SunTrust 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

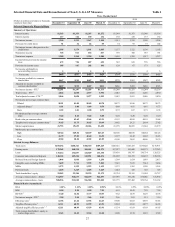

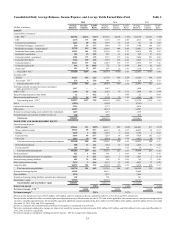

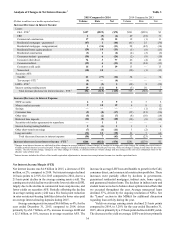

37

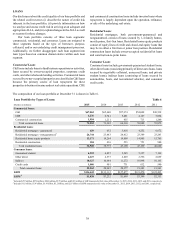

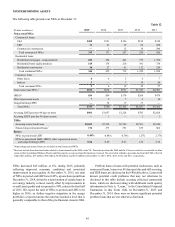

NONINTEREST EXPENSE

Table 5

Year Ended December 31

(Dollars in millions) 2015 2014 2013

Employee compensation $2,576 $2,576 $2,488

Employee benefits 366 386 413

Total personnel expenses 2,942 2,962 2,901

Outside processing and software 815 741 746

Net occupancy expense 341 340 348

Equipment expense 164 169 181

Marketing and customer development 151 134 135

Regulatory assessments 139 142 181

Credit and collection services 71 91 264

Operating losses 56 441 503

Amortization 40 25 23

Other noninterest expense 1441 498 549

Total noninterest expense $5,160 $5,543 $5,831

Adjusted noninterest expense 2$5,160 $5,219 $5,412

1 Amortization expense related to qualified affordable housing investment costs is recognized in provision for income taxes for each of the periods presented as allowed by an

accounting standard adopted in 2014. Prior to 2014, these amounts were recognized in other noninterest expense, and therefore, for comparative purposes, $49 million of

amortization expense has been reclassified to provision for income taxes for the year ended December 31, 2013.

2 See Table 1 in this MD&A for a reconcilement of non-U.S. GAAP measures and additional information.

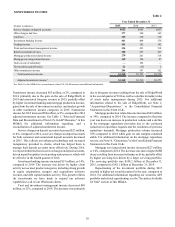

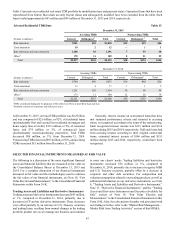

Noninterest expense decreased $383 million, or 7%, compared

to 2014, driven primarily by $324 million of legacy mortgage-

related operating losses recognized in 2014. Further declines

were driven by the sale of RidgeWorth in the second quarter of

2014 and the associated reduction of expenses, as well as our

continued focus on expense management, as noninterest expense

for 2015 decreased $59 million, or 1%, compared to 2014

adjusted noninterest expense. See Table 1, "Selected Financial

Data and Reconcilement of Non-U.S. GAAP Measures," in this

MD&A for additional information regarding, and a

reconciliation of, adjusted noninterest expense.

Personnel expenses decreased $20 million, or 1%, compared

to 2014. The decrease compared to the prior year was largely

due to the sale of RidgeWorth and lower medical claims, partially

offset by higher incentive-based compensation due to improved

business performance in 2015. Looking ahead to the first quarter

of 2016, we anticipate an increase in our personnel expenses by

up to $100 million due to the typical seasonal increases in 401

(k) and FICA expenses, and a return to more normal accrual rates

on certain incentive and benefit costs.

Outside processing and software expenses increased $74

million, or 10%, compared to 2014. The increase was due to the

higher utilization of third party services, increased business and

compliance activity, as well as increased investments in

technology.

Marketing and customer development increased $17

million, or 13%, compared to 2014. The increase compared to

the prior year was due to higher advertising costs and other client

development costs in 2015. We expect total marketing costs to

increase in 2016 and be weighted more towards the first half of

the year versus the second half, which would be more typical,

as we are introducing a new campaign to further advance our

Company’s purpose.

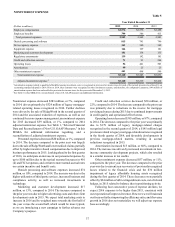

Credit and collection services decreased $20 million, or

22%, compared to 2014. The decrease compared to the prior year

was primarily due to reductions in the reserve for mortgage

servicing advances during 2015 due to continued improvements

in credit quality and operational effectiveness.

Operating losses decreased $385 million, or 87%, compared

to 2014. The decrease compared to the prior year was primarily

due to $179 million of legacy mortgage-related charges

recognized in the second quarter of 2014, a $145 million legal

provision related to legacy mortgage-related matters recognized

in the fourth quarter of 2014, and favorable developments in

previous mortgage-related matters, resulting in accrual

reductions recognized in 2015.

Amortization increased $15 million, or 60%, compared to

2014. The increase was driven by increased investments in low-

income community development projects, which also resulted

in a similar increase in tax credits.

Other noninterest expense decreased $57 million, or 11%,

compared to the prior year. The decrease compared to the prior

year was due to current year recoveries of previously recognized

losses related to the financial crisis and the $36 million

impairment of legacy affordable housing assets recognized

during the first quarter of 2014. These decreases were partially

offset by $24 million of debt extinguishment costs, net of related

hedges, in 2015 related to balance sheet repositioning activity.

Following four consecutive years of expense declines, we

expect 2016 expenses to be higher than 2015, consistent with

our expectation of improved revenue. However, we will maintain

our focus on further improving the efficiency ratio, and if revenue

growth in 2016 does not materialize we will adjust our expense

base accordingly.