SunTrust 2015 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

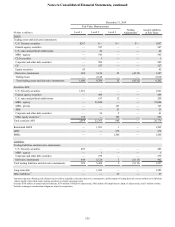

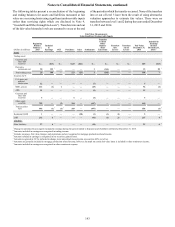

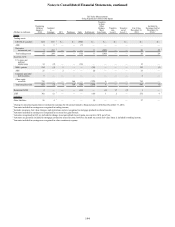

Notes to Consolidated Financial Statements, continued

138

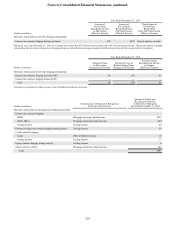

Fair Value Gain/(Loss) for the Year Ended

December 31, 2013 for Items Measured at Fair Value

Pursuant to Election of the FVO

(Dollars in millions)

Trading

Income

Mortgage

Production

Related

Income 1

Mortgage

Servicing

Related

Income

Total Changes

in Fair Values

Included in

Earnings 2

Assets:

Trading loans $13 $— $— $13

LHFS 1 (135) — (134)

LHFI — (10) — (10)

MSRs — 4 50 54

Liabilities:

Brokered time deposits 8 — — 8

Long-term debt 36 — — 36

1 Income related to LHFS does not include income from IRLCs. For the year ended December 31, 2013, income related to MSRs includes income recognized upon the sale of loans

reported at LOCOM.

2 Changes in fair value for the year ended December 31, 2013 exclude accrued interest for the period then ended. Interest income or interest expense on trading loans, LHFS, LHFI,

brokered time deposits, and long-term debt that have been elected to be measured at fair value are recognized in interest income or interest expense in the Consolidated Statements of

Income.

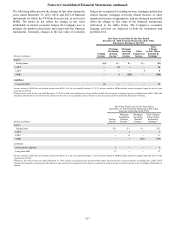

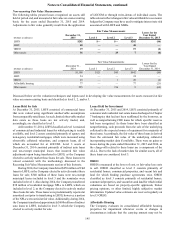

The following is a discussion of the valuation techniques and inputs used in estimating fair value measurements for assets and

liabilities measured at fair value on a recurring basis and classified as level 2 or 3.

Trading Assets and Derivative Instruments and Securities

Available for Sale

Unless otherwise indicated, trading assets are priced by the

trading desk and securities AFS are valued by an independent

third party pricing service.

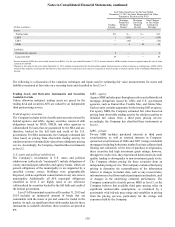

Federal agency securities

The Company includes in this classification securities issued by

federal agencies and GSEs. Agency securities consist of debt

obligations issued by HUD, FHLB, and other agencies or

collateralized by loans that are guaranteed by the SBA and are,

therefore, backed by the full faith and credit of the U.S.

government. For SBA instruments, the Company estimated fair

value based on pricing from observable trading activity for

similar securities or obtained fair values from a third party pricing

service. Accordingly, the Company classified these instruments

as level 2.

U.S. states and political subdivisions

The Company’s investments in U.S. states and political

subdivisions (collectively “municipals”) include obligations of

county and municipal authorities and agency bonds, which are

general obligations of the municipality or are supported by a

specified revenue source. Holdings were geographically

dispersed, with no significant concentrations in any one state or

municipality. Additionally, all AFS municipal obligations

classified as level 2 are highly rated or are otherwise

collateralized by securities backed by the full faith and credit of

the federal government.

Level 3 AFS municipal securities at December 31, 2015 and

2014 includes an immaterial amount of bonds that are

redeemable with the issuer at par and cannot be traded in the

market. As such, no significant observable market data for these

instruments is available; therefore, these securities are priced at

par.

MBS – agency

Agency MBS includes pass-through securities and collateralized

mortgage obligations issued by GSEs and U.S. government

agencies, such as Fannie Mae, Freddie Mac, and Ginnie Mae.

Each security contains a guarantee by the issuing GSE or agency.

For agency MBS, the Company estimated fair value based on

pricing from observable trading activity for similar securities or

obtained fair values from a third party pricing service;

accordingly, the Company has classified these instruments as

level 2.

MBS – private

Private MBS includes purchased interests in third party

securitizations, as well as retained interests in Company-

sponsored securitizations of 2006 and 2007 vintage residential

mortgages (including both prime jumbo fixed rate collateral and

floating rate collateral). At the time of purchase or origination,

these securities had high investment grade ratings; however,

through the credit crisis, they experienced deterioration in credit

quality leading to downgrades to non-investment grade levels.

The Company obtains pricing for these securities from an

independent pricing service. The Company evaluates third party

pricing to determine the reasonableness of the information

relative to changes in market data, such as any recent trades,

information received from market participants and analysts, and/

or changes in the underlying collateral performance. The

Company continued to classify private MBS as level 3, as the

Company believes that available third party pricing relies on

significant unobservable assumptions, as evidenced by a

persistently wide bid-ask price range and variability in pricing

from the pricing services, particularly for the vintage and

exposures held by the Company.