SunTrust 2015 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

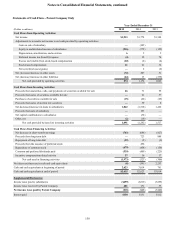

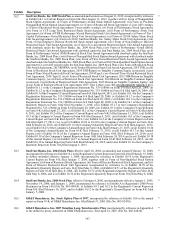

Notes to Consolidated Financial Statements, continued

153

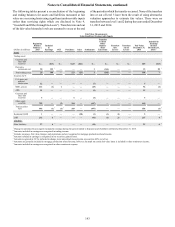

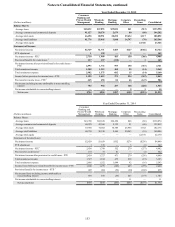

Year Ended December 31, 2015

(Dollars in millions)

Consumer

Banking and

Private Wealth

Management

Wholesale

Banking

Mortgage

Banking

Corporate

Other

Reconciling

Items Consolidated

Balance Sheets:

Average loans $40,632 $67,853 $25,024 $61 ($12) $133,558

Average consumer and commercial deposits 91,127 50,376 2,679 80 (60) 144,202

Average total assets 46,498 80,951 28,692 29,634 3,117 188,892

Average total liabilities 91,776 55,995 3,048 14,797 (70) 165,546

Average total equity — — — — 23,346 23,346

Statements of Income:

Net interest income $2,729 $1,771 $483 $147 ($366) $4,764

FTE adjustment 1 138 — 3 — 142

Net interest income - FTE 12,730 1,909 483 150 (366) 4,906

Provision/(benefit) for credit losses 2137 137 (110) — 1 165

Net interest income after provision/(benefit) for credit losses -

FTE 2,593 1,772 593 150 (367) 4,741

Total noninterest income 1,508 1,215 460 99 (14) 3,268

Total noninterest expense 2,902 1,575 682 15 (14) 5,160

Income before provision for income taxes - FTE 1,199 1,412 371 234 (367) 2,849

Provision for income taxes - FTE 3445 458 84 66 (147) 906

Net income including income attributable to noncontrolling

interest 754 954 287 168 (220) 1,943

Net income attributable to noncontrolling interest — — — 9 1 10

Net income $754 $954 $287 $159 ($221) $1,933

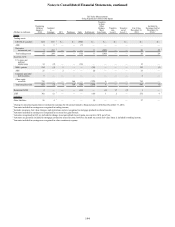

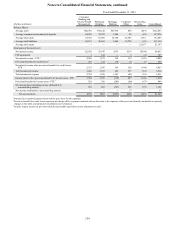

Year Ended December 31, 2014

(Dollars in millions)

Consumer

Banking and

Private Wealth

Management

Wholesale

Banking

Mortgage

Banking

Corporate

Other

Reconciling

Items Consolidated

Balance Sheets:

Average loans $41,700 $62,638 $26,494 $48 ($6) $130,874

Average consumer and commercial deposits 86,070 43,566 2,333 91 (48) 132,012

Average total assets 47,380 74,302 30,386 26,966 3,142 182,176

Average total liabilities 86,798 50,310 2,665 20,243 (10) 160,006

Average total equity — — — — 22,170 22,170

Statements of Income/(Loss):

Net interest income $2,629 $1,659 $552 $276 ($276) $4,840

FTE adjustment 1 139 — 3 (1) 142

Net interest income - FTE 12,630 1,798 552 279 (277) 4,982

Provision for credit losses 2191 71 81 — (1) 342

Net interest income after provision for credit losses - FTE 2,439 1,727 471 279 (276) 4,640

Total noninterest income 1,527 1,104 473 238 (19) 3,323

Total noninterest expense 2,866 1,552 1,049 92 (16) 5,543

Income/(loss) before provision/(benefit) for income taxes - FTE 1,100 1,279 (105) 425 (279) 2,420

Provision/(benefit) for income taxes - FTE 3405 404 (52) (20) (102) 635

Net income/(loss) including income attributable to

noncontrolling interest 695 875 (53) 445 (177) 1,785

Net income attributable to noncontrolling interest — — — 11 — 11

Net income/(loss) $695 $875 ($53) $434 ($177) $1,774