SunTrust 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

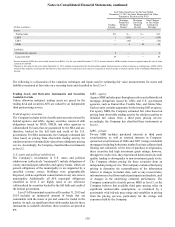

Notes to Consolidated Financial Statements, continued

141

trades and indications from buy side investors, if available, are

taken into consideration as additional support for the value. Due

to the availability of this information, the Company determined

that the appropriate classification for these debt issuances is level

2. The election to fair value certain fixed rate debt issuances was

made to align the accounting for the debt with the accounting

for offsetting derivative positions, without having to apply hedge

accounting, thus avoiding the complex and time consuming fair

value hedge accounting requirements.

The Company’s public debt measured at fair value impacts

earnings predominantly through changes in the Company’s

credit spreads as the Company has entered into derivative

financial instruments that economically convert the interest rate

on the debt from a fixed to a floating rate. The estimated earnings

impact from changes in credit spreads above U.S. Treasury rates

resulted in an immaterial amount of losses for the year ended

December 31, 2015, and losses of $19 million and gains of $40

million for the years ended December 31, 2014 and 2013,

respectively.

Other liabilities

The Company’s other liabilities that are measured at fair value

on a recurring basis include contingent consideration obligations

related to acquisitions. Contingent consideration associated with

acquisitions is adjusted to fair value until settled. As the

assumptions used to measure fair value are based on internal

metrics that are not market observable, the earn-out liability is

considered level 3.

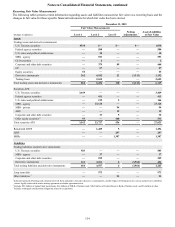

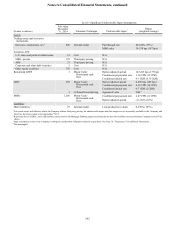

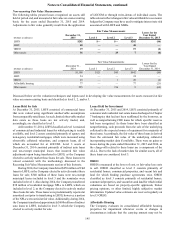

The valuation technique and range, including weighted average, of the unobservable inputs associated with the Company's level 3

assets and liabilities are as follows:

Level 3 Significant Unobservable Input Assumptions

(Dollars in millions)

Fair value

December

31, 2015 Valuation Technique Unobservable Input 1Range

(weighted average)

Assets

Trading assets and derivative

instruments:

Corporate and other debt securities $89 Market comparables Yield adjustment 126-447 bps (287 bps)

Derivative instruments, net 215 Internal model Pull through rate 24-100% (79%)

MSR value 29-210 bps (103 bps)

Securities AFS:

U.S. states and political subdivisions 5 Cost N/A

MBS - private 94 Third party pricing N/A

ABS 12 Third party pricing N/A

Corporate and other debt securities 5Cost N/A

Other equity securities 440 Cost N/A

Residential LHFS 5 Monte Carlo/

Discounted cash

flow

Option adjusted spread 104-197 bps (125 bps)

Conditional prepayment

rate 2-17 CPR (8 CPR)

Conditional default rate 0-2 CDR (0.5 CDR)

LHFI 251 Monte Carlo/

Discounted cash

flow

Option adjusted spread 62-784 bps (193 bps)

Conditional prepayment

rate 5-36 CPR (14 CPR)

Conditional default rate 0-5 CDR (2 CDR)

6 Collateral based

pricing Appraised value NM 4

MSRs 1,307 Monte Carlo/

Discounted cash

flow

Conditional prepayment

rate 2-21 CPR (10 CPR)

Option adjusted spread (5)-110% (8%)

Liabilities

Other liabilities 323 Internal model Loan production volume 150% (150%)

1 For certain assets and liabilities where the Company utilizes third party pricing, the unobservable inputs and their ranges are not reasonably available to the Company, and

therefore, have been noted as not applicable ("N/A").

2 Represents the net of IRLC assets and liabilities entered into by the Mortgage Banking segment and includes the derivative liability associated with the Company's sale of Visa

shares.

3 Input assumptions relate to the Company's contingent consideration obligations related to acquisitions. See Note 16, "Guarantees," for additional information.

4 Not meaningful.