SunTrust 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

ALCO and the Board, we manage the Parent Company’s

liquidity by structuring its net maturity schedule to minimize the

amount of debt maturing within a short period of time. A majority

of the Parent Company’s liabilities are long-term in nature,

coming from the proceeds of issuances of our capital securities

and long-term senior and subordinated notes. See Note 11,

“Borrowings and Contractual Commitments,” to the

Consolidated Financial Statements in this Form 10-K for further

information regarding Parent Company debt.

We manage the Parent Company to maintain most of its

liquid assets in cash and securities that it could quickly convert

into cash. Unlike the Bank, it is not typical for the Parent

Company to maintain a material investment portfolio of publicly

traded securities. We manage the Parent Company cash balance

to provide sufficient liquidity to fund all forecasted obligations

(primarily debt and capital service) for an extended period of

months in accordance with our risk limits.

The primary uses of Parent Company liquidity include debt

service, dividends on capital instruments, the periodic purchase

of investment securities, loans to our subsidiaries, and common

share repurchases. See further details of the authorized common

share repurchases in the "Capital Resources" section of this

MD&A and in Item 5, "Market for Registrant's Common Equity,

Related Stockholder Matters and Issuer Purchases of Equity

Securities" in this Form 10-K. We fund corporate dividends with

Parent Company cash, the primary sources of which are

dividends from our banking subsidiary and proceeds from the

issuance of debt and capital securities. We are subject to both

state and federal banking regulations that limit our ability to pay

common stock dividends in certain circumstances.

Other Liquidity Considerations. At December 31, 2015, our

liability for UTBs was $100 million and the liability for interest

related to these UTBs was $8 million. The UTBs represent the

difference between tax positions taken or expected to be taken

in our tax returns and the benefits recognized in accordance with

the accounting guidance for income taxes. If taxes related to these

positions are ultimately paid, the payments would be made from

our normal operating cash flows, likely over multiple years. See

additional discussion in Note 14, "Income Taxes," to the

Consolidated Financial Statements in this Form 10-K.

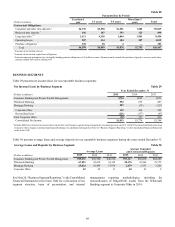

As presented in Table 27, we had an aggregate potential

obligation of $85.5 billion to our clients in unused lines of credit

at December 31, 2015. Commitments to extend credit are

arrangements to lend to clients who have complied with

predetermined contractual obligations. We also had $2.9 billion

in letters of credit at December 31, 2015, most of which are

standby letters of credit, which require that we provide funding

if certain future events occur. Approximately $633 million of

these letters supported variable rate demand obligations at

December 31, 2015. Unused commercial lines of credit have

increased since December 31, 2014, as we continued to provide

credit availability to our clients. Unused credit card lines

increased during 2015 due to our strategic focus on growing this

business and our launch of new, streamlined credit card product

offerings in 2015. Additionally, our mortgage commitments

increased during 2015 due to higher production volume.

Unfunded Lending Commitments Table 27

As of Average for the Three Months Ended

(Dollars in millions)

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

Unused lines of credit:

Commercial $58,855 $50,122 $58,032 $49,932

Mortgage commitments 13,232 3,259 3,215 3,317

Home equity lines 10,523 10,858 10,558 10,873

CRE 4,455 3,302 4,111 3,151

Credit card 8,478 6,675 8,203 6,380

Total unused lines of credit $85,543 $74,216 $84,119 $73,653

Letters of credit:

Financial standby $2,775 $2,917 $2,758 $3,161

Performance standby 137 121 140 64

Commercial 27 32 27 32

Total letters of credit $2,939 $3,070 $2,925 $3,257

1 Includes IRLC contracts with notional balances of $2.3 billion at both December 31, 2015 and 2014.