SunTrust 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

110

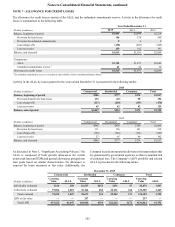

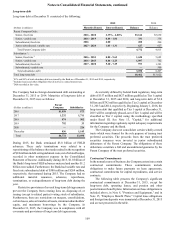

Payments Due by Period

(Dollars in millions) 2016 2017 2018 2019 2020 Thereafter Total

Purchase obligations 1$349 $17 $13 $4 $— $— $383

Consumer and other time deposits 2, 3 4,736 1,933 1,317 575 876 382 9,819

Brokered time deposits 3196 83 104 181 212 123 899

1 Amounts represent termination fees for legally binding purchase obligations of $5 million or more. Payments made towards the purchase of goods or services under these

contracts totaled $243 million, $223 million, and $194 million in 2015, 2014, and 2013, respectively.

2 The aggregate amount of time deposit accounts in denominations of $250,000 or more totaled $1.4 billion at both December 31, 2015 and 2014, respectively.

3 Amounts do not include interest.

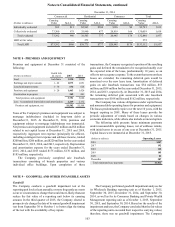

NOTE 12 – NET INCOME PER COMMON SHARE

Equivalent shares of 14 million, 15 million, and 18 million

related to common stock options and common stock warrants

outstanding at December 31, 2015, 2014, and 2013, respectively,

were excluded from the computations of diluted net income per

average common share because they would have been anti-

dilutive.

Reconciliations of net income to net income available to

common shareholders and the difference between average basic

common shares outstanding and average diluted common shares

outstanding are presented below.

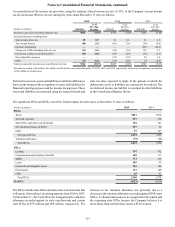

Year Ended December 31

(Dollars and shares in millions, except per share data) 2015 2014 2013

Net income $1,933 $1,774 $1,344

Preferred dividends (64) (42) (37)

Dividends and undistributed earnings allocated to unvested shares (6) (10) (10)

Net income available to common shareholders $1,863 $1,722 $1,297

Average basic common shares 515 528 534

Effect of dilutive securities:

Stock options 21 1

Restricted stock, RSUs, and warrants 44 4

Average diluted common shares 521 533 539

Net income per average common share - diluted $3.58 $3.23 $2.41

Net income per average common share - basic $3.62 $3.26 $2.43

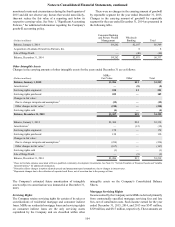

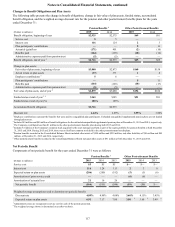

NOTE 13 – CAPITAL

During 2015, pursuant to the Federal Reserve's non-objection to

the Company's capital plan in conjunction with the 2015 CCAR,

the Company increased its quarterly common stock dividend

from $0.20 to $0.24 per share beginning in the second quarter

of 2015, maintained dividend payments on its preferred stock,

and repurchased $525 million of its outstanding common stock

at market value (approximately 12.7 million shares) under the

2015 plan. During the first quarter of 2015, the Company also

repurchased $115 million of its outstanding common stock at

market value, which completed the repurchase of shares pursuant

to its 2014 CCAR capital plan, which effectively expired on

March 31, 2015. At December 31, 2015, the Company had

capacity under its 2015 capital plan to purchase an additional

$350 million of its outstanding common stock through June 30,

2016. In December 2015, the Company repurchased an

additional $39 million of its outstanding common stock at market

value, which was incremental to and separate from the existing

availability under the 2015 CCAR capital plan.

During the years ended December 31, 2015, 2014, and 2013,

the Company declared and paid common dividends of $475

million, or $0.92 per common share, $371 million, or $0.70 per

common share, and $188 million, or $0.35 per common share,

respectively. The Company also recognized dividends on

perpetual preferred stock of $64 million, $42 million, and $37

million during the years ended December 31, 2015, 2014, and

2013, respectively. During 2015, both the Series A and Series B

Perpetual Preferred Stock dividend was $4,056 per share, the

Series E Perpetual Preferred Stock dividend was $5,875 per

share, and the Series F Perpetual Preferred Stock dividend was

$6,219 per share.

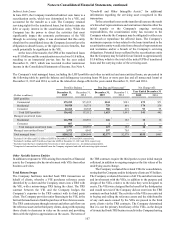

The Company remains subject to certain restrictions on its

ability to increase the dividend on common shares as a result of

participating in the U.S. Treasury’s CPP. If the Company

increases its dividend above $0.54 per share per quarter prior to

the tenth anniversary of its participation in the CPP, then the anti-

dilution provision within the warrants issued in connection with

the Company’s participation in the CPP will require the exercise