SunTrust 2015 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

113

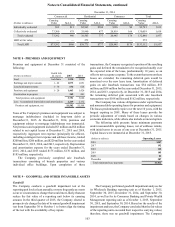

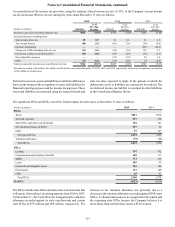

A reconciliation of the income tax provision, using the statutory federal income tax rate of 35%, to the Company’s actual income

tax provision and effective tax rate during the years ended December 31 were as follows:

2015 2014 2013

(Dollars in millions) Amount

% of

Pre-Tax

Income Amount

% of

Pre-Tax

Income Amount

% of

Pre-Tax

Income

Income tax provision at federal statutory rate $944 35.0% $793 35.0% $583 35.0%

Increase/(decrease) resulting from:

State income taxes, net 25 0.9 12 0.5 21 1.2

Tax-exempt interest (88) (3.3) (89) (3.9) (80) (4.8)

Internal restructuring — — — — (343) (20.6)

Changes in UTBs (including interest), net (31) (1.1) (82) (3.6) 152 9.1

Income tax credits, net of amortization 1(69) (2.6) (65) (2.9) (53) (3.2)

Non-deductible expenses — — (57) (2.5) 49 3.0

Other (17) (0.6) (19) (0.8) (7) (0.4)

Total provision for income taxes and effective tax rate $764 28.3% $493 21.8% $322 19.3%

1 Excludes tax credits of $8 million, $21 million, and $0 for the years ended December 31, 2015, 2014, and 2013, respectively, which were recognized as a reduction

to the related investment asset.

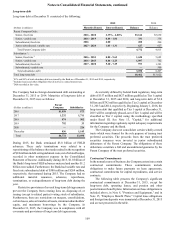

Deferred income tax assets and liabilities result from differences

between the timing of the recognition of assets and liabilities for

financial reporting purposes and for income tax purposes. These

assets and liabilities are measured using the enacted federal and

state tax rates expected to apply in the periods in which the

deferred tax assets or liabilities are expected to be realized. The

net deferred income tax liability is recorded in other liabilities

in the Consolidated Balance Sheets.

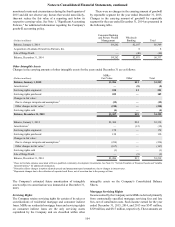

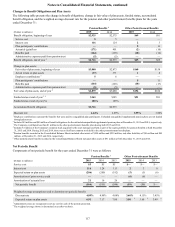

The significant DTAs and DTLs, net of the federal impact for state taxes, at December 31 were as follows:

(Dollars in millions) 2015 2014

DTAs:

ALLL $651 $710

Accrued expenses 297 358

State NOLs and other carryforwards 192 201

Net unrealized losses in AOCI 257 56

Other 97 127

Total gross DTAs 1,494 1,452

Valuation allowance (79) (98)

Total DTAs 1,415 1,354

DTLs:

Leasing 707 762

Compensation and employee benefits 140 113

MSRs 372 515

Loans 109 93

Goodwill and intangible assets 216 190

Fixed assets 131 140

Other 65 61

Total DTLs 1,740 1,874

Net DTL ($325) ($520)

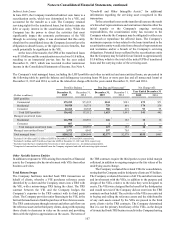

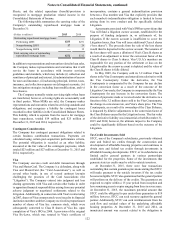

The DTAs include state NOLs and other state carryforwards that

will expire, if not utilized, in varying amounts from 2016 to 2035.

At December 31, 2015 and 2014, the Company had a valuation

allowance recorded against its state carryforwards and certain

state DTAs of $79 million and $98 million, respectively. The

decrease in the valuation allowance was primarily due to a

decrease in the valuation allowance recorded against STM's state

NOLs. A valuation allowance is not required for the federal and

the remaining state DTAs because the Company believes it is

more-likely-than-not that these assets will be realized.