SunTrust 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

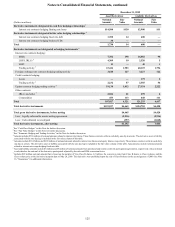

Notes to Consolidated Financial Statements, continued

120

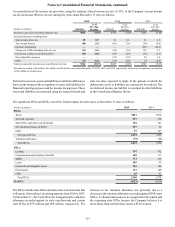

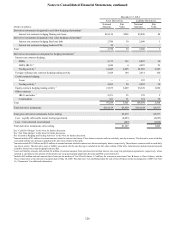

Expected Cash Flows

Expected cash flows for the pension and other postretirement benefit plans is as follows:

(Dollars in millions) Pension Benefits 1Other Postretirement Benefits

(excluding Medicare Subsidy) 2

Employer Contributions:

2016 (expected) to plan trusts $— $—

2016 (expected) to plan participants 38 —

Expected Benefit Payments:

2016 191 7

2017 172 7

2018 166 6

2019 165 5

2020 167 5

2021 - 2025 819 20

1 Based on the funding status and ERISA limitations, the Company anticipates contributions to the Retirement Plan will not be required during 2016.

2 Expected payments under other postretirement benefit plans are shown net of participant contributions.

3 The expected benefit payments for the SERP will be paid directly from the Company's corporate assets.

Defined Contribution Plans

SunTrust's employee benefit program includes a qualified

defined contribution plan. For years ended December 31, 2015,

2014, and 2013, the 401(k) plan provided a dollar-for-dollar

match on the first 6% of eligible pay that a participant, including

executive participants, elected to defer. The related 401(k)

Company expense was $102 million, $98 million, and $96

million for the years ended December 31, 2015, 2014, and 2013,

respectively.

SunTrust also maintains the SunTrust Banks, Inc. Deferred

Compensation Plan in which key executives of the Company are

eligible. Matching contributions for the deferred compensation

plan are the same percentage as provided in the 401(k) plan,

subject to limitations imposed by the plans' provisions and

applicable laws and regulations.

Matching contributions for both the Company's 401(k) plan

and the deferred compensation plan fully vest upon two years of

completed service. Furthermore, both plans permit an additional

discretionary Company contribution equal to a fixed percentage

of eligible pay. Discretionary contributions to the 401(k) plan

and the deferred compensation plan are shown in the following

table.

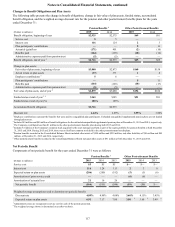

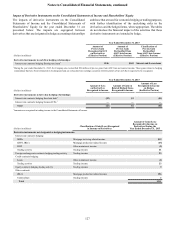

Performance Year 1

(Dollars in millions) 2015 2014 2013

Contribution $19 $19 $19

Percentage of eligible pay 1% 1% 1%

1 Contributions for each of these performance years are paid in the first quarter of the

following performance year.

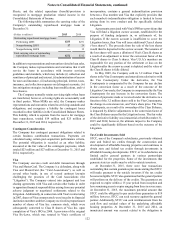

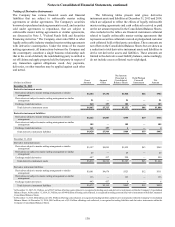

NOTE 16 – GUARANTEES

The Company has undertaken certain guarantee obligations in

the ordinary course of business. The issuance of a guarantee

imposes an obligation for the Company to stand ready to perform

and make future payments should certain triggering events occur.

Payments may be in the form of cash, financial instruments, other

assets, shares of stock, or provision of the Company’s services.

The following is a discussion of the guarantees that the Company

has issued at December 31, 2015. The Company has also entered

into certain contracts that are similar to guarantees, but that are

accounted for as derivatives as discussed in Note 17, “Derivative

Financial Instruments.”

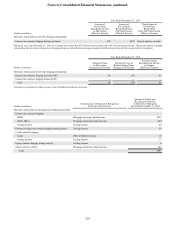

Letters of Credit

Letters of credit are conditional commitments issued by the

Company, generally to guarantee the performance of a client to

a third party in borrowing arrangements, such as CP, bond

financing, and similar transactions. The credit risk involved in

issuing letters of credit is essentially the same as that involved

in extending loan facilities to clients and may be reduced by

selling participations to third parties. The Company issues letters

of credit that are classified as financial standby, performance

standby, or commercial letters of credit.

At December 31, 2015 and 2014, the maximum potential

amount of the Company’s obligation for issued financial and

performance standby letters of credit was $2.9 billion and $3.0

billion, respectively. The Company’s outstanding letters of credit

generally have a term of less than one year but may extend longer.

Some standby letters of credit are designed to be drawn upon in

the normal course of business and others are drawn upon only

in circumstances of dispute or default in the underlying

transaction to which the Company is not a party. In all cases, the

Company is entitled to reimbursement from the client. If a letter

of credit is drawn upon and reimbursement is not provided by

the client, the Company may take possession of the collateral

securing the letter of credit, where applicable.