SunTrust 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

104

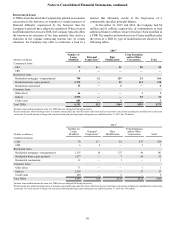

monitored events and circumstances during the fourth quarter of

2015 and did not observe any factors that would more-likely-

than-not reduce the fair value of a reporting unit below its

respective carrying value. See Note 1, "Significant Accounting

Policies," for additional information regarding the Company's

goodwill accounting policy.

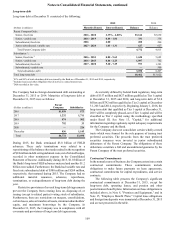

There were no changes in the carrying amount of goodwill

by reportable segment for the year ended December 31, 2015.

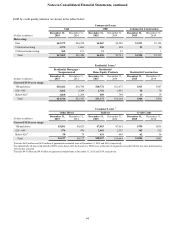

Changes in the carrying amount of goodwill by reportable

segment for the year ended December 31, 2014 are presented in

the following table.

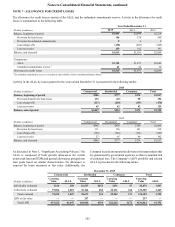

(Dollars in millions)

Consumer Banking

and Private Wealth

Management

Wholesale

Banking Total

Balance, January 1, 2014 $4,262 $2,107 $6,369

Acquisition of Lantana Oil and Gas Partners, Inc. — 8 8

Sale of RidgeWorth — (40) (40)

Balance, December 31, 2014 $4,262 $2,075 $6,337

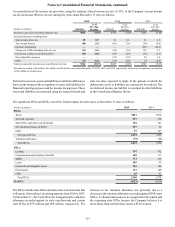

Other Intangible Assets

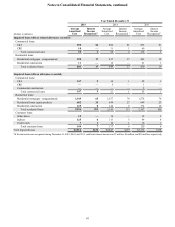

Changes in the carrying amounts of other intangible assets for the years ended December 31 are as follows:

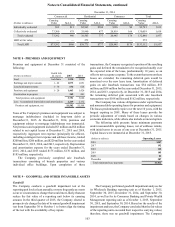

(Dollars in millions)

MSRs -

Fair Value Other Total

Balance, January 1, 2015 $1,206 $13 $1,219

Amortization 1— (8) (8)

Servicing rights originated 238 13 251

Servicing rights purchased 109 — 109

Changes in fair value:

Due to changes in inputs and assumptions 2(32) — (32)

Other changes in fair value 3(210) — (210)

Servicing rights sold (4) — (4)

Balance, December 31, 2015 $1,307 $18 $1,325

Balance, January 1, 2014 $1,300 $34 $1,334

Amortization 1— (12) (12)

Servicing rights originated 178 — 178

Servicing rights purchased 130 — 130

Changes in fair value:

Due to changes in inputs and assumptions 2(234) — (234)

Other changes in fair value 3(167) — (167)

Servicing rights sold (1) — (1)

Sale of RidgeWorth — (9) (9)

Balance, December 31, 2014 $1,206 $13 $1,219

1 Does not include expense associated with non-qualified community development investments. See Note 10, "Certain Transfers of Financial Assets and Variable

Interest Entities," for additional information.

2 Primarily reflects changes in option adjusted spreads and prepayment speed assumptions, due to changes in interest rates.

3 Represents changes due to the collection of expected cash flows, net of accretion due to the passage of time.

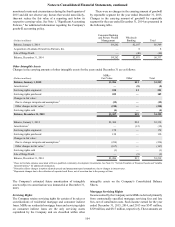

The Company's estimated future amortization of intangible

assets subject to amortization was immaterial at December 31,

2015.

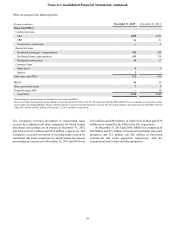

Servicing Rights

The Company retains servicing rights for certain of its sales or

securitizations of residential mortgage and consumer indirect

loans. MSRs on residential mortgage loans and servicing rights

on consumer indirect loans are the only servicing assets

capitalized by the Company and are classified within other

intangible assets on the Company's Consolidated Balance

Sheets.

Mortgage Servicing Rights

Income earned by the Company on its MSRs is derived primarily

from contractually specified mortgage servicing fees and late

fees, net of curtailment costs. Such income earned for the year

ended December 31, 2015, 2014, and 2013 was $347 million,

$329 million, and $317 million, respectively. These amounts are