SunTrust 2015 Annual Report Download - page 63

Download and view the complete annual report

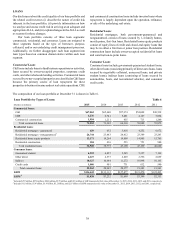

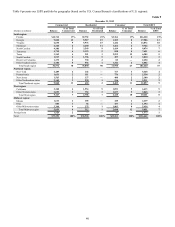

Please find page 63 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

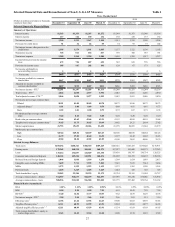

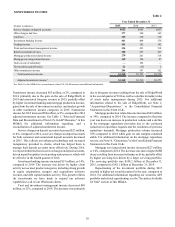

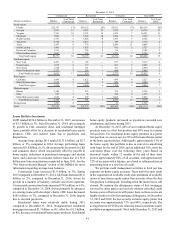

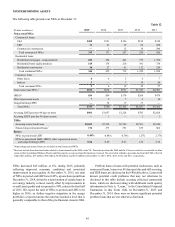

by a decline in yield on average commercial loans, particularly

in our C&I portfolio, as well as a decline in yield on average

nonguaranteed residential mortgages. The declines were driven

by lower commercial loan swap income, the paydown of higher

yielding loans, and the addition of new loan production at lower

rates than the existing portfolio due to the highly competitive,

low interest rate environment. Additionally, yields on securities

AFS declined 31 basis points compared to the year ended

December 31, 2014, driven largely by the addition of lower-

yielding U.S. Treasury securities during 2015 in preparation for

LCR requirements that took effect on January 1, 2016. Also

contributing to the decline in yield was higher MBS premium

amortization during 2015 of $208 million, compared to $152

million during 2014, as a result of increased MBS prepayments.

See the "Securities Available for Sale" section in this MD&A for

additional information regarding the composition and associated

yields on our investment securities.

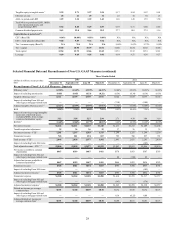

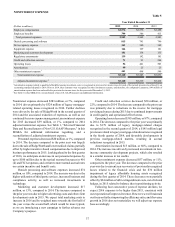

We utilize interest rate swaps to manage interest rate risk.

These instruments are primarily receive-fixed, pay-variable

swaps that convert a portion of our commercial loan portfolio

from floating rates, based on LIBOR, to fixed rates. At

December 31, 2015, the outstanding notional balance of active

swaps that qualified as cash flow hedges on variable rate

commercial loans was $16.9 billion, compared to active swaps

of $15.4 billion at December 31, 2014.

In addition to the income recognized from active swaps, we

also continue to recognize interest income over the original

hedge period resulting from terminated or de-designated swaps

that were previously designated as cash flow hedges on variable

rate commercial loans. Interest income from our commercial

loan swaps decreased to $261 million in 2015, compared to $387

million in 2014. The decline was primarily due to a reduction in

income from the maturity of active and previously terminated

swaps that reached their original maturity date during the second

half of 2014 and in 2015. As we manage our interest rate risk we

may continue to purchase additional and/or terminate existing

interest rate swaps. In 2016, commercial loan swap income will

decline modestly relative to 2015, largely due to a potential

increase in LIBOR, which would be more than offset by higher

net interest income from other areas of the balance sheet.

Remaining swaps on commercial loans have maturities

through 2022. The average maturity of our active swaps at

December 31, 2015 was 3.3 years. The commercial loan swaps

are receive-fixed, pay-variable based on LIBOR. The weighted

average rate on the receive-fixed rate leg of the commercial loan

swap portfolio at December 31, 2015 was 1.38%.

Compared to the year ended December 31, 2014, average

interest-bearing liabilities increased $4.0 billion, or 3%,

primarily due to an increase in average lower-cost deposits,

partially offset by declines in average wholesale funding and

time deposits. Average noninterest-bearing demand deposits also

increased $1.7 billion, or 4%, compared to the year ended

December 31, 2014. The increase in lower-cost deposits enabled

a $4.0 billion, or 65%, decrease in average other short-term

borrowings, primarily FHLB advances and master notes, as well

as a $1.5 billion, or 12%, decrease in average long-term debt,

driven by a decrease in average long-term FHLB advances,

compared to 2014. See the "Borrowings" section in this MD&A

for additional information regarding other short-term

borrowings and long-term debt.

The five basis point reduction in rates paid on average

interest-bearing liabilities during 2015 was driven by slightly

lower rates paid on interest-bearing deposits, as well as a seven

basis point decline in rates paid on other short-term borrowings.

The decline in the average rate paid on interest-bearing deposits

was a result of the improved mix driven by the shift from time

deposits to lower-cost deposit products, as well as a reduction in

rates paid on time deposits as higher rate CDs matured.

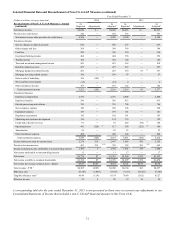

Looking forward, we expect first quarter 2016 net interest

margin to improve two to five basis points relative to the fourth

quarter of 2015 from the benefit of slightly higher short-term

interest rates. We will continue to carefully manage the duration

of our overall balance sheet in light of the current low interest

rate environment, while also ensuring our balance sheet is

structured to benefit from potential increases in short-term rates.

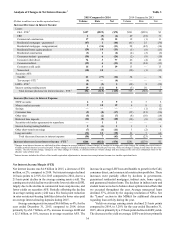

See Table 22, "Net Interest Income Asset Sensitivity," in this

MD&A for an analysis of potential changes in net interest income

due to instantaneous moves in benchmark interest rates.

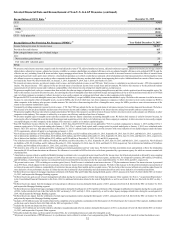

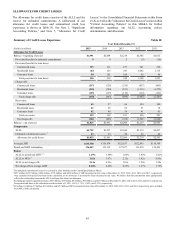

Foregone Interest

As average nonaccrual loans continued to decrease, foregone

interest income from NPLs had limited effect on the net interest

margin for the year ended December 31, 2015. Foregone interest

income from NPLs reduced net interest margin by two basis

points for the year ended December 31, 2014. See additional

discussion of our expectations of future credit quality in the

“Loans,” “Allowance for Credit Losses,” and “Nonperforming

Assets” sections of this MD&A. In addition, Table 2 of this

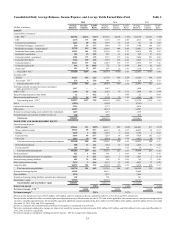

MD&A contains more detailed information concerning average

balances, yields earned, and rates paid.