SunTrust 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

EXECUTIVE OVERVIEW

Financial Performance

We experienced solid earnings growth in 2015, driven by

improved efficiency and continued improvement in asset quality

arising from consistent execution of our strategies and the

diversity of our business model. Targeted loan and deposit

growth during the year, as well as efforts to further optimize our

balance sheet, helped offset the negative impact of the prolonged

low interest rate environment. We were also successful in

advancing the revenue growth trajectory of many of our

businesses while controlling expenses and improving efficiency.

These developments allowed us to meaningfully increase the

capital return for our shareholders by increasing our dividend

and buying back more shares, while also investing in growth

opportunities to enhance future financial performance.

Our net income available to common shareholders totaled

$1.9 billion for 2015, an increase of 8% compared to 2014, with

diluted EPS of $3.58, up 11% from the prior year.

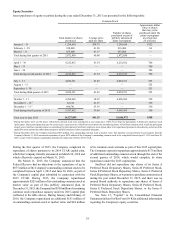

Noteworthy 2015 items included:

• We delivered to our common shareholders 8% net income

growth and 11% EPS growth

• We generated record investment banking income for the year

• Noninterest expense decreased $383 million compared to the

prior year; noninterest expense decreased $59 million

compared to the prior year adjusted level

• We continued to become more efficient, evidenced by the

efficiency ratio and adjusted tangible efficiency ratio

improving from 66.7% and 63.3% in 2014 to 63.1% and 62.6%

in 2015, respectively, marking the fourth consecutive year of

improvement

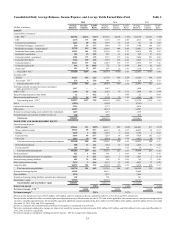

• Average total loans increased 2% compared to the prior year,

with approximately 8% growth in C&I loans

• Average consumer and commercial deposits increased 9%

compared to the prior year, with the favorable mix shift toward

lower-cost deposits continuing

• We maintained strong capital ratios that continue to be well

above regulatory requirements, with our Basel III CET1 and

estimated, fully phased-in CET1* ratios at 9.96% and 9.80%,

respectively

• We repurchased approximately $680 million of common

shares, resulting in a 3% decline in outstanding shares, and

increased our quarterly common stock dividend by 20%.

• Book value per share was $43.66, and tangible book value per

share* was $31.65, up 5% and 6%, respectively, from the prior

year

• Asset quality continued to improve as NPAs declined 6% from

the prior year and NPLs totaled 0.49% of total loans

• Our provision for loan losses declined $182 million, or 54%,

compared to the prior year

• Net charge-offs were down $104 million, or 23%, compared

to 2014, representing 0.26% of average loans, down eight basis

points from the prior year

• Our LCR is above the January 1, 2016 requirement of 90%

• Our ROE and ROTCE* improved by 36 and 31 basis points

compared to the prior year, to 8.42% and 11.64%, respectively

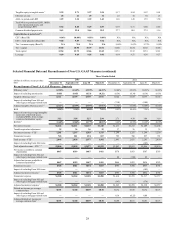

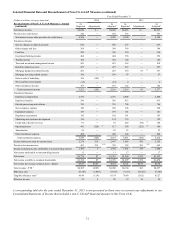

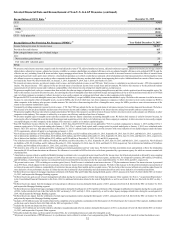

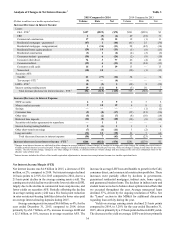

* : See Table 1 in this MD&A for a reconcilement of non-U.S.

GAAP measures and additional information

Our prior year results included several matters of a non-core

nature that were separately disclosed in Forms 8-K. See

additional detail and the resulting impacts that these Form 8-K

and other legacy mortgage-related items had on our 2014

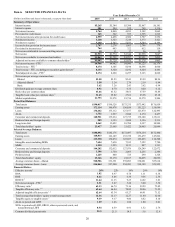

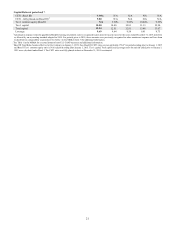

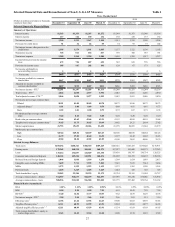

financial results in Table 1, "Selected Financial Data and

Reconcilement of Non-U.S. GAAP Measures," in this MD&A.

Total revenue for 2015 declined $131 million compared to

2014. Excluding the gain on sale of RidgeWorth that impacted

2014 results, total revenue declined $26 million due to lower net

interest income, driven primarily by the decline in commercial

loan swap income and lower earning asset yields, as well as

foregone RidgeWorth investment management income. These

year-over-year reductions were offset partially by earning asset

growth, higher investment banking and mortgage production

income, gains from the sale of investment securities, and modest

growth in other noninterest income categories in 2015, compared

to 2014. Excluding the 2014 gain on sale of RidgeWorth,

noninterest income for 2015 increased $50 million, or 2%,

compared to 2014. See Table 1, "Selected Financial Data and

Reconcilement of Non-U.S. GAAP Measures," in this MD&A

for reconciliations of total adjusted revenue and adjusted

noninterest income.

Looking ahead, we expect first quarter net interest margin

to improve two to five basis points relative to the fourth quarter

of 2015. We will continue to carefully manage the duration of

our overall balance sheet in light of the current low interest rate

environment, while also ensuring our balance sheet is structured

to benefit from potential increases in short-term rates. See

additional discussion related to revenue, noninterest income, and

net interest income and margin in the "Noninterest Income" and

"Net Interest Income/Margin" sections of this MD&A. Also in

this MD&A, see Table 22, "Net Interest Income Asset

Sensitivity," for an analysis of potential changes in net interest

income due to instantaneous moves in benchmark interest rates.

Noninterest expense decreased $383 million, or 7%,

compared to 2014, driven primarily by $324 million of legacy

mortgage-related operating losses that were recognized in 2014.

The remainder of the decline was driven by the sale of

RidgeWorth in 2014 and the associated reduction of expenses

thereafter, as well as our continued focus on expense

management. Noninterest expense for 2015 decreased $59

million, or 1%, compared to 2014 adjusted noninterest expense.

See additional discussion related to noninterest expense in the

"Noninterest Expense" section of this MD&A. Also see Table 1,

"Selected Financial Data and Reconcilement of Non-U.S. GAAP

Measures," in this MD&A for additional information regarding,

and a reconciliation of, adjusted noninterest expense.

During 2015, our efficiency ratio improved to 63.1% from

66.7% in 2014. Our tangible efficiency ratio also improved in

2015 to 62.6%, which was better than our 2015 target, and also

better than our 2014 tangible efficiency and adjusted tangible

efficiency ratios of 66.4% and 63.3%, respectively, despite the

significant headwinds from a declining net interest margin. For

2016, we are targeting revenue growth that exceeds expense

growth, and thus, an improved tangible efficiency ratio relative

to 2015. We expect the pace of improvement will be slower than

previous years, as our core expenses have already declined

substantially, and the operating environment, while improving