilement of Non-U.S. GAAP

Measures," in this MD&A for additional information regarding,

and reconciliations of, our tangible and adjusted tangible

efficiency ratios.

Our asset quality performance was strong during 2015. Total

NPAs were down 6% compared to December 31, 2014, driven

largely by the sale of $122 million in nonperforming mortgages

during 2015. Reductions in OREO also continued, declining

43% from the prior year to $56 million, the lowest level since

2006. At December 31, 2015, the ALLL balance equaled 1.29%

of total LHFI, a decline of 17 basis points compared to

December 31, 2014. The provision for loan losses decreased

$182 million, or 54%, compared to 2014, attributed to the

continued improvement in credit quality trends, particularly in

our residential loan portfolio, and lower net charge-offs. The net

charge-off ratio reached another multi-year low of 0.26% for

2015, down eight basis points compared to 2014. Going into

2016, we expect NPLs and net charge-offs to increase, primarily

as a result of further stress amongst our energy clients, but also

due to normalization from the overall low levels of net charge-

offs and NPLs we had in 2015. However, we expect our overall

net charge-off ratio to be between 30 and 40 basis points in 2016,

which is below our long-term expectation of 40 to 70 basis points.

See additional discussion of credit and asset quality in the

“Loans,” “Allowance for Credit Losses,” and “Nonperforming

Assets” sections of this MD&A.

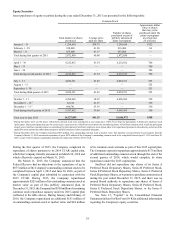

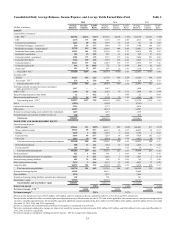

During 2015, our average loans increased $2.7 billion, or

2%, compared to the prior year, driven primarily by growth in

our C&I and consumer direct portfolios, partially offset by

declines in our government-guaranteed residential mortgage,

residential home equity, and consumer indirect portfolios. The

momentum in our consumer direct portfolio continues to be

strong, driven by our online and third-party origination channels,

and increased success with our credit card offering. The

reduction in consumer indirect loans was driven in large part by

the second quarter of 2015 securitization of $1.0 billion of

indirect auto loans. Since the middle of 2014, we have sold or

securitized approximately $5 billion of loans from various

portfolios. Going forward, we expect to periodically sell or

securitize lower-return loans as part of our balance sheet

optimization focus. We have built positive and broad-based

momentum across our lending platforms and are focused on

continuing to generate targeted loan growth at accretive risk-

adjusted returns. See additional loan discussion in the “Loans,”

“Nonperforming Assets,” and "Net Interest Income/Margin"

sections of this MD&A.

Average consumer and commercial deposits increased 9%

during 2015, driven by strong and broad-based growth in lower

cost deposits across most of our business segments, partially

offset by gradual declines in higher-cost time deposits. Our

success growing deposits during 2015 reflects our overall

strategic focus on meeting more clients’ deposit and payment

needs, supplemented by investments in technology platforms

and client-facing bankers. Our strong deposit growth directly

enabled us to support our lending platform and reduce higher-

cost long-term debt by $4.6 billion, or 35%, over the past year.

Importantly, the strong deposit growth we have delivered has not

resulted in adverse changes in rates paid or deposit mix. If interest

rates begin to rise, some of these trends may change; however,

we will maintain a disciplined approach to pricing with a focus

on maximizing our value proposition for clients. See additional

discussion on our deposits in the "Net Interest Income/Margin"

and "Deposits" sections of this MD&A.

Capital and Liquidity

During 2015, we repurchased approximately $680 million of our

outstanding common stock at market value, which included $115

million under our 2014 capital plan, $525 million under our 2015

capital plan, and a $39 million incremental repurchase in

December 2015, which was separate from our 2014 and 2015

capital plans. During January and February of 2016, we

repurchased an additional $151 million of our outstanding

common stock and $24 million of our common stock warrants

as part of the 2015 capital plan. We currently expect to repurchase

approximately $175 million of additional outstanding common

stock through the end of the second quarter of 2016, which would

complete our share repurchases under our 2015 capital plan. See

additional details related to our capital actions in the “Capital

Resources” section of this MD&A.

Our book value and tangible book value per common share

increased 5% and 6%, respectively, compared to the prior year

due primarily to growth in retained earnings and a lower share

count. Additionally, we increased our quarterly common stock

dividend by 20% beginning in the second quarter of 2015, which

resulted in dividends for 2015 of $0.92 per common share, an

increase from $0.70 per common share in 2014. See additional

details related to our capital actions in the “Capital Resources”

section of this MD&A and in Note 13, "Capital," to the

Consolidated Financial Statements in this Form 10-K. Also see

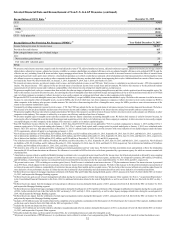

Table 1, "Selected Financial Data and Reconcilement of Non-

U.S. GAAP Measures," in this MD&A for additional information

regarding, and a reconciliation of, tangible book value per

common share.

Our regulatory capital position remained strong during the

year, with a CET1 ratio of 9.96% at December 31, 2015.

Additionally, our estimated CET1 ratio at December 31, 2015,

on a fully phased-in basis, was 9.80%, which is well above the

current regulatory requirement. See Table 1, "Selected Financial

Data and Reconcilement of Non-U.S. GAAP Measures" in this

MD&A for a reconciliation of our transitional CET1 ratio to our

fully phased-in, estimated CET1 ratio.

Separately, our LCR at December 31, 2015 continued to

exceed the January 1, 2016 requirement of 90%, for which we

are now formally required to be in compliance. The cumulative

actions we have taken to improve our risk and earnings profile,

combined with our strong capital and liquidity levels, should

help us to further increase capital returns to shareholders. See

additional discussion of our capital and liquidity position in the

"Capital Resources" and "Liquidity Risk Management" sections

of this MD&A. See additional discussion of our capital and

liquidity position in the "Capital Resources" and "Liquidity Risk

Management" sections of this MD&A.