SunTrust 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

107

Indirect Auto Loans

In June 2015, the Company transferred indirect auto loans to a

securitization entity, which was determined to be a VIE, and

accounted for the transfer as a sale. The Company retained

servicing rights for the transferred loans, but did not retain any

debt or equity interest in the securitization entity. While the

Company has the power to direct the activities that most

significantly impact the economic performance of the VIE

through its servicing rights, it was determined that this entity

should not be consolidated since the Company does not have the

obligation to absorb losses, or the right to receive benefits, that

could potentially be significant to the VIE.

At the time of the transfer, the UPB of the transferred loans

was $1.0 billion and the consideration received was $1.0 billion,

resulting in an immaterial pre-tax loss for the year ended

December 31, 2015, which was recorded in other noninterest

income in the Consolidated Statements of Income. See Note 9,

"Goodwill and Other Intangible Assets," for additional

information regarding the servicing asset recognized in this

transaction.

To the extent that losses on the transferred loans are the result

of a breach of representations and warranties related to either the

initial transfer or the Company's ongoing servicing

responsibilities, the securitization entity has recourse to the

Company whereby the Company may be obligated to either cure

the breach or repurchase the affected loans. The Company’s

maximum exposure to loss related to the loans transferred to the

securitization entity would arise from a breach of representations

and warranties and/or a breach of the Company's servicing

obligations. Potential losses suffered by the securitization entity

that the Company may be liable for are limited to approximately

$1.0 billion, which is the total of the initial UPB of transferred

loans and the carrying value of the servicing asset.

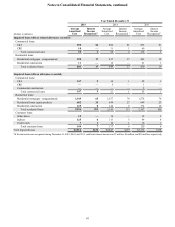

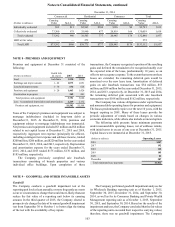

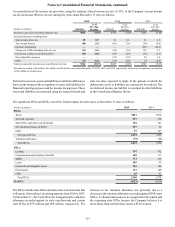

The Company's total managed loans, including the LHFI portfolio and other securitized and unsecuritized loans, are presented in

the following table by portfolio balance and delinquency (accruing loans 90 days or more past due and all nonaccrual loans) at

December 31, 2015 and 2014, as well as the related net charge-offs for the years ended December 31, 2015 and 2014.

Portfolio Balance 1Past Due and Nonaccrual 2Net Charge-offs

December 31,

2015

December 31,

2014

December 31,

2015

December 31,

2014

Year Ended December 31

(Dollars in millions) 2015 2014

LHFI portfolio:

Commercial $75,252 $73,392 $344 $181 $72 $71

Residential 38,928 38,775 729 891 176 279

Consumer 22,262 20,945 580 619 93 95

Total LHFI portfolio 136,442 133,112 1,653 1,691 341 445

Managed securitized loans:

Residential 116,990 110,591 126 3183 312 16

Consumer 807 —1—2—

Total managed securitized loans 117,797 110,591 127 183 14 16

Managed unsecuritized loans 43,973 4,943 597 705 ——

Total managed loans $258,212 $248,646 $2,377 $2,579 $355 $461

1 Excludes $1.8 billion and $3.2 billion of LHFS at December 31, 2015 and 2014, respectively.

2 Excludes $1 million and $39 million of past due LHFS at December 31, 2015 and 2014, respectively.

3 Excludes loans that have completed the foreclosure or short sale process (i.e., involuntary prepayments).

4 Comprised of unsecuritized residential loans the Company originated and sold with servicing rights retained.

Other Variable Interest Entities

In addition to exposure to VIEs arising from transfers of financial

assets, the Company also has involvement with VIEs from other

business activities.

Total Return Swaps

The Company facilitates matched book TRS transactions on

behalf of clients, whereby a VIE purchases reference assets

identified by a client and the Company enters into a TRS with

the VIE, with a mirror-image TRS facing the client. The TRS

contract between the VIE and the Company hedges the

Company’s exposure to the TRS contract with its third party

client. The Company provides senior financing to the VIE, in the

form of demand notes to fund the purchase of the reference assets.

The TRS contracts pass through interest and other cash flows on

the reference assets to the third party clients, along with exposing

those clients to decreases in value on the assets and providing

them with the rights to appreciation on the assets. The terms of

the TRS contracts require the third parties to post initial margin

collateral, in addition to ongoing margin as the fair values of the

underlying assets change.

The Company evaluated the related VIEs for consolidation,

noting that the Company and its third party clients are VI holders.

The Company evaluated the nature of all VIs and other interests

and involvement with the VIEs, in addition to the purpose and

design of the VIEs, relative to the risks they were designed to

create. The VIEs were designed for the benefit of the third parties

and would not exist if the Company did not enter into the TRS

contracts on their behalf. The activities of the VIEs are restricted

to buying and selling the reference assets and the risks/benefits

of any such assets owned by the VIEs are passed to the third

party clients via the TRS contracts. The Company determined

that it is not the primary beneficiary of the VIEs, as the design

of its matched book TRS business results in the Company having