SunTrust 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

118

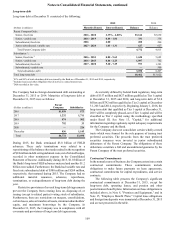

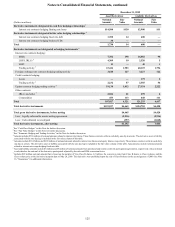

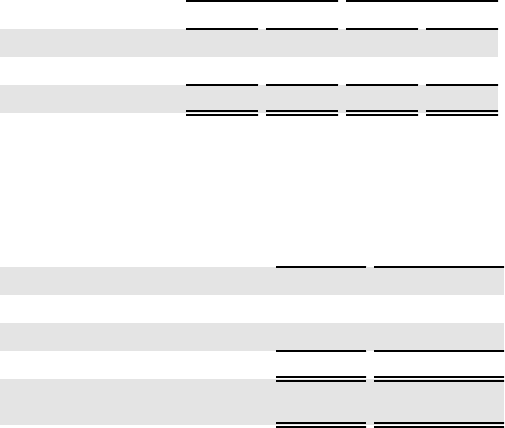

Amounts Recognized in AOCI

Components of the benefit obligations AOCI balance at

December 31 were as follows:

Pension Benefits

Other

Postretirement

Benefits

(Dollars in millions) 2015 2014 2015 2014

Prior service credit $— $— ($64) ($70)

Net actuarial loss/(gain) 1,072 1,021 (11) (14)

Total AOCI, pre-tax $1,072 $1,021 ($75) ($84)

Other changes in plan assets and benefit obligations recognized

in AOCI during 2015 were as follows:

(Dollars in millions)

Pension

Benefits

Other

Postretirement

Benefits

Current year actuarial loss $72 $3

Amortization of prior service credit — 6

Amortization of actuarial loss (21) —

Total recognized in AOCI, pre-tax $51 $9

Total recognized in net periodic

benefit and AOCI, pre-tax ($13) $—

For pension plans, the estimated actuarial loss that will be

amortized from AOCI into net periodic benefit in 2016 is $25

million. For other postretirement benefit plans, the estimated

prior service credit to be amortized from AOCI into net periodic

benefit in 2016 is $6 million.

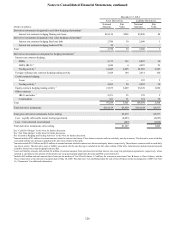

Plan Assumptions

Each year, the SBFC, which includes several members of senior

management, reviews and approves the assumptions used in the

year-end measurement calculations for each plan. The discount

rate for each plan, used to determine the present value of future

benefit obligations, is determined by matching the expected cash

flows of each plan to a yield curve based on long-term, high

quality fixed income debt instruments available as of the

measurement date. A series of benefit payments projected to be

paid by the plan is developed based on the most recent census

data, plan provisions, and assumptions. The benefit payments at

each future maturity date are discounted by the year-appropriate

spot interest rates. The model then solves for the discount rate

that produces the same present value of the projected benefit

payments as generated by discounting each year’s payments by

the spot interest rate.

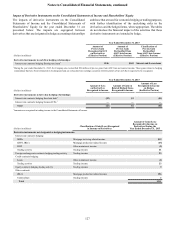

On December 31, 2015, the Company refined the calculation

of the service and interest cost components of net periodic benefit

expense for pension and other postretirement benefit

plans. Previously the Company estimated service and interest

cost components utilizing a single weighted-average discount

rate derived from the yield curve used to measure the benefit

obligation at the beginning of the period. Under the refined

method, the Company utilized a full yield curve approach to

estimate these components by applying specific spot rates along

the yield curve used in the determination of the benefit obligation

to the relevant projected cash flows. The Company made this

change to more closely match the projected benefit cash flows

and the corresponding yield curve spot rates, and to provide a

more precise measurement of service and interest costs. This

change had no impact on the measurement of the Company’s

total benefit obligations recorded at December 31, 2015 or any

other prior period. The Company accounted for this service and

interest cost methodology refinement as a change in estimate

that is inseparable from a change in accounting principle, and,

accordingly, will recognize its effect prospectively beginning in

2016.

Actuarial gains and losses are created when actual

experience deviates from assumptions. The actuarial losses on

plan assets generated within the pension plans during 2015

resulted primarily from asset experience. The actuarial losses on

obligations generated within the pension plans during 2014

resulted primarily from lower interest rates.

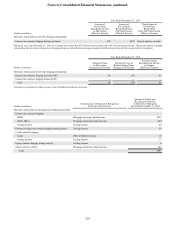

The SBFC establishes investment policies and strategies and

formally monitors the performance of the investments

throughout the year. The Company’s investment strategy with

respect to pension assets is to invest the assets in accordance with

ERISA and related fiduciary standards. The long-term primary

investment objectives for the pension plans are to provide a

commensurate amount of long-term growth of principal and

income in order to satisfy the pension plan obligations without

undue exposure to risk in any single asset class or investment

category. The objectives are accomplished through investments

in equities, fixed income, and cash equivalents using a mix that

is conducive to participation in a rising market while allowing

for protection in a declining market. The portfolio is viewed as

long-term in its entirety, avoiding decisions regarding short-term

concerns and any single investment. Asset allocation, as a percent

of the total market value of the total portfolio, is set with the

target percentages and ranges presented in the investment policy

statement. Rebalancing occurs on a periodic basis to maintain

the target allocation, but normal market activity may result in

deviations.

The basis for determining the overall expected long-term

rate of return on plan assets considers past experience, current

market conditions, and expectations on future trends. A building

block approach is used that considers long-term inflation, real

returns, equity risk premiums, target asset allocations, market

corrections, and expenses. Capital market simulations from

internal and external sources, survey data, economic forecasts,

and actuarial judgment are all used in this process. The expected

long-term rate of return for pension obligations is 6.68% for

2016.

The investment strategy for the other postretirement benefit

plans is maintained separately from the strategy for the pension

plans. The Company’s investment strategy is to create a series

of investment returns sufficient to provide a commensurate

amount of long-term principal and income growth in order to

satisfy the other postretirement benefit plan's obligations. Assets

are diversified among equity funds and fixed income investments

according to the mix approved by the SBFC. Due to other

postretirement benefits having a shorter time horizon, a lower

equity profile is appropriate. The expected long-term rate of

return for other postretirement benefits is 3.13% for 2016.