SunTrust 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

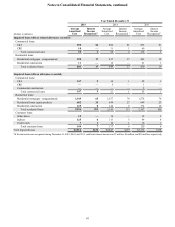

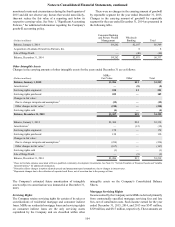

Notes to Consolidated Financial Statements, continued

94

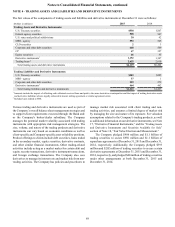

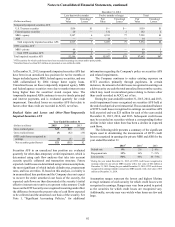

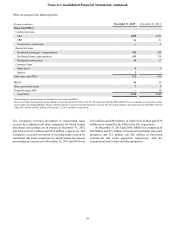

LHFI by credit quality indicator are shown in the tables below:

Commercial Loans

C&I CRE Commercial Construction

(Dollars in millions)

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

Risk rating:

Pass $65,379 $64,228 $6,067 $6,586 $1,931 $1,196

Criticized accruing 1,375 1,061 158 134 23 14

Criticized nonaccruing 308 151 11 21 —1

Total $67,062 $65,440 $6,236 $6,741 $1,954 $1,211

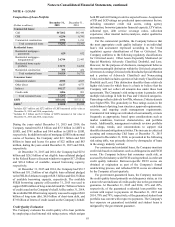

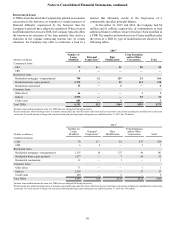

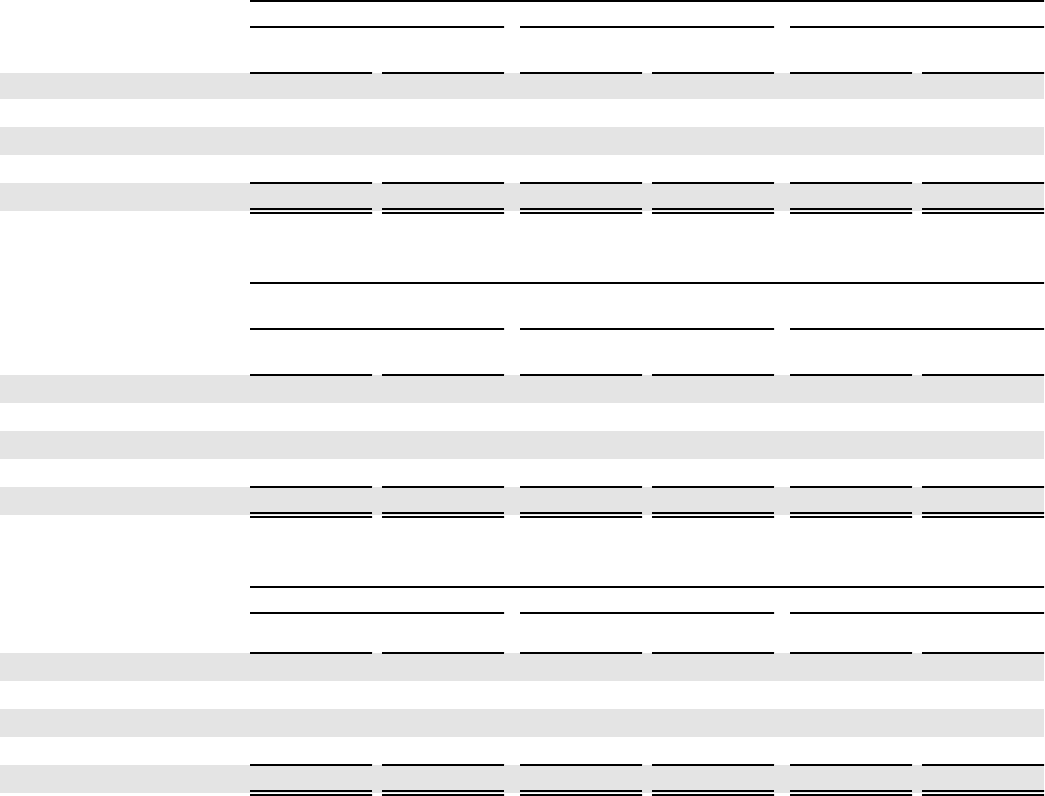

Residential Loans 1

Residential Mortgages -

Nonguaranteed

Residential

Home Equity Products Residential Construction

(Dollars in millions)

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

Current FICO score range:

700 and above $20,422 $18,780 $10,772 $11,475 $313 $347

620 - 699 3,262 3,369 1,741 1,991 58 70

Below 620 21,060 1,294 658 798 13 19

Total $24,744 $23,443 $13,171 $14,264 $384 $436

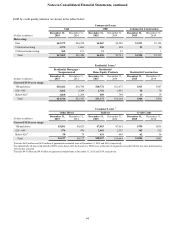

Consumer Loans 3

Other Direct Indirect Credit Cards

(Dollars in millions) December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

Current FICO score range:

700 and above $5,501 $4,023 $7,015 $7,661 $759 $639

620 - 699 576 476 2,481 2,335 265 212

Below 620 250 74 631 648 62 50

Total $6,127 $4,573 $10,127 $10,644 $1,086 $901

1 Excludes $629 million and $632 million of guaranteed residential loans at December 31, 2015 and 2014, respectively.

2 For substantially all loans with refreshed FICO scores below 620, the borrower’s FICO score at the time of origination exceeded 620 but has since deteriorated as

the loan has seasoned.

3 Excludes $4.9 billion and $4.8 billion of guaranteed student loans at December 31, 2015 and 2014, respectively.