SunTrust 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

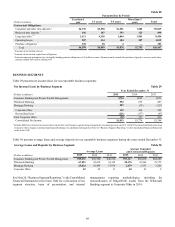

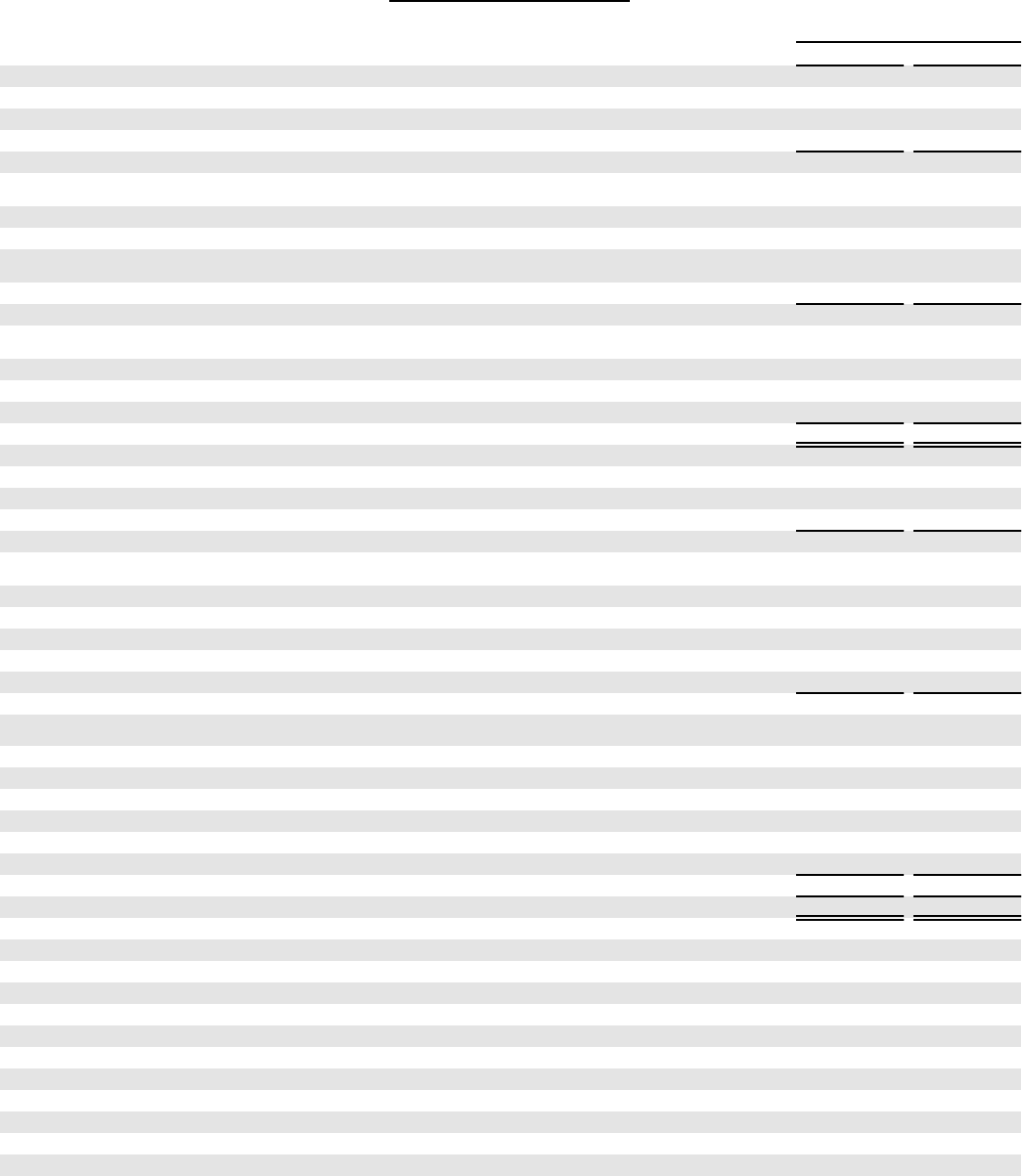

77

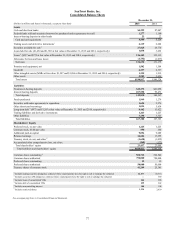

SunTrust Banks, Inc.

Consolidated Balance Sheets

December 31,

(Dollars in millions and shares in thousands, except per share data) 2015 2014

Assets

Cash and due from banks $4,299 $7,047

Federal funds sold and securities borrowed or purchased under agreements to resell 1,277 1,160

Interest-bearing deposits in other banks 23 22

Cash and cash equivalents 5,599 8,229

Trading assets and derivative instruments 16,119 6,202

Securities available for sale 227,825 26,770

Loans held for sale ($1,494 and $1,892 at fair value at December 31, 2015 and 2014, respectively) 1,838 3,232

Loans 3 ($257 and $272 at fair value at December 31, 2015 and 2014, respectively) 136,442 133,112

Allowance for loan and lease losses (1,752) (1,937)

Net loans 134,690 131,175

Premises and equipment, net 1,502 1,508

Goodwill 6,337 6,337

Other intangible assets (MSRs at fair value: $1,307 and $1,206 at December 31, 2015 and 2014, respectively) 1,325 1,219

Other assets 5,582 5,656

Total assets $190,817 $190,328

Liabilities

Noninterest-bearing deposits $42,272 $41,096

Interest-bearing deposits 107,558 99,471

Total deposits 149,830 140,567

Funds purchased 1,949 1,276

Securities sold under agreements to repurchase 1,654 2,276

Other short-term borrowings 1,024 5,634

Long-term debt 4 ($973 and $1,283 at fair value at December 31, 2015 and 2014, respectively) 8,462 13,022

Trading liabilities and derivative instruments 1,263 1,227

Other liabilities 3,198 3,321

Total liabilities 167,380 167,323

Shareholders’ Equity

Preferred stock, no par value 1,225 1,225

Common stock, $1.00 par value 550 550

Additional paid-in capital 9,094 9,089

Retained earnings 14,686 13,295

Treasury stock, at cost, and other 5(1,658) (1,032)

Accumulated other comprehensive loss, net of tax (460)(122)

Total shareholders’ equity 23,437 23,005

Total liabilities and shareholders’ equity $190,817 $190,328

Common shares outstanding 6508,712 524,540

Common shares authorized 750,000 750,000

Preferred shares outstanding 12 12

Preferred shares authorized 50,000 50,000

Treasury shares of common stock 41,209 25,381

1 Includes trading securities pledged as collateral where counterparties have the right to sell or repledge the collateral $1,377 $1,316

2 Includes securities AFS pledged as collateral where counterparties have the right to sell or repledge the collateral —369

3 Includes loans of consolidated VIEs 246 288

4 Includes debt of consolidated VIEs 259 302

5 Includes noncontrolling interest 108 108

6 Includes restricted shares 1,334 2,930

See accompanying Notes to Consolidated Financial Statements.